Gold Price Slides Again as Expected

Commodities / Gold and Silver 2015 Sep 11, 2015 - 10:44 AM GMTBy: P_Radomski_CFA

Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

Gold, silver and mining stocks declined once again yesterday, but this was not surprising to those who followed our analysis. We moved to the short side many days ago and the profits have just increased. Will they increase even more?

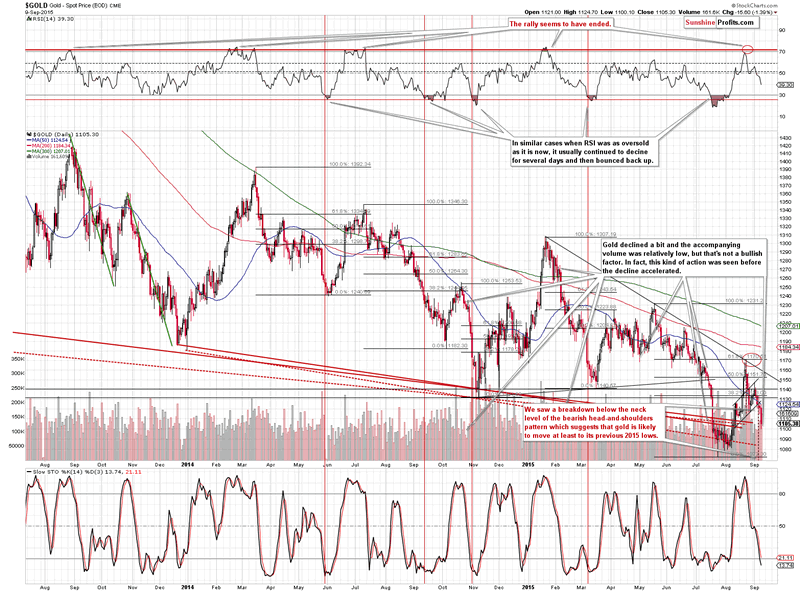

Quite likely. The gold chart features a good reason for it (charts courtesy of http://stockcharts.com).

To a large extent, our previous comments on the above chart remain up-to-date:

We just saw another daily close below the neck line of the bearish head-and-shoulders pattern, which makes the breakdown more confirmed. Based on our experience, it usually takes 3 trading days for a given move to be completely confirmed, so the situation will become even more bearish if gold closes below the neck line also today (which seems quite likely).

Gold indeed closed below the neck level of the head-and-shoulders pattern and that's a very bearish sign as it means that the breakdown was confirmed. A move below $1,080 has just become much more likely and so has the chance of increasing our profits on the current short position.

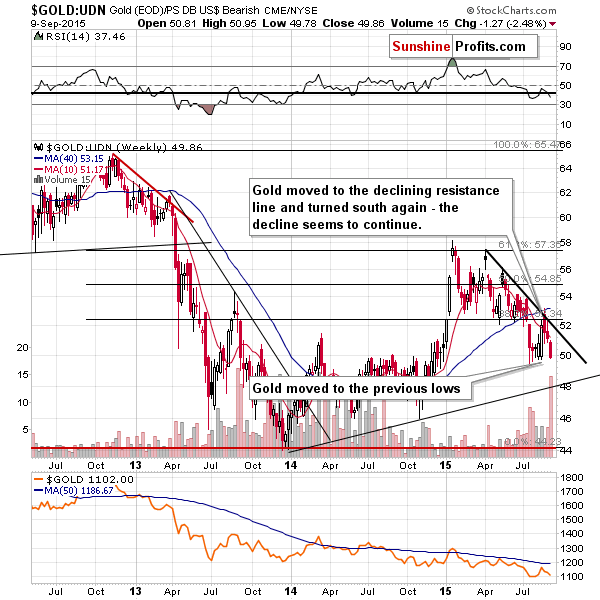

From the non-USD perspective, we see that gold is at its previous lows. It's not at the 2013 / 2014 lows but its certainly at the 2015 ones. The medium-term trend remains down and it seems very likely that gold will move even lower in the coming weeks.

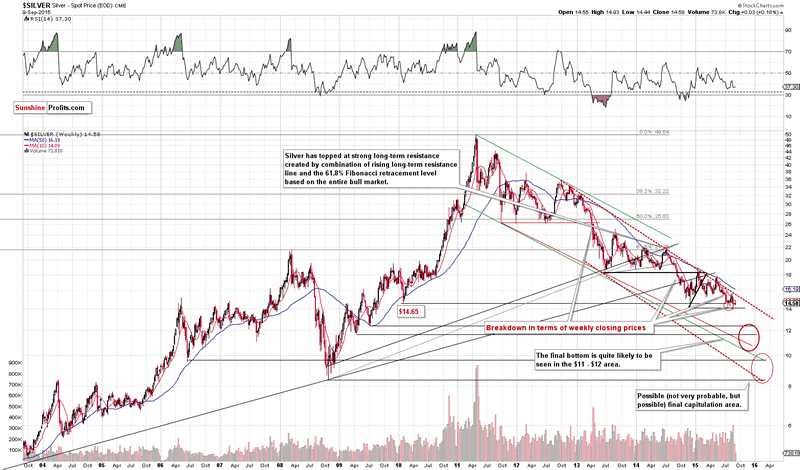

We recently commented on silver's performance from the short-term perspective and in today's alert we would like to focus on the long-term one. Silver's recent move higher is almost invisible on the above chart and that tells us something about this move's importance. Silver is below its 2010 low and it's already after a rebound that followed the first attempt to move below it.

Consequently, it's much more likely that silver will manage to move below the 2010 low at this attempt. If it doesn't, it's not likely to rally significantly anyway, as the declining red dashed resistance line is relatively close. The outlook remains bearish.

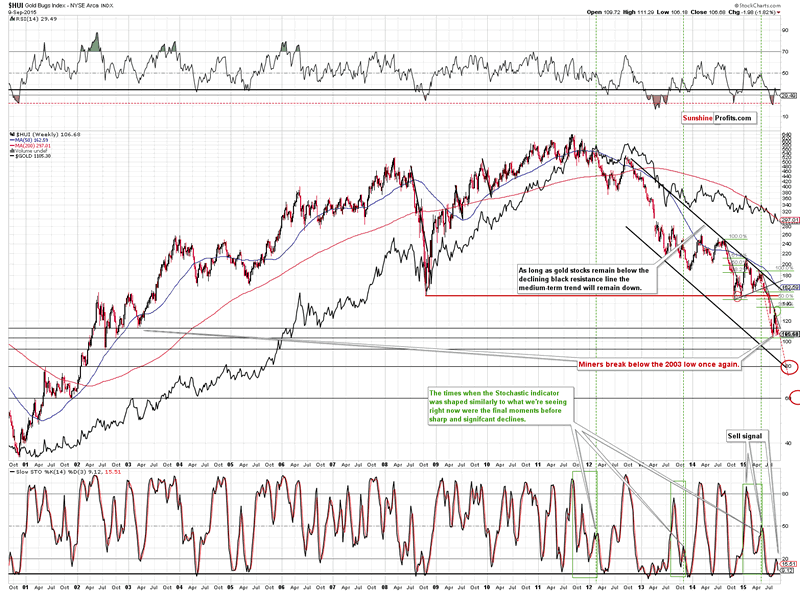

We'll change the perspective also in the case of mining stocks. The decline in gold stocks proceeds in tune with what we saw in 2008 and we have just seen an important signal that miners will move considerably lower in the coming weeks. The Stochastic indicator based on the weekly closing prices flashed a sell signal and these signals are not to be ignored - they've been quite reliable in the previous several years.

Summing up, the precious metals sector declined as expected, but it seems that the real decline is only beginning and that our profits from the short position will be much higher before the decline is over. We just saw 2 additional reasons for metals and miners to move lower: the verification of the breakdown in gold and a sell signal from the Stochastic indicator, and both of them have quite strong bearish implications. Even if we see a small corrective rally shortly, it will likely not change the main medium-term trend, which remains down.

To summarize:

Trading capital (our opinion): Short position (full) position in gold, silver and mining stocks is justified from the risk/reward perspective. Specific stop-loss orders and initial target prices are available to our subscribers.

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.