China Stock Market on the Edge. TNX Rising

Stock-Markets / Stock Markets 2015 Sep 15, 2015 - 02:14 PM GMT Good Morning!

Good Morning!

All eyes turn to china as the Shanghai Index sits on a ledge of support at 3000.00. As ZeroHedge comments, “What, however, is dawning right now on traders is that China has once again lost control of its market, and days after crushing index futures trading by hiking margins to unprecedented levels, the SHCOMP resumed its old acrobatics tumbling as much as 4.2% in final hour of trading, and dropping below 3,000 for the first time since Aug. 27, before closing 3.5% lower at 3,005.172.”

This was the “panic point” for the PBOC to pull out its big guns to stop the decline a week ago. A day later, the Chinese government called in Larry Fink, CEO of BlackRock to consult with them on how to better manage the market. Since the Chinese currency reserves have already been drawn down, it may resume selling US Treasuries.

TNX appears to have completed its retracement as may be heading higher, possible evidence of a liquidation of Treasuries. If done in $100 billion lots as in August and the first week of September, this could put a serious dent in market liquidity.

It may also be sending a false signal to the Fed as key interest rates rise going into the fed decision.

Whether this makes any difference, “Retail Sales on an annual basis rose just 1.6% from 2014, testing increasingly recessionary waters.”

Meanwhile, the Empire Manufacturing Index is collapsing.

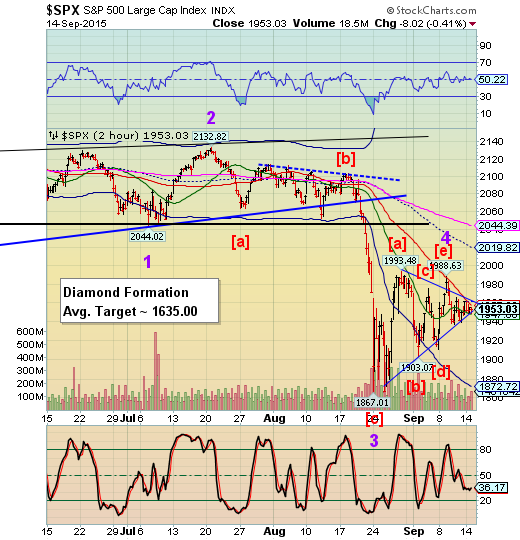

SPX has held steady through the Premarket and is likely to make a small pop at the open before declining. The algos seem to be busy keeping the SPX from a further decline, at least until the open.

ZeroHedge opines, “One survey recently recorded the highest level of expectations for a market rally in its (admittedly brief) history.

Not too long ago, stock market bulls were fond of dubbing this cyclical rally “the most hated bull market in history”. The premise was that, despite the considerable gains accrued by the market since the 2009 lows, investors were relatively slow to embrace the rally. We would say that based on various money flow and sentiment metrics, there was probably some truth to that notion, up until perhaps mid-2013. Since then, we have seen a notable pickup in investors’ collective “embrace” of stocks. In fact, according to the University of Michigan’s Survey of Consumers, respondents’ expectations for a stock market rally have never been higher than they were in June. That should be a red flag from a contrarian sentiment basis.”

Good luck and good trading!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.