The Great Deflation Will Destroy All Bubbles – These Too

Stock-Markets / Deflation Sep 22, 2015 - 04:25 PM GMTBy: Harry_Dent

It’s not enough that jobs are less stable, or that the ones we’re adding are increasingly more part-time…

It’s not enough that jobs are less stable, or that the ones we’re adding are increasingly more part-time…

It’s not enough that rapidly growing student loan costs are plaguing more young echo boomers and millennials…

It’s not enough that the high costs of education are increasing the inequality gap and making upward mobility impossible…

Or that, even after the last crash, housing is still expensive and loans are harder to get…

Today, the young generation ALSO has to deal with runaway childcare costs. It’s no wonder many of them aren’t having kids!

But I believe much of this will change in the great deleveraging we see ahead. When this bubble bursts, it will bring many of our “inflated” economic realities – in this case, the ones that affect the majority of our consumer population – to center stage.

This is something important to remember. When it comes to education, health care, even child care to an extent – they’re all service industries. But these service industries rely on higher-than-average skills. They’re not hotel clerks. They’re not servers. For that reason and many others, they’re subject to heavy special interests and lobbying, and scarcer skills. And that’s one of the reasons all this stuff is so expensive!

But these trends simply cannot continue without financially killing most families.

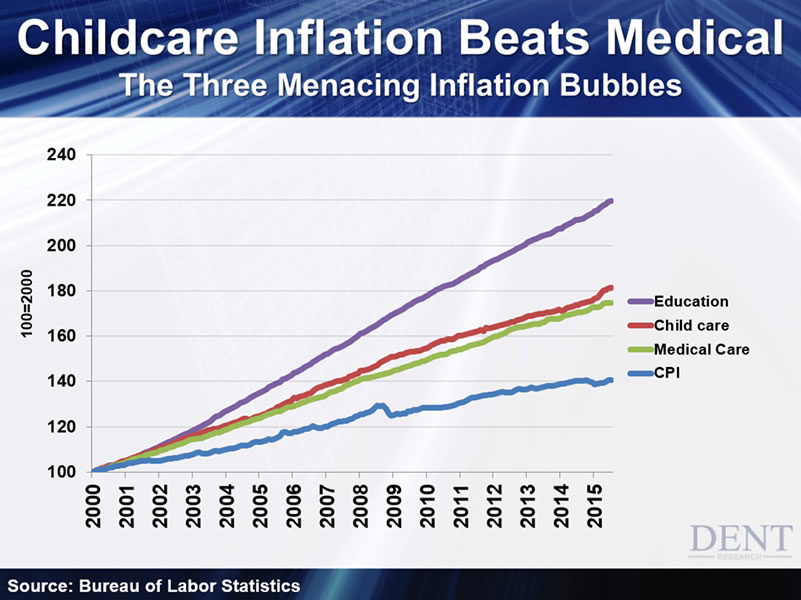

Let’s use the consumer price index (CPI) as our benchmark. It’s up 41% since the beginning of 2000, an average gain of 2.6% each year.

Medical care is up substantially higher at 75%, or 4.8% per year.

Educations costs are off their rocker – 120%, or 7.6% annually.

But more surprising to me, childcare has now surpassed medical care at 82%, or 5.2% per year. Take a look:

How are young families supposed to have kids? How are we supposed to keep our populations stable?

We need 2.1 kids per family just to be even! But inflation of this magnitude is crushing millennials and even young echo boomers before they can even get off their feet financially.

Rodney wrote back in August that the cost of child care averages $972 a month. How is a young couple supposed to pay that? Plus student loan payments? Plus a mortgage? Plus one or two car loans? And I don’t know – eat!?

It helps when both people in the household work, but at some point, it’s cheaper just to have one of them stay at home. That’s why countries like Sweden and France subsidize child care. That has proven more than any other government policy to help women have careers and kids.

Hence, the best thing would be to lower the cost of childcare. More generous maternity leave helps. As do tax credits for having kids. But childcare costs are the greatest burden.

I don’t mean to focus just on the younger generation. Inflation in medical care is making the lives of baby boomers more difficult as well.

But all of these bubbles in basic higher-end service costs will come down when the great financial asset bubble bursts and our economy enters a deflationary spiral.

Child care and education inflation will likely be stopped in their tracks. They’ll at least fall substantially. Business will have to lower costs to put up with more frugal consumers. And governments, like the U.S., that are trying even harder to fight falling births and immigration in a depression will likely reach a hard conclusion: that subsidizing child care may be the best entitlement for younger families and those suffering from unemployment.

The baby boomers will also finally get relief when health care inflation comes down. In fact, it’s already slowing a bit in recent years.

That will be the payoff of this economic winter. It will allow households and businesses to get much of their debt written off, and that will lower the cost of living.

But the boomers have other problems: the bubbles in stocks, bonds and real estate that dominate their portfolios for retirement will not come bouncing back. Not for many years, or even decades.

The average net worth today is $525,000 as of 2013, while the median for the typical household in the middle is $90,000. What if half of that disappeared? How would the baby boomers retire? That’s why the bubble burst will positively affect the younger generation more so than them down the road – as nature would have it.

Fortunately, you know what’s coming. That’s why now’s the time to protect yourself and your family from this inevitable and final bubble burst that now looks like it has already begun.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.