The Asian Megaproject Could Make You (and Your Grandchildren) Rich

Companies / Infrastructure Sep 24, 2015 - 01:48 PM GMTBy: ...

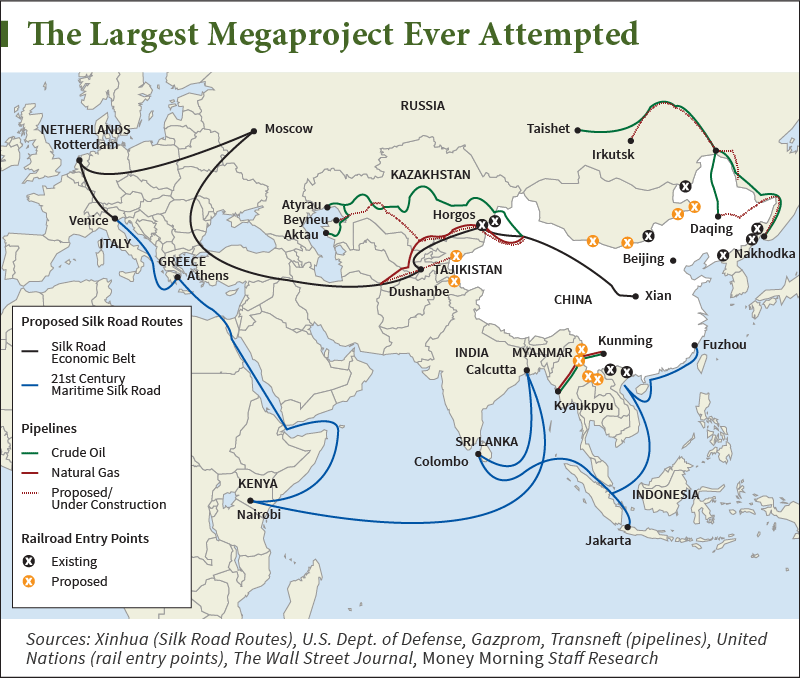

It will be on the "New Silk Road," spanning the entire Eurasian landmass – with links to Africa and Oceania, too.

Such a transport corridor is an ancient concept, but what's being built now will be far bigger and more lucrative than anything the old Han emperors could have ever imagined.

Its immediate aim is to move goods, raw materials, information, and money across borders from China to Portugal (and back) with unprecedented speed, efficiency, and of course, profitability. In fact, this is already becoming routine along the first segments of the corridor.

The New Silk Road will ultimately cement China's preeminent global status, but in the decades it will take to complete, it could make well-positioned investors very rich indeed.

You see, the multinational I'm about to show you is one of the only companies in the world with the know-how and resources to help turn China's ancient, lofty ambitions into a concrete 21st-century reality…

Realigning the World from East to West

Announced by Chinese President Xi Jinping in 2013, the New Silk Road will require the intertwining of international economics and politics on an unprecedented scale.

But… in just the last decade, we've seen the establishment of numerous cross-border government-sponsored trade and development institutions to facilitate this project.

Already armed with hundreds of billions in funding, and even more on the way, China's "road builders" are being provided with the means to put these formidable goals firmly in reach.

In fact, the first components of the New Silk Road are already in place.

In November 2014, the Yiwu to Madrid railway line, now the world's longest at 6,111 miles, was opened for business.

This means that goods can be shipped overland from eastern China to central Spain in just 21 days – twice as fast as the quickest sea route, and with three times less CO2 emissions than surface roads.

This is just one of the initial transport components of this New Silk Road. What's coming next is almost unbelievable…

The revival of this ancient trade route, famously traveled by Marco Polo, will boast all the modern advancement of multimodal transport infrastructure. Trains, planes, ships, and trucks will crisscross the Eurasian landmass in new record times.

Within a decade, it's expected that super-high-speed trains will get tens of thousands of tons of materials from London to Beijing… in only two days.

Cell towers and fiber-optics will provide virtual connections right across Europe's Atlantic coast to Asia's Pacific coast.

As you can see here, the scope of this megaproject is immense.

And that demands unprecedented financial resources, organization, and logistics.

But it's the political will and determination that's perhaps the most impressive of all.

It's all part of an unstoppable trend that will see the "developing world" establish unbreakable infrastructure, trade, and financial links with the West, even as it grows more competitive with it.

A New Challenger to Old Institutions

In 2014, I told you about how the BRICS nations – Brazil, Russia, India, China, and South Africa – were setting up the New Development Bank (NDB).

Essentially, NDB is a rival to the World Bank and International Monetary Fund (IMF), both dominated by America and Europe. The stated goal of the new megabank is to fund infrastructure projects in developing nations. Reinforcing the inclusion approach, the NDB has an Indian leader while the institution is headquartered in Shanghai, China.

Consider that grouped together, these countries' economies represent a total population of 3 billion and GDP of $16 trillion. And although membership is open to other UN member countries, the BRICS' share is not to dip under 55%, allowing them to effectively retain control.

Then in January, the free-trade zone known as the Eurasian Economic Union, whose members include Russia, Kazakhstan, and Belarus, became reality. Even Armenia, where 27% of total trade is with the European Union, and whose in-country delegation has been trying for years to coax the South Caucasus nation into joining its Western neighbors, has linked with its Eastern suitor instead.

And just this past April, traditional U.S. allies including Germany, France, and Italy announced they'd join almost 60 nations as members of the new Chinese-led Asian Infrastructure Investment Bank (AIIB).

Remarkably, even the IMF and World Bank have declared their support.

The AIIB's core shareholders are China along with India and Russia. And chief among its goals are to finance development projects along the New Silk Road.

And the AIIB is looking to hire one multinational with the "shovel power" and expertise that can help turn this ambition into reality.

Pass These Shares (and Profits) on to Your Grandchildren

In May 2014, China's state-owned Xinhua News Agency presented its first installment in a series entitled "New Silk Road, New Dreams." The article describes Beijing emphasizing how its economy is compatible with the nations along the route, seeing the region as the site of "more capital convergence and currency integration."

Keep in mind that many, if not most, of the financial transactions these organizations partake in will be settled using their own currencies. That will further reduce the importance of the U.S. dollar as the world's reserve currency.

That's why you need to look at non-U.S. multinationals that specialize in infrastructure to get profits of your own from this New Silk Road.

And the best way to do that is ABB Ltd. (NYSE ADR: ABB), one of the largest engineering companies in the world.

Founded in 1988 through the merger of Sweden's ASEA and Switzerland's Brown, Boveri, the company's origins date back to 1883. Today, ABB is headquartered in Zurich, Switzerland.

The company describes itself as "a leader in power and automation technologies that enable utility, industry, and transport and infrastructure customers to improve their performance while lowering environmental impact. The ABB Group of companies operates in roughly 100 countries and employs about 140,000 people."

ABB is cutting edge, and it intends to remains so by spending some $1.5 billion to fund research and development through its 8,500 technologists across five divisions and seven corporate research centers.

The five divisions are:

- Power Products offers circuit breakers, switchgear, capacitors, and transformers to electric and other infrastructure utilities. (ABB is the world's largest transformers supplier.)

- Power Systems offers turnkey solutions for power generation plants, transmission grids, and distribution networks to power generation, transmission, and other infrastructure utilities.

- Discrete Automation and Motion offers motors, generators, drives, and robotics to manufacturers across multiple industries.

- Low Voltage Products offers products and solutions from home automation to industrial buildings.

- Process Automation helps to optimize productivity of industrial processes to oil and gas, petrochemicals, mining, and other heavy industries.

For the quarter that ended June 30, revenue was $9 billion and net earnings $592 million. Gross margins and operating margins were both up year on year, but revenue was down about 12%. That, however, is near the average of its peer group, which suggests the company is holding its market share.

In fact, the strong U.S. dollar was cited by management as negatively impacting recent results. That indicates revenue in other currencies is down when converted to dollars, thanks to foreign currencies weakening against the dollar.

A potential catalyst for the stock is a restructuring that might facilitate the sale of the less-profitable Power Grid business. And perhaps not coincidentally, China's State Grid is viewed as a potential bidder. Management has recently announced $1 billion in cost cuts and potential layoffs in a bid for a leaner, meaner, and more agile company.

There's another catalyst to consider, as well: quantitative easing, which I expect to continue on a massive level.

There is even a political movement underway in the United Kingdom right now to implement "people's QE," whereby central banks funnel trillions into infrastructure projects, like Scotland's new Third Forth Bridge, rather than commercial banks. The wisdom of such a move is debatable, but it could see massive amounts of money pouring into "mega-infrastructure" like the New Silk Road.

Investors who own ABB today will only see their returns increase as the New Silk Road and projects like it grow closer to completion.

Even More Infrastructure Profits Are Up for Grabs

We recommend getting your share of the trillions that China is pouring into the New Silk Road, but that's far from the only infrastructure megaproject on the drafting table. Dealmakers all over the planet are capitalizing on a $57 trillion need, according to McKinsey, and there is plenty of money to be made here by investors like you. Executive Editor Bill Patalon couldn't agree more; he's uncovered a stock that's about to be launched by four powerful catalysts – and it's being accumulated by an influential "activist" investor. For a full report, click here.

Join the conversation! Follow Money Morning on Facebook and Twitter.

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Peter Krauth writes: It's obvious that China has superpower ambitions, but now we have, quite literally, a map detailing how she'll get there.

Peter Krauth writes: It's obvious that China has superpower ambitions, but now we have, quite literally, a map detailing how she'll get there.