Germany’s Immigration Challenge

Politics / Refugee Crisis Sep 24, 2015 - 02:11 PM GMTBy: John_Mauldin

This immigration crisis in Europe is a big deal, and it’s a bigger deal for Germany than for any other European country. Germany is directly in the firing line, both geographically and in terms of how many of the migrants want to settle there. Nearly 40% of migrants choose Germany as their preferred final destination, while the only other nation that is chosen by more than 10% of migrants is Hungary, at 18%.

This immigration crisis in Europe is a big deal, and it’s a bigger deal for Germany than for any other European country. Germany is directly in the firing line, both geographically and in terms of how many of the migrants want to settle there. Nearly 40% of migrants choose Germany as their preferred final destination, while the only other nation that is chosen by more than 10% of migrants is Hungary, at 18%.

Daniel Stelter is a very wired German economist and business thinker. He wrote to me a couple days ago, said he had read my remarks on Germany and the immigration crisis in last week’s Thoughts from the Frontline, and recommended to my attention a couple of articles he had just written on the issue. They are today’s Outside the Box.

In his note to me, Daniel says:

I doubt that it will work out as politicians hope. In theory we agree: well-educated people come to Germany to help us deal with the demographic crisis we face. The reality is that a big part of the immigrants will not be able to fulfill these hopes as they are illiterate, etc. We would have to invest heavily to make this happen, but politicians shy away from doing so. I have summarized what the scenarios are and what we would have to do to make it happen in this two-part comment for the Globalist, which you might want to have a look at. To be clear: Germany looks like ending up with more problems than less if we don’t change gears fast.

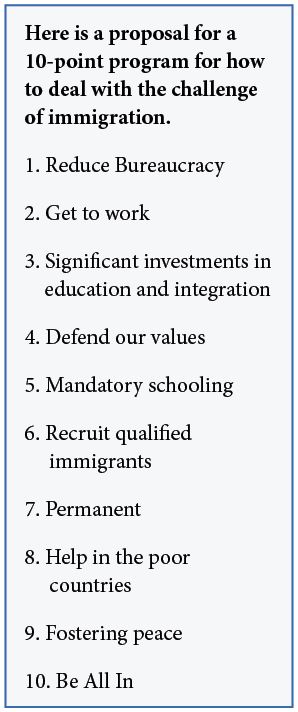

Please note that Stelter is not anti-immigration. His first piece below, “Germany’s Immigration Challenge,” enumerates the difficulties to be faced if Germany is to greatly increase immigration and lays bare a number of misconceptions about Germany’s ability to do so; but he doesn’t stop there. In the second piece, “Germany: A 10-Point Plan to Deal with the Immigration Challenge,” he thoroughly details what it would actually take for Germany to sustainably integrate the current wave of immigrants. This is a no-nonsense, no-holds-barred effort to confront the immigration crisis. Whether or not you think Stelter’s scheme can be realized, this (or something much like it) is what it will take to get the job done, not just in Germany but throughout Europe. This is going to be a costly endeavor no matter what, and it is going to happen as services and retirement payments are cut due to strained budgets. Which is going to strain nerves. This is the type of problem that has led to Marine Le Pen in France and others throughout Europe on the radical right and left beginning to show real strength in the polls. (Take a look at this piece on Le Pen from yesterday.)

Perhaps I am more fretful than I should be after my dinner with George Friedman, who loves Europe but doesn’t think the EU is the answer, nor that will it last in its current form.

I spent much of the day and will continue long into the evening in a planning session for the 2016 Strategic Investment Conference. It will be held in Dallas May 24-27, and I truly believe it will be my best conference ever. Part of the new emphasis is going to be on the ability of attendees to network with one another. There are cool new technologies that allow us to do that. The biggest “problem” is trying to sort out who the speakers will be this year: we have an embarrassment of riches. Well, that problem plus the half-dozen other major priorities that are already demanding lots of attention. I actually remember a time in my life when I felt that I could read the sports page and watch TV while still dealing with business and raising seven kids, plus being involved in politics and church, etc.

The irony is that I have this fabulous media system throughout the house, and I am ashamed to say that it is rarely used, except when kids or friends come over to watch something. I know I’m not the only person with insufficient bandwidth, because I hear it from friends everywhere. And the availability of great information is only going to increase. I am told that someday we’ll each have an information “butler” to help us handle the load, but that cool new personal AI app is going to have to wait for a lot more power in our computers and phones and monster upgrades in software.

I suppose it will come much like the speech-recognition technology that I’m using to write this letter. Given that I’m actually a relatively slow and clumsy typist, it has really increased my productivity. But I can’t tell you how many versions of this software I bought over the last 12 years that were not ready for prime time. I suspect that the introduction of techno-butlers will go much the same way. We’ll endure a lot of hype, spend our money, and be less than satisfied with the results. But by version 12.5, iButler will actually be a tool we can’t live without. If its development proceeds at the same pace as speech-recognition, then my personal butler might not show up ready for work until sometime in the late ’20s. On the other hand, the technological transformation is accelerating, so…

While we’re at it, I really do hope that Mike West over at Biotime can figure out how to make a new or at least a younger version of me, or at least the parts of me that I’m going need, by then.

You have a great week.

Your trying not to overload your inbox analyst,

John Mauldin, Editor

Outside the Boxsubscribers@mauldineconomics.com

Germany’s Immigration Challenge

We have to make an honest assessment of costs and benefits of the migration crisis.

By Daniel Stelter

September 13, 2015

Germany is considered a rational, fact-driven country, not an emotionally driven one. And yet, based on the current immigration debate in Germany, even the advocates of more immigration have little more to offer than emotional arguments.

Given our nation’s history, Germans want to help wherever and however possible. Offering asylum to those in danger is deeply rooted in our society and even those who look for a better living are welcomed by a large segment of German society.

The advocates of more openness point to the benefits which an aging and shrinking population receives from more immigration and they see the potential costs as rather minimal, at least for a rich country like Germany.

That is a rather rose-tinted assumption because it underestimates the financial costs, overestimates the benefits from immigration and clearly overestimates the financial capacity of Germany.

Being overly optimistic helps neither the immigrants themselves nor the cause of promoting greater openness in German society.

Tremendous costs

Proponents of more immigration to Germany refer to the shrinking workforce and the significant unfunded liabilities for pensions and health care, estimated at least at about four times the country’s GDP.

The ultimate answer about how significant more immigration is in that context depends on what the net contribution of immigrants is to the German economy.

Aside from the fact that the answer is very contested, even well beyond the realm of politics in the field of academic literature, there is an additional problem. No one can tell for sure, as the qualification of immigrants, especially refugees, is not registered.

Supporters of immigration point to the high number of academics immigrating, such as Syrian doctors. Critics point to a high number of uneducated and illiterate people. Most probably, Germany is receiving a mix of both, very well educated and uneducated people.

Even making a very optimistic assumption – that 50% of the one million immigrants expected in 2015 are well educated, willing to be integrated and want to contribute to the German society, while the other 50% will remain largely dependent on public support – we can make a simple calculation.

If the 50% share of skilled immigrants before long were to earn 80,000 euros on a per capita basis – well above Germany’s average income of about 40,000 euros – and paid taxes of 40%, their annual contribution to society in form of taxes would be about 16 billion euros per year.

Availability of only high-skill jobs

At the same time, assuming a social welfare cost of about 25,000 euros per “non-productive” immigrant, those costs would total 12.5 billion euros annually. That would still leave a positive net contribution to German society and the nation’s economy

This underscores that it is obviously critical from an economic point of view to attract a high share of productive immigrants.

But this matters for more than just economic considerations. As an advanced industrial democracy, Germany offers plentiful immigration opportunities for skilled people.

However, unlike the past when large swaths of low-skilled people came to Germany, the supply of low-skilled jobs in the manufacturing sector is drying up quite rapidly, not least due to the increased automation of German industry.

What is available are jobs in the services economy which require language skills and an ability to do abstract reasoning. Germany ought to be quite focused on this issue – not because it is heartless but prudent.

The country has made plenty of mistakes on the immigration front in the past, which ought not to be repeated. Not embracing an active, skills-based approach to the management of immigration – à la Canada or Australia – was one such mistake.

Does it matter?

Of course, one could conclude that net costs of a few billion per year do not matter for a country as rich as Germany. This is true – but only from the current perspective.

If one shifts from static to dynamic analysis and realizes that immigration into Germany may very well continue at the current speed, the picture looks quite different.

- Assuming a total pool of five million immigrants flowing in and a more likely mix of 30% skilled immigrants to 70% unskilled or low-skilled ones, the net costs would rise to 38 billion euros per year.

- Over a time horizon of 30 years, this would easily lead to costs of more than one trillion Euros. That is close to the entire costs of German reunification between 1990 and 2010.

Not as rich as it claims

Let’s also understand that Germany is not as rich as it claims. Besides the unfunded liabilities for the aging society of more than 400% of GDP, the strategy to exit from nuclear energy is expected to cost German consumers and businesses about 1 trillion euros.

Even that might be manageable if the euro were structured in a sound manner. As things stand, rescuing the Euro will at least cost another trillion euros. Add in the backlog of investments in public infrastructure and another trillion euros is gone.

A plan for immigration

Obviously, Germany needs to spend its money intelligently. But we also need to change our behavior.

From both an economic point of view, as well as from a humanitarian point of view and from the vantage point of providing of solid integration perspective in German society, we have to make the best out of the wave of immigration coming to Europe and Germany.

Germany: A 10-Point Plan to Deal With the Immigration Challenge

What does it take to make sure that the immigrants now arriving are integrated in a sustainable manner?

By Daniel Stelter

September 14, 2015

Reduce bureaucracy

The process of accepting someone as a refugee in Germany takes too long. We need to define safe countries, like Albania, and send immigrants from these countries back directly.

With all sympathy for their interest in a better living, they are not threatened by war or discrimination. On the other hand, refugees from countries in (civil) war should be accepted fast.

Get to work

It is very important to get immigrants into work once they are in Germany. It is bad for both skills and motivation levels if people cannot work.

Learning the German language is of utmost importance and should be mandatory. Ideally from day one onwards, immigrants should have to start learning the language.

And as long as the immigrants don’t have a job, they should do community service. This advances their integration into society and would give a clear signal: Everyone coming to Germany has to contribute to the common good with his or her abilities.

And as long as the immigrants don’t have a job, they should do community service. This advances their integration into society and would give a clear signal: Everyone coming to Germany has to contribute to the common good with his or her abilities.

Significant investments in education and integration

We need to register skills in order to find the appropriate job or define the necessary next steps in education. Education will the biggest challenge.

German schools even today fail to integrate and educate the children (and grandchildren) of migrants who have been in the country in some cases for some decades.

The school performance of children from Turkey, the Arab world and Africa is significantly below the average. We need to invest significantly, as this will define which share of migrants will become productive members of our society and which share will depend on social welfare.

Defend our values

Not only skills and language are important. In addition, we need to emphasize our principles and values. This includes freedom of speech and religion, women’s rights, tolerance for minorities and non-violence.

We have to make clear that integration will only work this way and is expected from everyone. Simply arriving is not enough to stay.

Canada, while generally being very welcoming to immigration, every year sends back about 10,000 immigrants – not necessarily for lack of integration, but it is not a one-way street.

Mandatory schooling

Participation in language school and courses on values and rules in Germany need to be mandatory for every new arrival. Just as Brazil does with its bolsa familia, the payment of social welfare should be linked to language and values training.

In doing so, we would convey the image of Germany as we should – a country willing to help, but also a country in which everyone has to make a contribution. Everyone who expects help and support needs to be willing to learn the language.

Recruit qualified immigrants

It is clear that a selection process as in Canada and Australia succeeds in attracting better-qualified migrants.

Besides refugees from war and people in their home countries, who need our support and where economic considerations should play no role, Germany should become more attractive for well-qualified migrants and be more active in advertising the opportunity to build a new life here.

As a consequence, we should actively open the way for legal immigration to Germany. As a result, the applicants could spend their savings on building a new life here, instead of spending it on smugglers.

Permanent

Both sides, the migrants and the German population, need to accept immigration as a lifetime decision. It is not a temporary refuge.

Again, Canada proves the point: If it is seen as permanent, both sides, the migrant and the accepting country, work harder to make integration work.

That has been a particular shortcoming of Germany’s immigration policies in the past, especially regarding Turks.

Help in the poor countries

It would be cheaper and more effective to help the people in safe countries such as Albania, who aim for a better life, with direct financial and organizational support. The EU should invest there and help to build democratic institutions and a working rule of law.

Fostering peace

The current wave of immigration is the result of conflicts which have lasted for decades already – and will likely last decades more.

This is amplified by a demographic development which leads to a high number of young people without a credible perspective of finding a job in their home country. This, in turn, increases the propensity not just for social strife, but even for (civil) war.

The West needs to reconsider its strategy fundamentally. The current U.S.-led approach of favoring military intervention over development aid only leads to even more destabilization.

Be all in

The humanitarian and financial costs of such a strategy are enormous. But if we don’t do this, we will have much higher costs to incur.

Whoever speaks of the benefits of immigration also needs to make sure that all the groundwork is laid so that the possible benefits are also realized. Making the necessary investments can by no means be taken for granted.

In conclusion, the current and future wave of immigration to Germany could be beneficial for our country – but only if we address the challenge with full force.

Unfortunately, it seems as if, just as in the eurozone crisis, that our various countries’ leaderships – Germany’s included – are failing at the task.

There is no denying that any solution involves shouldering huge costs for all citizens, natives and migrants. Those who hope that the wave will end soon should think again: Sub-Saharan Africa’s population is about to grow by 600 million over the next 20 years.

100 million or more of those mostly young people will look for a better life in the north. We had better learn now how to deal with it.Like Outside the Box?

Sign up today and get each new issue delivered free to your inbox.

It's your opportunity to get the news John Mauldin thinks matters most to your finances.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.