Gold Signals The End Of This Monetary Era

Commodities / Gold and Silver 2015 Oct 13, 2015 - 08:49 PM GMTBy: Hubert_Moolman

Gold remains our best means of economic measurement. It is not a perfect, but it is our best. Due to its monetary properties, gold can be used to measure wealth across generations.

Gold remains our best means of economic measurement. It is not a perfect, but it is our best. Due to its monetary properties, gold can be used to measure wealth across generations.

Just like we have the sun and moon to discern the times and seasons, I believe, we have gold to discern changes in wealth. It is interesting that the sun is often compared to gold, and the moon to silver. Just like a day in the Middle Ages is comparable to a day in this century, an ounce of gold in the Middle Ages is comparable to one today.

Currently, we use fiat currency, like the dollar, for economic measurement. However, this creates a huge distortion due to the fiat currency being highly unstable. Can you imagine what would be the effect on our planet if we did not use the normal cycles that the sun and moon provide us with? Our ability to produce food, for example, could be severely disrupted, leading to famine or possible extinction of mankind.

By using a highly unreliable measure like the US dollar, our ability to make proper economic decisions is severely impaired, since we (the common man) are not easily able to distinguish between a real increase or decrease in wealth, for example. This causes a great misallocation of wealth and will lead to a severe economic depression.

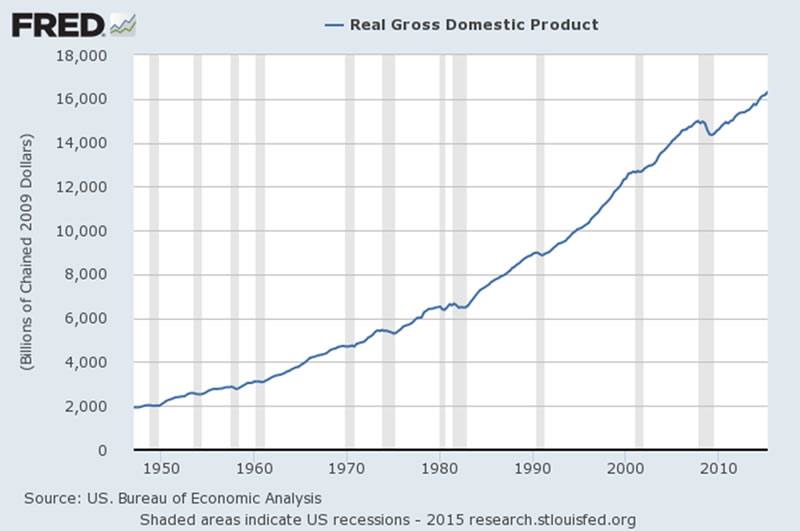

When you look at a chart of US GDP in US dollars, then it tells you that the US economy has been growing almost consistently – see below: Real GDP (inflation adjusted GDP) from US. Bureau of Economic Analysis:

It also tells you that the US economy is about eight times bigger than it was in 1947.

If you measure GDP in gold terms, see below – GDP as measured in Billions of gold grams (from PricedinGold.com):

Then, it tells you that GDP is in a massive downward trend since 2001. It also tells you that the US economy is only about twice the size that it was in 1947. In fact, it tells me that it is very likely heading to Great Depression levels and lower.

The same can be said for wages. When you look at any chart of US wages in dollars, it would show that wages are consistently going up, and are multiples higher of levels 60 or more years ago. Below, are two wages charts as measured in gold (again from PricedinGold.com):

Again, these charts as measured in gold tell a completely different story. Wages are almost at the lowest it has been over the last 70 years.

Gold allows us to keep track of the times and seasons of this corrupt system, by studying the behaviour of gold. Previously, I have shown how based on a gold measurement; it is very likely that the current monetary system will come to an end soon:

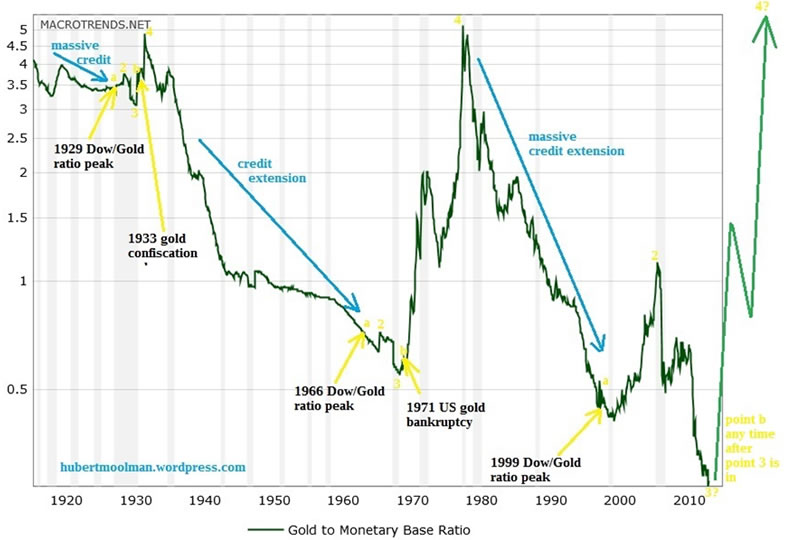

The chart (from macrotrends.com) shows the ratio of the gold price to the St. Louis Adjusted Monetary Base back to 1918. That is the gold price in US dollars divided by the St. Louis Adjusted Monetary Base in billions of US dollars. So, for example, currently the ratio is at 0.28 [$1 125 (current gold price)/ $4 019 (which represents 4 019 billions of US dollars)].

So, essentially this is a measure of the gold price relative to US currency in existence. This ratio is at an all-time low (extreme). Every time after it had reached an all-time low, based upon the patterns indicated (see point 3 in 1970 and 1932), we had a change in the monetary order.

The holders of gold obligations (US dollars) paid the price for the system reset, by getting less gold for their US dollars [1 oz for $35 instead of 1 oz for 20.67 in 1934 and 1 oz for $35 plus (up to $850)

instead of 1 oz for $35 after 1971].

After, this confidence in the system remained, and it could continue, without the perpetrators being held accountable or losing anything. Will the system continue this time as it did before, or will confidence in it forever be lost? Will the perpetrators live another day to continue their debt-based monetary system?

For more of this kind of analysis on silver and gold, you are welcome to subscribe to my premium service. I have also recently completed a Long-term Silver Fractal Analysis Report .

Warm regards

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2015 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.