Currency Devaluation's Dangerous Role in Deflation

Currencies / Deflation Oct 24, 2015 - 03:12 PM GMTBy: EWI

The following article on currency devaluation's role in deflation is from Elliott Wave International, the world's largest financial forecasting firm. EWI has just released a new report, Deflation and the Devaluation Derby, to help investors prepare now for the deflationary threat they see around the corner. Click here to read the new report >>

The following article on currency devaluation's role in deflation is from Elliott Wave International, the world's largest financial forecasting firm. EWI has just released a new report, Deflation and the Devaluation Derby, to help investors prepare now for the deflationary threat they see around the corner. Click here to read the new report >>

China's economy is slowing. Its stock market began to crash back in July. And the volatility rocking financial markets has been widely linked to the recent yuan devaluations by China's central bank.

"Surprise" has been a common word used by investors and financial pundits to describe the devaluation -- as in, "China's central bank surprise devaluation of yuan."

But what if we told you it wasn't a surprise -- it was in fact an expected event?

Below are three excerpts from analysis that EWI's own Chris Carolan published in his Sun-Tue-Thu Asian-Pacific Short Term Update on July 30 (several days before China's central bank first move to devalue the yuan against the U.S. dollar), then on Aug. 9 and Aug.11 (bold added).

The Asian-Pacific Short Term Update , July 30:

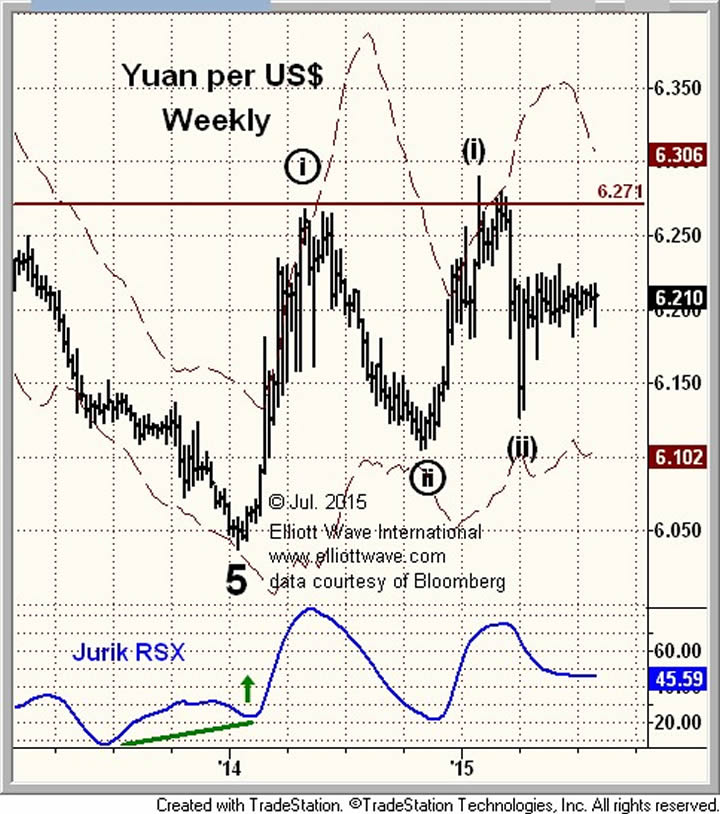

It's been some time since we checked in on the dollar yuan exchange rate. The rate is pegged by the Chinese government, though it is subject to market pressures. We've been patiently awaiting an upside breakout in the dollar against the yuan. Recent news reports have highlighted the increasing flight of capital from China. That capital flight causes upward pressure on the dollar yuan, which is the direction we've been expecting this market to take for some time. Reports are also tracking heavy Chinese selling of U.S. Treasuries in order to dampen the upward pressure on dollar yuan. For now, the peg holds tight... Yet at some point, markets are bigger than governments.

We expect dollar yuan to defeat those who are determined to peg it. And as the chart above shows, when that time comes, it will be a third-of-a-third wave higher for the dollar against the yuan.

At some point, the dollar should move strongly higher against the yuan and target that Minor wave 4 trading area at 6.80.

The Asian-Pacific Short Term Update, Aug. 9:

[T]here is real risk of a repeat of 1997's Asian currency crisis.

The Asian-Pacific Short Term Update, Aug. 11:

We've discussed important, unfolding trends in recent updates. We've shown how regional currency weakness would pressure the Chinese yuan to unpeg their currency from the dollar with an expected, wave three-of-three, strong moves as a result (July 30). We've shown how regional currency declines were widespread across the region (August 6.) And we've shown how these weak currencies are linked to weak equities markets, with an increasing risk for a full-blown currency crisis similar to 1997. This analysis has now been borne out by the Chinese devaluation today. To put all these observations together is to conclude that both regional equities and regional currencies are extremely weak here with the potential for a full-fledged crisis just ahead.

China allowed the yuan peg to the dollar to break, an eventuality that we discussed just two weeks ago. This upside breakout in the dollar is the beginning of a third wave.

The Chinese have now joined in the competitive devaluation game. Neighboring currencies have been falling for some time. The yuan has quite a bit further to fall (and the dollar to rally) before any type of equilibrium is reached. This move by the Chinese is deflationary for the rest of the world. China is now an exporter of deflation.

This move will be felt in all markets, not simply currencies, and in all regions of the world, not simply Asia.

We all know what came next: the stunning 2,000-point decline in the DJIA, which -- in less than a week! -- erased two years' worth of rally in the world's benchmark stock index.

Is a huge U.S. stock plunge dead ahead? Not necessarily -- and when you read our latest analysis, you will see why -- but falling share prices are an inevitable result of the same deflationary forces that spark countries to devalue their currencies, and China is hardly alone. Countries around the world are following suit.

Make no mistake; currency devaluation in China and elsewhere is a side-effect of the deflationary forces spreading around the world. If history is any guide, only those who recognize the risks and opportunities of deflation, and see it coming, can prepare to protect their money from its tightening grip.

For more, read EWI's new report, Deflation and the Devaluation Derby, to get the facts and figures today so you can see around the corner and prepare for tomorrow. Click here to read the report now >>

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.