Zero Percent Inflation…What’s Next?

Economics / Deflation Oct 27, 2015 - 02:37 PM GMTBy: Harry_Dent

During World War II, the Fed bought its own bonds to keep interest rates low and demand high enough to finance the war effort.

During World War II, the Fed bought its own bonds to keep interest rates low and demand high enough to finance the war effort.

Back then, the Fed’s efforts did what you’d expect: they caused a modest level of inflation.

So you’d expect the unprecedented stimulus of today to create substantially higher inflation. In fact, with the greatest money printing in history, it wouldn’t be unreasonable to fear hyperinflation.

That’s what most gold bugs fear.

It’s what most everyone seems to fear.

They’re completely wrong.

Inflation is low… will stay low… and there will be no hyperinflation to speak of.

The money the Fed printed has largely gone into financial speculation. It hasn’t performed any real stimulus efforts by expanding the money supply through lending and spending.

So instead of inflation, we’ve seen bubbles pop up all over the financial markets. And they’re just like the ones we’ve seen before when tech stocks blew up. It was the same with real estate to follow… then emerging markets… then commodities… then gold… then junk bonds… then Treasury bonds.

Those bubbles did nothing to create a stronger future.

Instead, they tempted investors to misallocate resources. So when the bubbles inevitably burst, the system they’d stretched and warped with debt fell apart.

So why are gold bugs’ fears of hyperinflation so misplaced?

Because they’re only looking at the amount of new money being created.

I’ll grant them – current printing is unprecedented. There’s a lot of new money.

But what they’re not considering is the velocity of money.

Dr. Lacy Hunt – the only classical economist I like – explains this when we invite him to speak at our Irrational Economic Summits.

When money velocity is rising, it means the economy is expanding. Production capacity is increasing. Wages rise. Deposits are lent and invested effectively.

Essentially, more money moves around the economy in the places that it should. Late 1978 into 1997 was such a period.

But when money velocity falls, it means investment becomes increasingly speculative. Less money is spent on production and capacity. Workers’ wages stagnate or fall. They spend less. The money flow shifts.

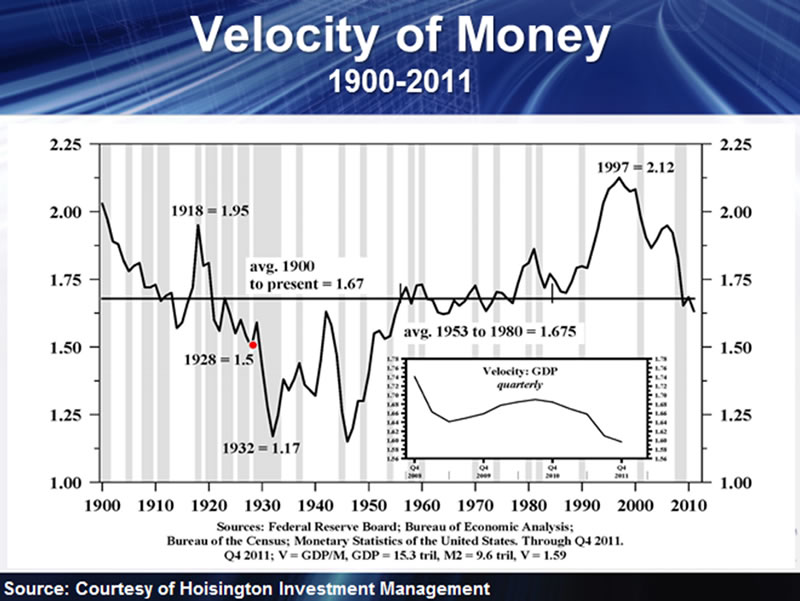

Here’s the chart that Lacy Hunt uses. Notice how the velocity of money rose basically from the end of World War II into 1997. It’s been going negative ever since and is now below its average (the black line in the center). When that happens, it means those bubbles and the debt behind them are starting to deleverage.

The result? Deflation.

Think of it like the circulation of blood. When money velocity rises, blood flows through the veins and arteries smoothly. It feeds our muscles and organs the necessary nutrients and oxygen they need to function optimally.

When money velocity falls, blockages form. The blood pools. Blood clots and strokes become a constant threat.

The last time we saw money velocity drop like a rock was between 1919 and 1929. It went negative in 1930 and stayed in that territory until 1933.

During those three years, bubbles burst left, right, and center. Debt deleveraged at breakneck speeds. We saw deflation, not inflation, even with record low interest rates and Fed stimulus to fight the Great Depression.

It’s happening again today.

The velocity of money has turned lower… and since 2008 and 2009 when we started to see deflation, the Fed and other central banks have declared war, hell bent on wiping out deflation and foregoing debt deleveraging through massive QE.

As of last month, inflation is zero.

Some war!

Pretty soon they’ll run out of steam. They can’t continue to fight the massive debt overhang AND worsening demographic trends. They’re losing the war. Deflation is coming.

So ask yourself: are your investments protected from inflation, or deflation?

Most debt crisis experts have people protected from inflation. The people that followed their recommendations in 2008 got slaughtered.

Don’t resign yourself to the same fate.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.