The Stocks Bear Market Meter is Running

Stock-Markets / Stocks Bear Market Nov 04, 2015 - 05:03 AM GMTBy: EWI

Taxicab medallions and margin debt: A similar reversal in the making

Taxicab medallions and margin debt: A similar reversal in the making

As a native New Yorker, I can say with complete confidence: It's true; there's no place on earth like The Big Apple. It's also true that, until recently, most New Yorkers would trip a nun if it meant hailing a Yellow cab first.

Fact is, the NYC Yellow cab used to be the hottest commodity in the five boroughs. When you needed a ride, spotting a cab with its service light on was like finding the last pair of Manolo Blahnik shoes in your size at a Manhattan Sample Sale.

But those days are over in NYC (and nearly every major U.S. metropolis). In the past year alone, street hail vehicles have suffered a series of crippling blows -- including plummeting demand, fleet changes, sliding medallion values, and the "Taxi King" himself -- Gene Freidman -- filing for bankruptcy.

Today Friedman is on the hook for millions of dollars he borrowed to purchase hundreds of taxi medallions. (At one point, he "owned" more than 1000!) Writes an October 26 article in The Federalist:

"His willingness to bid on practically any medallion that came up for sale helped drive a rapid increase in medallion prices across the country. This model can work when times are good... until consumers move on and funding dries up."

"While yellow taxi medallions were selling for $1.32 million as recently as May 2013, now they may be worth as little as $650,000."

Which brings us to ... why?

Well, according to the mainstream experts, the decline of taxicabs is a direct result of the rise in ride-sharing companies like Uber and Lyft:

"Uber is crushing the taxicab industry that has dominated NYC for so many years" (August 21 Business Insider)

But there's a flaw in that logic. Namely, Uber has been around since early 2011. For three years, its presence failed to knock the iconic Yellow cab off its pedestal. To wit: in February 2014, one single taxi medallion sold for a record-shattering $1 million-plus at auction.

Wrote one February 26, 2014 NY Post:

"The auctions give the lie to the notion that Uber is having an apocalyptic impact on the taxi industry. The taxi industry is as strong as it's ever been, despite Uber, because people in major cities will still go and stick their hands in the air." (Bloomberg)

So, if it's not Uber, what's taking the shine off the metal taxi medallion?

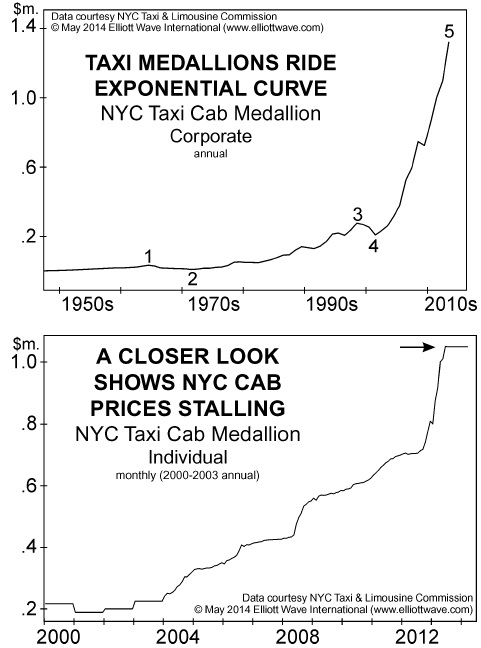

Well, in our May 2014 Elliott Wave Financial Forecast, we confirmed that the fate of NYC's taxicab industry was about to suffer a major reversal -- not because of rising competition, but rather a five-wave rise in investor psychology:

"The next two charts offer street-level evidence that things are about to take a bearish turn for the Big Apple. Notice the acceleration [in the price of NYC taxicab medallions] comes at the end of a five-wave pattern...

At this point, it probably comes as no surprise that taxi medallions are just another financial instrument that has been launched skyward on the heady combination of credit and the ubiquitous fever for higher and higher prices. In the next leg of the bear market, medallion prices should fall..."

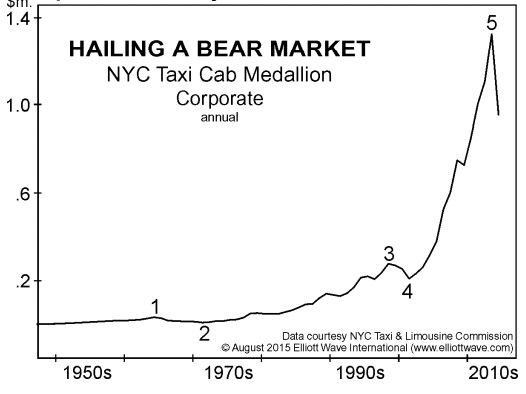

Fast forward to our August 2015 Elliott Wave Financial Forecast, which shows what happened next:

"The updated chart shows that the decline in medallion prices started almost immediately after our forecast...Sales have now dried up, and two corporate medallions sold for as low as $700,000 in February."

Borrowing money to buy into an asset that you and the rest of the world believes can only go up in value -- does that sound at all familiar?

Well, in our June 2015 Elliott Wave Financial Forecast, we showed "overwhelming evidence of an extended market" in U.S. stocks, one piece of which was an all-time record in margin debt.

Flash ahead to today, and behold a raft of headlines like this one from Bloomberg (Oct 4, 2015): "Margin debt in free fall... Margin debt balances at NYSE member firms sustained a $19.5 billion decline in September, the biggest monthly fall since 2011."

Make no mistake: The bear market meter is running. The question is, can you afford the fare?

|

Credit Insanity: The Biggest Debt Bomb in History and the Fuse is Lit Created for paying subscribers and now accessible to the public for the first time, this eye-opening new report reveals the precarious consumer, corporate and government debt situation around the world. Read this three-part report now and hear directly from the top analyst at the world's largest financial forecasting firm about key research, statistics and concerns about U.S. and global debt, as well as its imminent threats to investors. |

This article was syndicated by Elliott Wave International and was originally published under the headline The Bear Market Meter is Running. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.