Government - The Most Devious Liars In The Room

Politics / US Politics Nov 05, 2015 - 05:54 AM GMTBy: James_Quinn

There were a few different stories coming out over the last few days that reveal the true nature of government and the apparatchiks who use disinformation, devious machinations, fraudulent accounting, and taxpayer money to cover up their criminality, lies, and the true state of the American economy. The use of government accounting tricks to obscure the truth about our dire financial straits is designed to keep the masses sedated and confused.

There were a few different stories coming out over the last few days that reveal the true nature of government and the apparatchiks who use disinformation, devious machinations, fraudulent accounting, and taxpayer money to cover up their criminality, lies, and the true state of the American economy. The use of government accounting tricks to obscure the truth about our dire financial straits is designed to keep the masses sedated and confused.

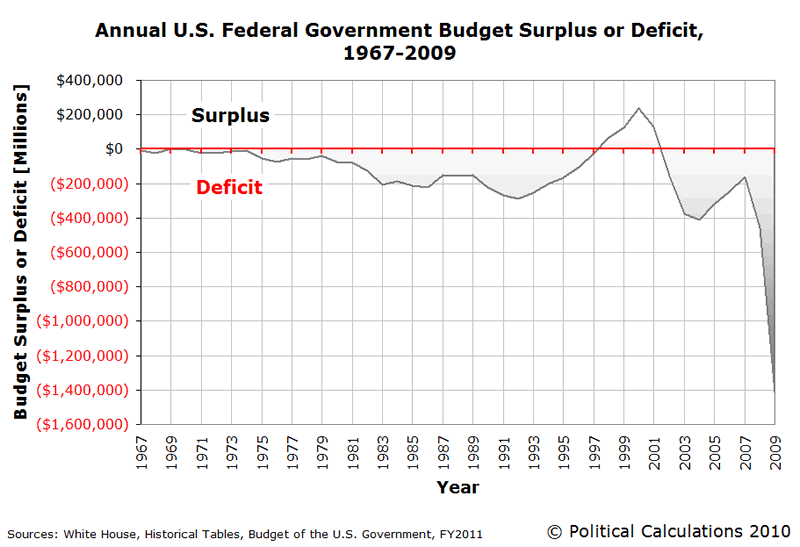

A few weeks ago, to great fanfare from the fawning faux journalists who never question any Washington D.C. propaganda, they announced the lowest annual deficit of Obama's reign of error.

For the fiscal year that ended Sept. 30 the shortfall was $439 billion, a decrease of 9%, or $44 billion, from last year. The deficit is the smallest of Barack Obama's presidency and the lowest since 2007 in both dollar terms and as a percentage of gross domestic product.

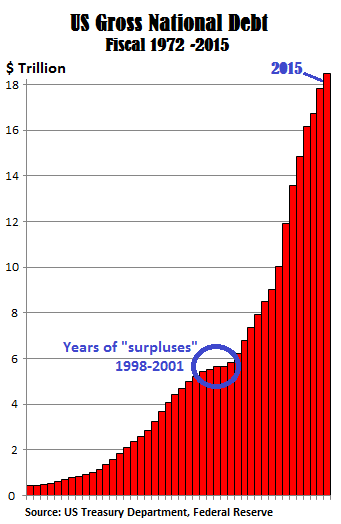

Jack Lew, the Treasury Secretary, and Obama were ecstatic as they boasted about this tremendous accomplishment. I find it disgusting that our leaders hail a $439 billion deficit as a feather in their cap, when until the mid-2000's the country had never had an annual deficit above $300 billion. After 183 years as a country, the entire national debt was only $427 billion in 1972. Now our beloved leaders cheer annual deficits above that figure. What a warped, deformed, dysfunctional nation we've become.

When the government reported this tremendous accomplishment, there was no way to verify the number against the national debt figures, as the government stopped reporting the daily national debt figure because of the debt ceiling impasse with Congress. The farce of these Kabuki Theater exercises in government incompetence is almost beyond comprehension.

The Treasury Department pretends the national debt is not increasing, even though they continue to spend $1.43 billion more per day than they are bringing into their coffers. Future generations see their debt obligation rise by $59.6 million per hour and we act like this is a reasonable and normal situation. The idiocy of these Keynesian extremists is enough to make a rational person's head explode.

Once the two heads of one party agreed to raise the debt limit to infinity, the Treasury decided to update the National Debt figure. They stopped counting in mid-March at $18.151 trillion. When they resumed counting on November 2 it skyrocketed by $341 billion to $18.492 trillion. Then it jumped another $40 billion on November 3 to $18.532 trillion.

It takes a little addition and subtraction to estimate the true fiscal 2015 increase in the National Debt, so most of graduates of our government controlled public education system would be helpless, as they are concentrating the crucial issues of social justice, celebrating diversity, and declaring global warming non-debatable.

It seems the National Debt increased by $1.43 billion per day while they weren't counting, so using that figure for the 205 days leaves you with a National debt of $18.444 trillion on September 30, 2015. The year began with a National Debt of $17.824 trillion. Therefore, the TRUE fiscal 2015 annual deficit of the country was $620 billion. As a reminder, interest doesn't accrue against reported government accounting deficits. It accrues against the true increase in the national debt.

If you were paying attention earlier in this article you might remember Obama and Lew announced a $493 billion deficit, not a $620 billion deficit. A critical thinking person might wonder why the National Debt went up by 26% more than the deficit officially reported by our trustworthy leaders. This is where the hocus pocus of government accounting enters the picture.

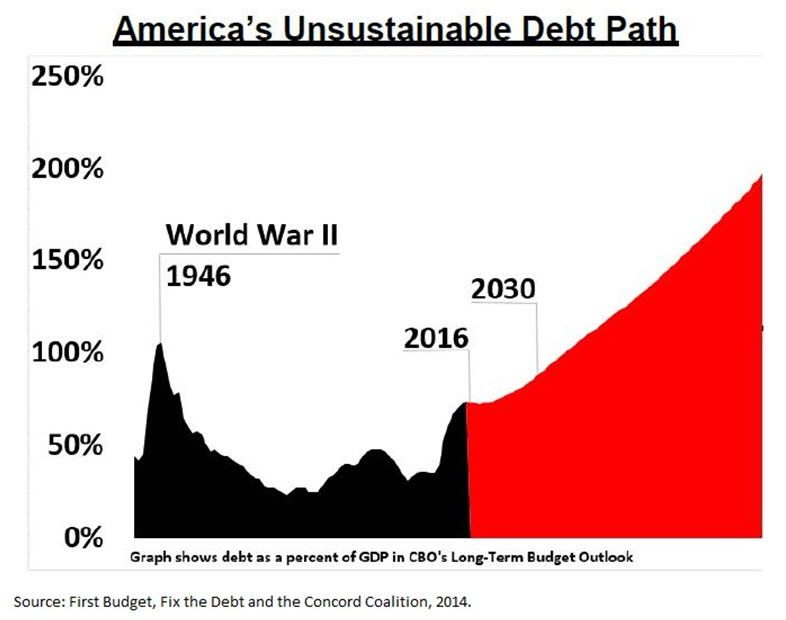

You just don't count things that would make the deficit bigger. You pretend the SSI and SSDI entitlement programs aren't running deficits. You pretend you are being paid back by Fannie and Freddie, when it is just meaningless accounting entries. And this doesn't even scratch the surface of the true annual deficits. Laurence Kotlikoff, professor at Boston University, is one of the few honest men in academia when it comes to economics and our dire financial straits. Using true accrual accounting, our annual deficits are really $5 trillion per year. His recent testimony before the Senate laid out the truth:

"Our country is broke. It's not broke in 75 years or 50 years or 25 years or 10 years. It's broke today. Indeed, it may well be in worse fiscal shape than any developed country, including Greece. In reality we're facing a fiscal gap of $210 trillion. That's 16 times larger than official U.S. debt, which indicates precisely how useless official debt is for understanding our nation's true fiscal position, and almost 12 times the current GDP of $18 trillion."

This brings us to the other stories hitting the wires this week that tie into the deficit deception being perpetrated on the American people. One of the major reasons the government has been reporting declining deficits are the $239 billion of "payments" from Fannie Mae and Freddie Mac to the U.S. Treasury. But those "payments" were not cash. They were phantom journal entries. It's really very simple.

In March 2009, at the stock market lows, Bernanke and Geithner threatened the weenie accountants at the FASB and forced them to suspend their mark to market accounting rules so that bankrupt insolvent Wall Street banks, along with Fannie and Freddie, could falsify their financial statements by valuing worthless toxic mortgage sludge at 100% of their book value. It's amazing how profitable a financial institution can be if they fake their financial statements.

So over the last few years, criminal Wall Street banks have produced fake profits, which they then used to "pay back" their TARP funds to the U.S. Treasury. Fannie and Freddie have been able to announce hundreds of billions in fake profits, which they have used to pay fake dividends back to the U.S. Treasury. If they were real profits their stocks wouldn't be lingering at $2 per share, down 95% from their 2007 highs. Essentially, most of the deficit reduction over the last few years, lauded by the Obama administration, has been nothing but an accounting ruse cooked up by the Fed, the Treasury, Wall Street, and the captured housing mortgage entities.

The announcement this week marks an end to this charade. Freddie Mac lost $475 million in the third quarter and Fannie is also expected to report a big loss. No more phantom paybacks to the U.S. Treasury to reduce the deficits. It is now highly likely these pitiful excuses for business enterprises will require billions in taxpayer bailouts in the foreseeable future. When this latest Fed induced housing bubble pops for the second time in a decade, Fannie and Freddie will lose $187 billion again in the blink of an eye.

WASHINGTON (MarketWatch) - Fannie Mae and Freddie Mac are at risk of needing an injection of Treasury capital after the latter reported its first quarterly loss in four years, the director of the Federal Housing Finance Agency said Tuesday.

FHFA Director Mel Watt issued a statement following mortgage-finance company Freddie Mac's $475 million third-quarter loss, its first quarterly loss in four years.

"Volatility in interest rates coupled with a capital buffer that will decline to zero in 2018 under the terms of the senior preferred stock purchase agreements with Treasury will likely make both Enterprises increasingly susceptible to the possibility of quarterly losses that could result in draws going forward," Watt said.

Freddie Mac said its loss was driven by interest rate changes that soured the value of derivatives it holds.

It seems the deviants in Washington D.C. have run out of tricks. The treat will be soaring deficits, as entitlements, Obamacare, war expenditures, and a myriad of other goodies promised by corrupt politicians of both parties, overwhelm the nation. The projection for fiscal 2016 is already higher than 2015, and this is before the current recession's impact on tax revenues has been taken into account. The $1 trillion deficits of a few years ago are coming back shortly.

The average maturity of our existing debt is about 5 years. Instead of locking our debt in at 30 year rates below 3%, our government has decided to play Russian Roulette with interest rates. A 1% increase in interest rates will drive interest on the debt from $400 billion per year to $600 billion per year, a 50% increase. A normalization of rates to 2007 levels would drive the annual interest on the debt to almost $1 trillion and blow an enormous hole in the budget. Now you know why Madam Yellen can't bring herself to increasing rates by even a paltry .25%.

Lastly, we put the cherry on the cake of governmental incompetence, recklessness, self interest, and foolish disregard for the taxpayer. Fannie and Freddie are again reporting losses. Home prices have been driven by speculators, hedge funds, and foreign money to new record highs. Mortgage rates remain near record lows and will immediately spike when the Fed increases rates. The middle and lower classes have seen their real household income continue to shrink.

The economy is clearly weakening as corporate profits fall, global trade shrinks, layoffs soar, and all economic indicators flash red. Sounds like the best time to lure low income dupes into the housing market with 3% down payment mortgages with no minimum cash contribution - all backed by the U.S. taxpayer. The low income home buyer will instantly be 5% underwater, as it costs 8% to sell a house. The coming 20% to 30% decline in home prices will do wonders for the foreclosure business. At least we have plenty of experience in this arena.

Fannie Mae has announced their latest program - HomeReady:

"HomeReady is designed for creditworthy, low-to moderate-income borrowers, with expanded eligibility for financing homes in designated low-income, minority, and disaster-impacted communities. HomeReady lets you lend with confidence while expanding access to credit and supporting sustainable homeownership."

Fannie is encouraging fly by night mortgage brokers and shady lenders to dole out subprime mortgages to anyone that can fog a mirror, with the full confidence that the billions in future losses will be picked up by the American taxpayer. Where have I seen this story before? We really need some patriotic Wall Street banks to package these loans into a CMO derivative and sell them to pensions funds across the globe. What could go wrong?

We've allowed our nation to be overtaken by a financial elite who have captured the politicians, the judiciary, the mass media, and the economic levers of the state. The issuance of ever increasing levels of debt leads to their enrichment and our impoverishment. If we continue to act like passive sheep, we will forever be ruled by wolves.

"I sincerely believe that banking establishments are more dangerous than standing armies, and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale." - Thomas Jefferson

"A nation of sheep will beget a government of wolves." - Edward R. Murrow

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.