Why Gold Prices Could Bounce This Week

Commodities / Gold and Silver 2015 Nov 16, 2015 - 09:57 AM GMTBy: Bob_Kirtley

Since the last US employment release and comments from Yellen suggesting a December hike is likely, gold has struggled to maintain its downward momentum. Whilst we believe that the Fed will increase rates in December and gold prices will move lower over the medium term, there is a strong case for a bounce in gold prices in the short term. Technically gold is oversold and holding support at $1080. This is too low relative to market pricing for a Fed hike and should find support from weaker US data since NFP, lower stocks, lower oil as well as a safe haven bid from any escalation of issues related to ISIS and recent tragic events in Paris.

Since the last US employment release and comments from Yellen suggesting a December hike is likely, gold has struggled to maintain its downward momentum. Whilst we believe that the Fed will increase rates in December and gold prices will move lower over the medium term, there is a strong case for a bounce in gold prices in the short term. Technically gold is oversold and holding support at $1080. This is too low relative to market pricing for a Fed hike and should find support from weaker US data since NFP, lower stocks, lower oil as well as a safe haven bid from any escalation of issues related to ISIS and recent tragic events in Paris.

Weak Data, Stronger Bonds

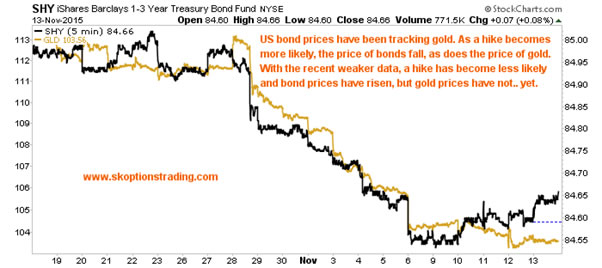

Let us begin with the data, since that will ultimately drive monetary policy as Yellen increasingly links the future path of interest rates to US economic health. US retail sales was weak on Friday, +0.1% versus expected +0.3% as was producer prices with an expectation of +0.2% only being followed by a -0.4%, even taking out food and energy a very weak -0.3%. With price indices falling there is hardly the inflationary pressure to force the Fed to hike rates. CPI data will give us more information this week, but it’s a poor start. Stocks and bonds responded as one would expect on weaker data, stocks falling and bond yields lower, but gold prices were stable.

As the chart above shows, GLD could easily rise to $106 to catch up the recent move, which is equivalent to gold bouncing to around $1100, and if bonds keep rallying it could go even further.

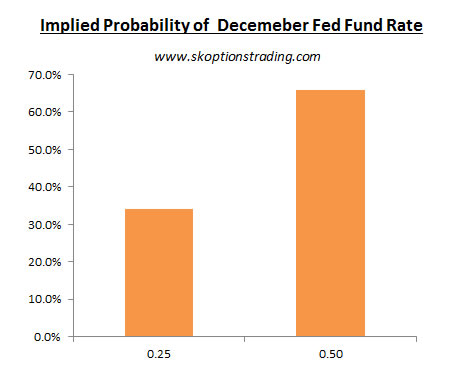

Market pricing of the implied probability of a Fed hike in December has dropped from roughly 75% to 65% (according to the CME FedWatch tool). And yet the gold price is barely changed from its close following the boomer NFP print? In fact it’s a just $10, a mere 0.93% from its intraday lows made this week. Even as medium term gold bears we cannot help but think that gold should bounce from here.

Fed Speakers

One of the key developments we have been watching is the calendar of Fed speakers between now and December. With no FOMC meeting, the Fed speakers will show clues as to what they intend to do at the next meeting. As we have noted in last week’s article “Its Now Or Never For Yellen”: “Between now and the FOMC meeting next month there multiple speeches by members of the Fed. This month this includes Vice Chair Fischer on the 13th and Bullard on the 21st, as well as Yellen herself on December 2nd and 3rd. We expect the Fed’s bias to hike to be re-enforced in these speeches. This will gradually get the market more and more comfortable with a hike in December.

If instead the Fed intends to not hike, then this should be swiftly reflected in these speeches as the Fed will certainly not want to deliver a no hike when pricing indicates that one has a 70% chance of happening.”

Let us take a quick look at the speeches made this week. Firstly we had Dudley, who is a voter and generally considered a dove (biased in favour of accommodative monetary policy). Dudley said that it was possible that liftoff conditions may soon be satisfied, with the international outlook appears like less of a problem that it was a few months ago. The wobbles in China arguably stopped the Fed hiking in September but Dudley noted that although there are still legitimate concerned about the Chinese economy, China does have a lot of tools to address economic issues.

Next Lacker, who is a voter and a hawk (biased in favour of tighter monetary policy) came out strongly in favour of a hike and even said there is a chance the Fed could raise rates faster if they get behind the curve on inflation. This is no real surprise, since Lacker dissented at the last two meetings, voting in favour of a hike in September.

Bullard, another hawk but non-voter, was clear in his view that the Fed's goals have been met and there was no reason to hold interest rates low since 5% unemployment is close to full employment. Evans, a dove and voter was more neutral, saying that inflation is still too low and would rather see later rate hike as the risk of premature rate hike is greater than the risk of holding off rate hikes.

On balance these speeches keep December live, but market pricing has moved to indicating a lower probability of a hike. It is evident that the market was expecting some more explicit guidance from the Fed that they will hike in December, and whilst there is still plenty of time for the Fed to deliver such a message, the risk is that the Fed language disappoints hawks. They key speeches to watch this week are Kaplan’s just before the Fed minutes are released, then Lockhart’s and Bullard’s speeches on the economy in Atlanta and Arkansas, before finally on Friday Williams speaks on monetary policy at Berkeley.

Technically Oversold

Having turned bearish above $1150, the MACD is now beginning to converge signalling that the downward momentum is waning. The RSI is sub 30 and oversold, combined with gold being and the bottom of recent ranges and on key support at $1180 paints a supportive technical picture for gold. There is no resistance to the topside until around $1125, thus a swift $20-$50 bounce in gold prices is easily achievable given the technical backdrop. Above $1125 gold will battle given the resistance at $1150 and the lower highs that we have seen since mid-2012 indicating that reaching the $1180 level is going to be a big ask.

Fade The Rally

In conclusion we see short term bounce in gold as highly probable given how low gold is relative to market pricing for a Fed hike and a backdrop of weaker US economic data since payrolls. Lower equities add to the risk off tone and even a safe haven bid from recent tragic events in France could support gold, as concerns grow about an increase in European involvement in the Middle East or further terrorist attacks. Position wise we have reduced our gold shorts, but will be looking to sell this rally. We are still medium term gold bears and hold the view that the Fed will hike rates in December sending gold below $1000.

However right here and now we cannot be selling at these levels. In the equities markets we sold topside protection which has worked well this week, but we are now more neutral and looking for opportunities to sell the VIX into its recent spike above 20, whilst we remain without a position on gold mining stocks. To find out details of our current portfolio and receive our full market update, please visit www.skoptionstrading.com for more information on how to subscribe.

Go gently.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.