End of Schengen, Stock Market’s Technical Strength Grows

Stock-Markets / Stock Markets 2015 Nov 20, 2015 - 05:40 PM GMT EU Seeking End to Passport-Free Travel.

EU Seeking End to Passport-Free Travel.

In an unprecedented move following the horrific attacks in Paris last Friday the 13th the European commission is reviewing its founding treaty with a view to strengthening border controls. This development goes to show the change in European conscious brought about by the sheer scale of the Parisian death and injury. The vision of the founding fathers of the EU saw the end-game being a Federal “one nation” Europe and progressive treaties over the last 70 years or so sought to bring this “binding” about. I believe that recent events have put a stop to this goal once and for all. If the European Union cannot protect its citizens (and it is obvious it cannot) then the only fallback is the individual state, ergo this state cannot be abolished in this new world of hyper-terror. It would thus now appear that David Cameron’s desire to see the EU revert back to being a common market of independent Nation States is going to come about after all. What negotiation was not achieving it would appear radical terrorism has. Who would have thought? Here is how the Associated Press reported this story:

AP. 20th. November 2015:

Between the French Interior Minister Cazeneuve: "we're face with a new kind of terrorism", and Hungary’s PM Orban: "allowing people into our own back yard who may then commit acts of terrorism was irresponsible”, AP reports that the EU's founding treaty with regard to passport-free travel - the so-called Schengen Agreement - is to be reformed. "We want Europe, which has lost too much time on a certain number of questions, to note the urgency and take decisions today," exclaimed Cazeneuve, with Orban adding "the founding treaty is currently an obstacle to this and I believe it needs to be reconsidered." According to Cazeneuve, the reforms will happen by year-end.

“EU ministers have agreed to carry out more stringent controls at the bloc's external borders, in response to the attacks in Paris last week”, says Luxembourg Deputy Prime Minister Etienne Schneider.

“Member states must fully apply the rules of the border-free Schengen zone to carry out systematic controls on EU citizens at the bloc's external borders, he says, adding, "It's not an option, it's an obligation."

“The bloc's internal and justice ministers have also requested a strengthening of the existing Schengen border controls. On one hand, “we cannot close Europe,” Schneider continued, “But on the other hand, we cannot open Europe totally for millions and millions of poor people in the world or even for all of those coming from conflict zones. Impossible,” he stated, calling for a change to the European refugee system.

Even Berlin intends to slash cash benefits to refugees, providing them with food instead.

“The European Union's founding treaty should be reconsidered”, Prime Minister Viktor Orban said after meeting Macedonian counterpart Nikola Gruevski on Friday.

The prime minister continued: “European should face up to the fact that migrants come from areas involved in military conflict with EU members. We are considered enemies in those countries, and the acts of terror committed in our areas are considered war successes over there, allowing people into our own back yard who may then commit acts of terrorism was irresponsible”.

"The founding treaty is currently an obstacle to this and I believe it needs to be reconsidered, In order to make Europe effective, basic questions need to be reevaluated”, he added. “It is increasingly obvious that the EU is capable only of responding to crises rather than taking preventive measures. It appears only now that European politicians are starting to assigning security its proper role”, Orban concluded.

Market’s Technical Strength Grows.

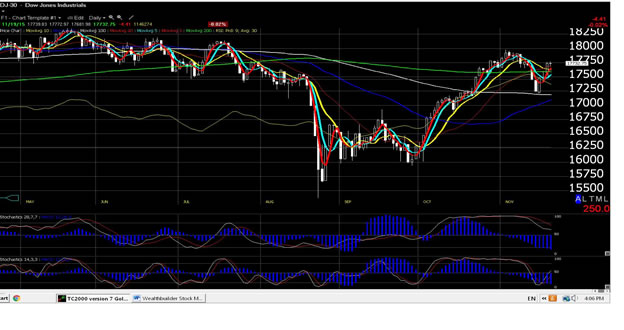

With each passing week the stock market is giving indications that it is rebuilding itself for a breakout to new all-time highs.

Given the scale of breakdown on August 20th. this is quite amazing. While from a Dow theory perspective the Dow Industrials are far stronger than the Transports, if the 8437 level on the Trannies is breached to the upside I believe by all accounts we will get a decent “Santa Rally”.

However there is one area of the market that is causing me some worry and that is the area of consumer retail. Many of the big players have the technical configuration of a looming recession. For example I attach the charts for Macy’s, Ross Stores, Best Buy and Sears. How their sales figures fare over “Black Friday” will play a major part in my rosy year end prediction. Let’s all keep our fingers crossed.

Chart: Dow Industrials: Daily.

Chart: Dow Transports: Daily.

Chart: Macy’s Inc: Daily.

Chart: Ross Stores: Daily.

Chart: Best Buy Co:Daily.

Chart: Sears Holding Co: Daily.

Charts courtesy of Worden Bros.

By Christopher M. Quigley

B.Sc., M.M.I.I. Grad., M.A.

http://www.wealthbuilder.ie

Mr. Quigley was born in 1958 in Dublin, Ireland. He holds a Bachelor Degree in Accounting and Management from Trinity College Dublin and is a graduate of the Marketing Institute of Ireland. He commenced investing in the stock market in 1989 in Belmont, California where he lived for 6 years. He has developed the Wealthbuilder investment and trading course over the last two decades as a result of research, study and experience. This system marries fundamental analysis with technical analysis and focuses on momentum, value and pension strategies.

Since 2007 Mr. Quigley has written over 80 articles which have been published on popular web sites based in California, New York, London and Dublin.

Mr. Quigley is now lives in Dublin, Ireland and Tampa Bay, Florida.

© 2015 Copyright Christopher M. Quigley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Christopher M. Quigley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.