Bracing for Another Breakdown in Gold Miners GDXJ and GDX

Commodities / Gold and Silver Stocks 2015 Nov 21, 2015 - 12:24 PM GMTBy: Jordan_Roy_Byrne

The bear market in the gold miners has been one for the record books but it is not over yet. Last week we noted that precious metals were on the cusp of making new lows while the US$ index was very close to another key breakout. This scenario remains well in play and would certainly affect the gold mining sector, which over the past two weeks failed to rebound or build on any strength.

The bear market in the gold miners has been one for the record books but it is not over yet. Last week we noted that precious metals were on the cusp of making new lows while the US$ index was very close to another key breakout. This scenario remains well in play and would certainly affect the gold mining sector, which over the past two weeks failed to rebound or build on any strength.

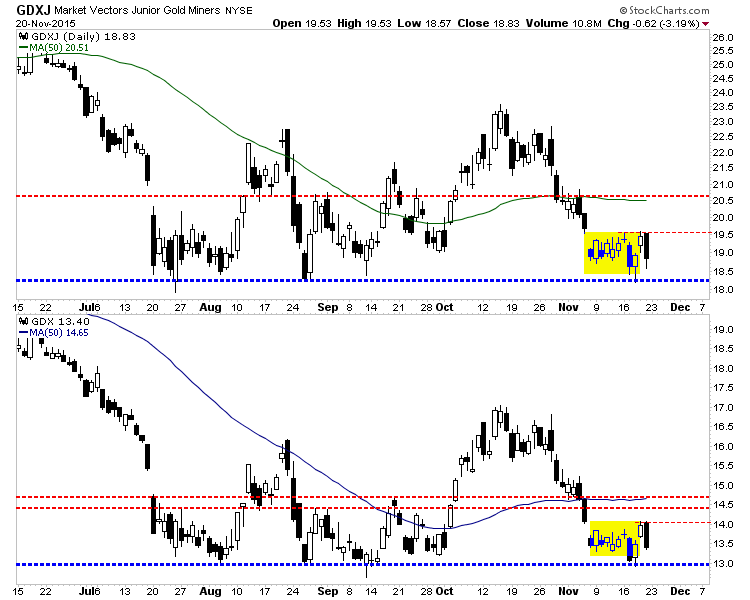

Below is a daily candle chart that shows GDXJ (large juniors) and GDX (largest miners). Before Friday both markets had essentially traded nowhere or sideways over the past 10 days. That could be enough time to "work off" the oversold condition that developed after the miners declined 16% and 18% over the previous eight days. Friday's sharp decline reduced the miners chances of testing the 50-day moving average and could be the start of the next leg lower. Any strength next week could be capped near $19.50 in GDXJ and $14.00 in GDX. A daily close below $18.00 in GDXJ and $13.00 in GDX could quickly lead to lower levels.

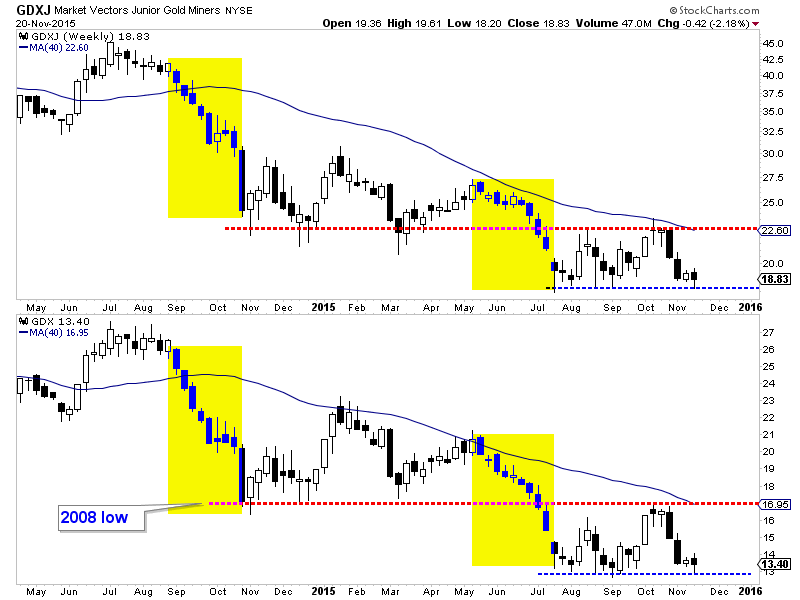

GDX and GDXJ have formed small hammers on the weekly candle charts but volume and size (of the reversal) are lacking. The miners appear to be biding time before an inevitable break to new lows. Unless they can close above the highs of this week or form a huge reversal next week, the prognosis for the weeks ahead remains bearish. Finally, note that previous declines lasted nine to ten weeks. While this decline may not last as long, it could continue for several more weeks as miners are not yet extremely oversold on a weekly basis.

The path of least resistance for gold shares (and the rest of the sector) continues to be lower. The miners, after 10 days of sideways action face an increased risk of a breakdown to new lows. While the entire sector is oversold and bounces can happen, note that severe selloffs and steep losses are born out of already oversold conditions. As Gold bulls we do not want to be buyers until we see a sector that becomes extremely oversold and is trading near strong support levels (i.e $970-$1000 Gold) amid extreme bearish sentiment.

As we navigate the end of this bear market, consider learning more about our premium service including our favorite junior miners which we expect to outperform into 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.