U.S. Silver Production Plunges by 20%

Commodities / Gold and Silver 2015 Dec 21, 2015 - 11:32 AM GMTBy: Jason_Hamlin

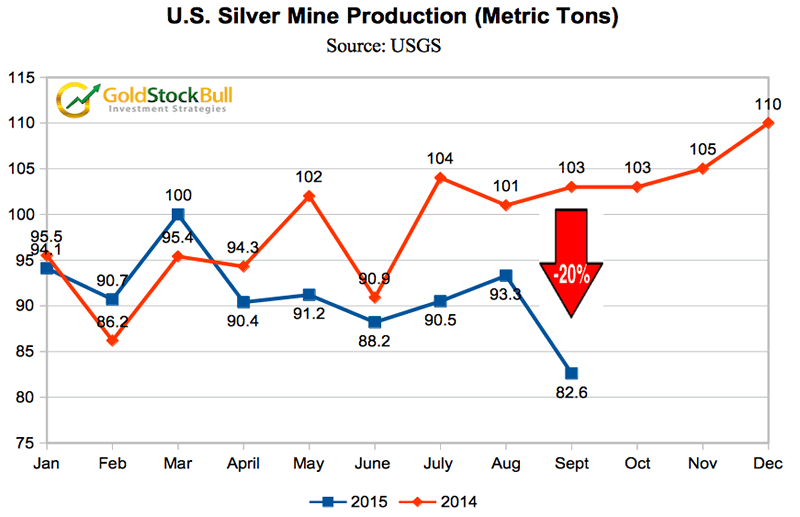

To view The U.S. Geological Survey (USGS) released their September silver production numbers this week and the results were incredible. Only 82.6 metric tons (mt) of silver were produced domestically in September versus 103 tons during September of last year. This represents a massive decline of 20% and is part of a greater trend of declining silver supply.

To view The U.S. Geological Survey (USGS) released their September silver production numbers this week and the results were incredible. Only 82.6 metric tons (mt) of silver were produced domestically in September versus 103 tons during September of last year. This represents a massive decline of 20% and is part of a greater trend of declining silver supply.

As you can see from the chart below, 2015 silver production started the year higher than 2014. But in the spring, things started to shift. Production dropped 4% in March and has been declining ever since for six straight months. This trend of falling silver production culminated with the sharpest decline on record during the latest period, down 20%! Indeed, many analysts believe that we may have already seen PEAK SILVER production.

During 2014, production ramped up significantly in the winter months, but this year is shaping up to be quite different. Even if production were to rebound a bit in the coming months, we are still likely to see the gap versus widen comparing this year vs. last year. And if production does not rebound sharply, we are going to see declines of 30% or more in the coming months.

This is a significant development for silver investors, as sharply dropping supply and steady demand is a clear recipe for higher prices. Remember, sales of American Silver Eagles are on pace to set a new record for the third year in a row. Total sales through the end of November stand at 44.7 million ounces passing last year’s record of 44.0 million ounces.

Silver demand has also been hot in Canada, with the most recent quarterly silver sales on pace to break 2014’s record. Silver sales increased 76% year over year from 5.4 million to 9.5 million ounces. Year to date through the third quarter of 2015, the Royal Canadian Mint has sold 25.2 million ounces of silver, on pace to surpass 2014’s record silver sales.

If we haven’t see the bottom in silver yet, these fundamentals factors suggest that we are close.

While silver miners have reduced their costs in recent years, many are still unprofitable at current silver prices. There aren’t many things that you can buy for less than the cost to produce it. There simply wouldn’t be anyone making the product anymore and silver is no different. These conditions can persist in the short-term, particularly with the leverage paper markets having such a large impact on pricing. However, I don’t believe that the silver price can remain below the average cost of production for long. Eventually the fundamentals force prices back to correct equilibrium given the supply and demand in the marketplace.

I have long anticipated that as a growing number of miners would suspend operations, pushing silver supplies down sharply. We are finally seeing this manifest with the latest monthly production data. It holds true for primary silver miners, but also for base metals producers where silver is a by-product. They are also facing plunging prices in industrial metals and are having a hard time remaining profitable. As they are forced to suspend or shutter operations, silver production is going to fall even lower.

The decline in silver supply is not going to be a short-term phenomenon. Not only is current production impacted as miners shut down operations, but future production is also impacted as exploration budgets are slashed. Even if the silver price were to double in 2016 and miners increased cash flows, it would still take a few years to increase exploration back to previous levels and have the type of production pipeline needed to sustain production levels. Anyway that you slice it, the industry is likely to face declining silver production for years to come.

I am not convinced that we have seen the absolute low in silver prices quite yet. But this type of data is encouraging for silver investors and suggests that the bottom may be near. Rather than attempting to time the exact bottom, I think it makes sense to begin purchasing in tranches around current levels. This is true of physical silver, but also the severely undervalued silver mining stocks that could offer leverage of 3X to 5X during the next upleg.

And although the FED finally pulled the trigger and raised rates by 25 basis points this week, there is plenty of evidence to suggest that silver (and gold) prices can climb higher along with interest rates. There is also the distinct possibility that the FED will not be able to continue raising rates beyond a token amount and will need to reverse course at some point in 2016. So, I do not believe that precious metals investors should fear increases rates.

If you would like to get an insider perspective on our thinking about the markets, view our model portfolio, receive trade alerts and get the monthly newsletter, you can get sign up by clicking here. The price is less than $1 per day and you can try it out for 30-day risk free! In addition to gold and silver stocks, we also cover energy, agriculture, and methods to short the market and hedge your portfolio.

HAPPY HOLIDAYS DISCOUNT: New subscribers can take 50% off the quarterly subscription price using the coupon code “SANTA15” (offer expires December 31, 2015)

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. Click here for instant access!

Copyright © 2015 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.