U.S. Housing Market Warning - Don’t Sit On Your Real Estate!

Housing-Market / US Housing Dec 22, 2015 - 06:11 PM GMTBy: Harry_Dent

I suppose you could say we have World War II to thank.

I suppose you could say we have World War II to thank.

Upon returning from the war, soldiers had their GI benefits to enjoy and a deep-seated desire to start a family. And so was born (quite literally) the baby boom, and an accompanying surge in home buying.

Out of the ashes of destruction arose an American middle class and the first generation able to more broadly buy homes with long-term mortgages.

Their kids, the now infamous baby boomers, decided this home-owning thing was a good idea. When their turn came in the 1970s, they surged into the real estate sector like a pig moving through the python!

By early 2006, they had convinced themselves and everyone else that real estate only goes up…

What a painful, rude awaking the 2006 to 2012 housing collapse was! I strongly warned of this in late 2005 in my newsletter. With 2008 the hardest time during that six-year period, and the subprime crisis of monumental proportions, it blew hardworking Americans out of the water and then drowned them in underwater mortgages, debt defaults and disgrace.

Thanks to my demographic and cycle research, this event was no surprise to us…

Personally, I was out of real estate early enough for the downfall between 2006 and 2012 to not impact my wealth in any way. And I’d warned my subscribers many times about the looming crisis, so many of them were also safely out of the sector when the sword fell as well.

I’ve actually received many notes from readers over the years telling me how my warnings saved them a fortune when the real estate bubble burst. One business person in our Network told me that he was spared millions by getting out of his real estate just before the crash. He was in the process of buying a building in South Florida in 2006 that was going to cost him somewhere between $10 million and $15 million. After attending one of our Demographics Schools (pre Irrational Economic Summit days) in Minneapolis, St. Paul, he hauled his board of directors out to a meeting with Rodney and me, and based on our research, cancelled that purchase. He’s grateful he did!

As it turned out, that real estate crash was worse than the one the Henry Ford generation endured in the early 1930s. The last crash saw real estate down 34% (compared to only 26% lost during the Great Depression years), with markets like Las Vegas, Phoenix and Miami losing as much as 50% or more!

I wish I could say that was it. I wish I could say that all the reports you’ve seen lately are proof that the real estate market has turned around again and home prices are set to rise for the next 18 years.

Unfortunately, I can’t, which is why I remain out of the real estate market.

You see, bubbles always go back down to where they started – and often a bit lower. I have chart after chart (after chart) that shows this happening time and again throughout history. It’s so reliable you could bet on it and win.

And right now, real estate would have to go down a total of 55%-plus to erase the bubble gains from just early 2000 – 40% or more from here after the bounce. That means, despite the “positive” reports, we haven’t seen the worst of the real estate meltdown yet!

Let me show you…

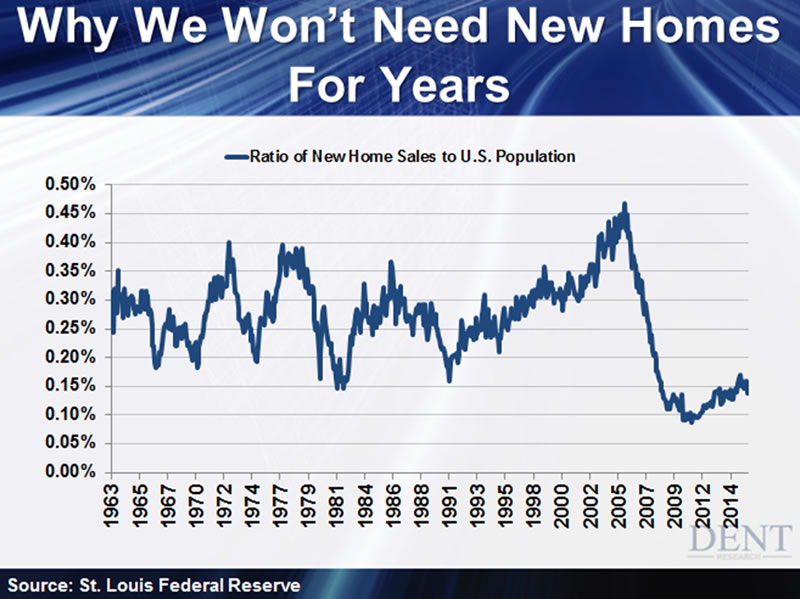

Look at how much new home sales fell from July 2005. The chart below adjusts for rising population – showing the ratio of new homes to the U.S. population – which makes that collapse even more dramatic.

The drop was 82% (adjusted for new homes per person)! This hasn’t happened since the 1970s and was much worse than even in the Great Depression.

What’s going on here?

Well, real estate is the only durable thing we buy that lasts nearly forever. We build a home and multiple generations live in it. When the baby boomers moved through the real estate market, they built more homes to accommodate their bigger numbers. But the millennial generation now following, even when adjusted for immigrants, doesn’t quite reach that same peak set by their predecessors.

In short, we won’t need more real estate for decades to come… especially as the baby boomers downsize and die, leaving more homes vacant. When I adjust real estate buying trends for peak buyers at age 41 minus dyers at age 79 in the U.S. (who are sellers, of course), the net demand for new homes actually declines into 2039 – that’s 24 years from now!

This will mark the greatest shift in real estate in history.

The greatest long-term bust into 2020-plus will follow the greatest long-term boom from 1933 to 2006.

That should not be a surprise as real estate in Japan has declined 60% (80% commercial) and never bounced significantly for 24 years!

You better really love your real estate, for business or personal reasons, to own it for decades. If you don’t, sell it. As I say in Chapter 3 of The Demographic Cliff: “Real estate will never be the same!”

And don’t expect to get rich by simply sitting on real estate anymore. You won’t enjoy the appreciation your parents, grandparents and great grandparents once did. All you can hope for is positive cash flow if that is feasible even in a downturn ahead – or if you can own cheaper than you can rent.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.