Why Austrian Investing Is Important In The Era Of State Imposed Fiat Money

Economics / Fiat Currency Dec 31, 2015 - 02:25 PM GMTBy: GoldSilverWorlds

We are living in extreme times. When it comes to investing, the economy and markets, the extreme monetary policies of central banks all over the world should be top of mind of every investor.

We are living in extreme times. When it comes to investing, the economy and markets, the extreme monetary policies of central banks all over the world should be top of mind of every investor.

To make our point, we refer to the 3 following charts that readers know by now … But it always helps to put things in perpsective. Our focus here is on the time period as of 1971 which will likely go in history books as the era of the “Great Monetary Experiment” (or something alike).

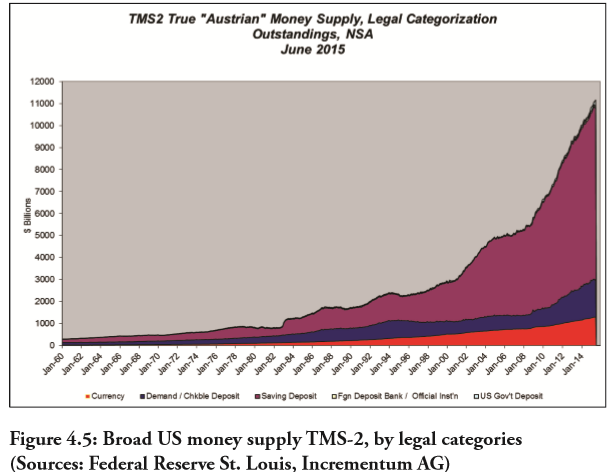

An explosion of the monetary base. Nothing new here, but notice the trend as of 1971, and the different phases of acceleration in growth of the monetary base.

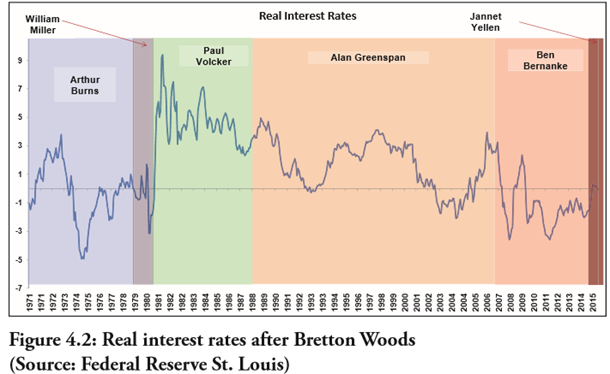

Real interest rates since 1971. Between 1971 and 1980, there was some sort of attempt to stabilize real interest rates, but as of 1980 the masters of the central bank have been pushing real interest down.

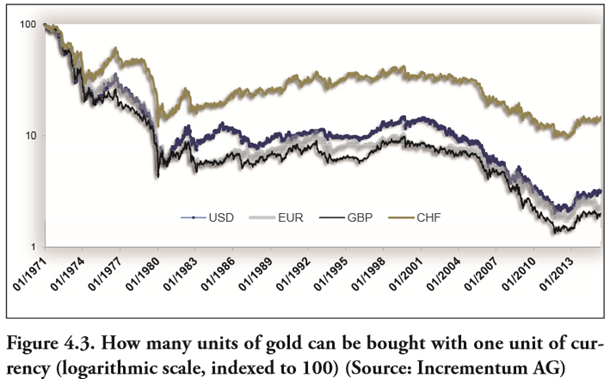

As a result of the previous two trends, the value of our currency has gone one (and only one) direction: down. These are simple economic laws: the more currency available, the lower its value, and gold has the ultimate characteristic to measure that.

Today’s complex economic and finanical environment requires a prudent investment approach. That’s where Austrian investing can play an crucial role. Although Austrian economics is witnessing a growing follower base, not much has been written about Austrian investing principles.

As of now, however, investors have a comprehensive guide at their disposal: the book “Austrian School for Investors: Austrian Investing between Inflation and Deflation” written by Rahim Taghizadegan, Ronald Stöferle, Mark Valek and Heinz Blasnik.

John Hathaway, Senior Portfolio Manager of Tocqueville Gold Fund, wrote the following in his foreword:

“The financial markets of today are dominated by hyper active high frequency trading guided by trend following quantitative algorithms. Original thought is replaced by artificial intelligence. Market prices are manipulated and gamed by institutional and political interests. Valuations are inflated by the zero interest rate policies of all central banks for whom it is dogma to drive up the prices of paper assets to influence the behavior of individuals and corporations to achieve their announced goals of full employment, moderate inflation, and financial market stability. Financial wealth has become an illusion that has little resemblance to real wealth. Financial wealth is dependent on the functionality of a matrix that must be navigated according to its unique rules that are often at odds with common sense. For those who fear that the functionality of this matrix is unsustainable, The Austrian School for Investors offers a path to the kind of critical thinking that will provide sustainability for its practitioners long after the demise of the artifice of paper wealth.”

Along the same lines, we very much like the following quote which is copied from the introduction of the book:

“Confusion and uncertainty with regard to investing have rarely been as pronounced as they are today. On the one hand, we are living in an era in which wealth can seemingly grow to incredible heights. On the other hand, there are always rumors of crisis – a dark premonition that security prices could collapse at any moment, and the savings of a lifetime could be decimated overnight. Although official data show only moderate inflation, in some cases even deflation, many people feel that their currency is continually losing value. Most of them suspect that they should give a bit more thought to preserving the value of their savings, but are faced with contradictory advice. Trust in “experts” is declining, whether they are economists, bankers or politicians. If someone dispenses investment advice, he wants to make money from it – just as everyone seems eager to make money from retail investors.

It is difficult for investors to do the right thing, but incredibly easy to make a mistake. The current economic environment seems like a game with marked cards, with the odds of winning systematically stacked against the multitude of small players. One gets the impression that it is all a giant rip-off.”

Uncoincidentally, the authors have focused on the monetary system, as without a deeper understanding of the monetary system it is impossible to understand current investment trends.

Looking at the above charts, it goes without saying that a new financial crash is in the making. And that’s where Austrian investing can save your wealth.

Why? Because times during which the monetary system was impaired were always times when monetary theory made great strides. In times of crisis, the enduring value of the Austrian School comes to the fore. It is no great feat to make money during a boom – it practically self-multiplies. Good investors differentiate themselves from bad ones in times of crisis. The most famous recent example of an investor who succeeds in times of crisis is probably Nassim Taleb, who is clearly influenced by the Austrian School. His long-term partner and even more successful investor, Mark Spitznagel, has written a book on “Austrian” investing as well.2 A book that, although penned by a practitioner, is far more theoretical and philosophical in its approach to the topic than this book.

Analysis grounded in Austrian thinking has been remarkably accurate in separating illusion from reality. It provides a sensible, highly accessible big picture of view of what exists and what is likely to happen as a result. That is because it portrays economic activity and likely developments as the product of individual behavior, a common sense and practical framework. It does not employ abstract groups or forces that are somehow quantified and correlated by unintelligible formulas, a methodology that succeeds only in explaining the artificial reality that it has created.

The Austrian analytical framework is not a prescription for short term investment success or even a pathway to building a fortune. There is no such magic here. However, it does provide a foundation for sanity in the midst of mass delusion. It is grounded in ethical behavior, common sense, and sober reflection. The Austrian investment approach eschews leverage, promotions, and fads. It is likely to steer one away from disastrous investment outcomes through a balanced approach to wealth preservation. In short, the Austrian methodology is based on reality, not fancy, and its application in daily practice will provide an investor with favorable odds to achieve financial well-being.

Let’s not forget that the Austrian theory is not ‘exotic’. On the contrary. Two of today’s most famous investors are testament to this: Warren Buffet’s father was strongly influenced by the Austrian School and passed important insights to his son. George Soros’ longtime partner and most important analyst Jim Rogers is also an Austrian School adherent. Benjamin Graham, Buffet’s teacher and mentor, developed a methodology that shows astonishing parallels to the Austrian School’s ideas, although Graham actually was not aware of it. Lastly, the Austrian School originated when its founder Carl Menger, who worked as an economic journalist, came to realize by observing activity on the stock exchange in great detail that classical economics was unable to explain the real world.

The book “Austrian School for Investors: Austrian Investing between Inflation and Deflation“does not introduce a new investment fad, it is not an advertisement for a new investment product and not an ideological program. It aims to make knowledge that is highly useful in dealing with the questions of our time but has been unjustly forgotten, available to the average investor. It is based on the research of an economic school of thought that has only in recent years slowly been rediscovered by the broader public, because it was once again proved to be prophetic. In the history of ideas, this tradition is known as the “Austrian School” or the “Viennese School of Economics”. Engaging with the Austrian scholars of yesteryear is tantamount to being inoculated against all sorts of illusions. The Austrian school makes clear why the so-called “orthodox” perspective on the economy, savings and investment borders on irresponsibility. While the Austrian School definitely offers a kind of therapy, it is not a ready-made miracle cure, but rather a thorough program in disillusionment helping to activate one’s own mind.

In sum, this book is to date the most comprehensive attempt at a critical examination of today’s investment universe from the perspective of the Austrian School and deriving conclusions for investors from it. To this end, we frequently move back and forth between theory and current practice. The difficulty of connecting these two worlds will become clear to the reader as the book progresses: the relationship between taking the time for slow and deliberate reflection and the pressure and urgency that characterize investing in financial markets under distorted and volatile circumstances.

More about this book on Amazon.

Source - http://goldsilverworlds.com/

© 2015 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.