The Fed Is Not Hiking Rates: Risk Assets To Perform

Interest-Rates / US Interest Rates Feb 01, 2016 - 11:57 AM GMTBy: Bob_Kirtley

The landscape of global monetary policy is changing. In late 2015 we had the Fed hiking, signalling more to come, the ECB holding back on fresh QE and even the BOJ, which has engaged in more easing than any other central bank in history, was sitting on its hands.

The landscape of global monetary policy is changing. In late 2015 we had the Fed hiking, signalling more to come, the ECB holding back on fresh QE and even the BOJ, which has engaged in more easing than any other central bank in history, was sitting on its hands.

That tune has changed.

The BoJ moved to negative rates this week. The Fed didn’t hike and signalled that they aren’t going to hike in the short term. The ECB is making noises about expanding its QE programs. In this article we explore direction of monetary policy going forward and its implications for financial markets.

The Fed Was Dovish This Week

This week the FOMC statement was very clear about highlighting the risks stemming from the recent instability in global markets and widening of credit spreads, saying they are “closely monitoring” the future impact this will have on the economy. The Fed had stated previously that the risks to the economic outlook were “balanced” but they are now “assessing the implications” of recent developments “for the balance of risks to the outlook”. This is a step towards the Fed saying that the balance of risks are to the downside, even though they are not quite there yet. If the Fed sees the balance of risks to the downside then they will not increase interest rates.

Weakening economic data was acknowledged, a move away from previous statements that said that the economy was expanding “at a moderate pace”, and this weakening was confirmed by Friday’s softer GDP number. Yellen also noted spending and investment were increasing at “moderate” rather than “solid” rates, but did note that, “labor market conditions improved further” referring to the stronger NFP print in January. Strong employment data has been a theme of last two years. The Fed’s target there has been met, and therefore strong employment does not add pressure on the Fed to hike; it’s now all about inflation and financial conditions.The Fed pointed to disinflationary pressure directly, saying they expect it “to remain low in the near term, in part because of the further declines in energy prices”.

Fed Cannot “Surprise Hike”

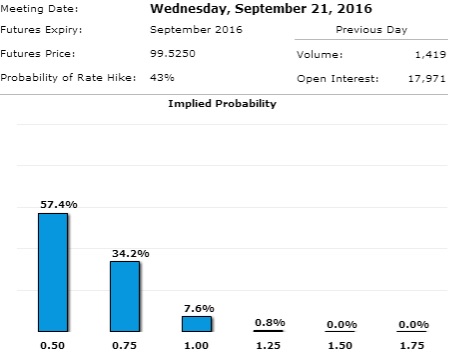

Time and time again the Fed has stressed the cautious nature of this tightening cycle. They have made it clear that market stability is critical to being able to lift rates from zero without negatively impacting the economy. Therefore the Fed will not hike without the financial markets expecting such a hike, or the hike would cause unnecessary volatility in asset prices, particularly in bond and interest rate markets. Currently pricing implies a 16% chance of a hike in March, 22% by April and 33% by June. Even September less than 50% priced for a hike (data taken from the CME FedWatch tool and Fed Funds Futures Pricing).

Without the market pricing more like 75% for a hike the Fed simply will not go.

In our view the Fed closed the door to a March hike with their statement this week. The probability of a hike in April would need to more than triple for us to be persuaded that the Fed may indeed hike then. That leaves us looking at June, which, whilst low at 33%, could still see a Fed hike if conditions improve. However in the short term we can say with a high degree of certainty that the Fed will not be increasing interest rates again.

Gold Prices Supported By Fed

When the Fed hiked in December and market pricing at for tighter monetary policy peaked, gold could not break below $1050. Having been gold bears through 2013, 2014 and 2015, we exited the bear camp not long after the December FOMC, saying “This decline [in gold] continued until the rate hike was announced. Following this gold initially moved lower, but then began to recover and regained ground on Friday, and has the potential to continue this recovery with no bearish catalyst to keep the price falling.”

Technically $1050 is now a massive support level, and is not going to break with the Fed on hold. Short term we believe gold prices will continue to move higher targeting $1150. At that level the risks are more symmetric, since it will take a major event for gold to break its major downtrend resistance around $1180.

BoJ Takes Easing To 3D

Late this week the BoJ today surprised the market by announcing that it would adopt a negative discount rate, in order to counter downside risks to growth and inflation. The BoJ is prepared to take rates even further negative if need be. The bank noted that this a third dimension to its already aggressive easing stance. The first dimension is the quantity of money, with the base already increasing at JPY 8Otrn a year. The second is asset purchases, mainly JGBs, but also JREIT and ETFs. Now they have a third dimension, negative rates, which they can utilize in addition to be the first two.

Given how linked the major global economies are, it is rare for the monetary policy of the major central banks to move in different directions. Euro, USD, and Sterling all strengthened versus the Yen following this action. The currency strengthening shifts the outlook for monetary policy for those currencies, as currency strength needs to be combated with a more accommodative stance to prevent the stronger currency impacting exports, and therefore growth. Thus in an environment where one central bank is easing monetary policy, the others are (at the margin) more inclined to ease also.

Potential ECB Easing

Flying slight more under the radar than the actions of the Fed and BoJ this week, let us not forget that Mario Draghi signalled last week that the European Central Bank is prepared to embark on a fresh round of monetary stimulus as soon as March. Draghi said the ECB would “review and possibly reconsider” its stance at its next meeting. The Euro fell 1 cent that day to 1.08 and European equities gained 2%.

The recent rhetoric of the Fed and actions by the BoJ add weight on the ECB to act. Whilst equities may have stabilized the underlying condition of the European economy is still far from ideal and deflationary risks are still present. We expect the ECB to act and moderately increase their QE program, accompanied by strong language suggesting they will do more if required.

Risk On

The shift in global monetary policy to a more accommodative stance implies “risk on” for financial markets. Risk assets should perform now after a brutal month, implying equities to move higher, volatility to decrease and some relief in hard hit sectors such as high yield. We went long S&P call options this week and expect the rally in stocks to continue for another 3%-5%, targeting 2000 in S&P.

China Devaluation Risk After New Year

Chinese New Year is unlikely to see the Yuan devalued with most Asian markets half closed and therefore liquidity being drastically reduced. The removes one of the year's drivers of risk off, at least for now, so we are comfortable being long equities here. However after Chinese New Year we will reassess, since further devaluation is likely in our view and this could send wobbles through financial markets again, abruptly ending the “risk on” tone.

Some have argued that the market action this week means Yuan devaluation is less likely. We disagree. Whilst equities in freefall is somewhat of a red light for further Yuan devaluation, (since China doesn’t wish to de-stabilize their own market, or the global scene, more than is necessary) a recovery in stocks turns the light back to orange. The BoJ action arguably puts the light right back on to green, with another major Asian economy actively trying to devalue their currency, why wouldn’t China follow suit?

Therefore before Chinese markets come back after their New Year we will likely exit our longs as the risk of further devaluation increases. For now we are content to stay long a ride the bounce, we are simply noting we view this move as a bounce not a major turnaround.

Trading Themes

The Fed on hold, BoJ going to negative rates, potential ECB easing and a temporary respite from Yuan devaluation are supportive of risk assets. Equities should bounce here and 1850 in the S&P will hold. Therefore we favour selling medium term put spreads with strikes equivalent to 1800-1850 and buying short dated, high gamma calls. Volatility wise we favour a lower VIX and steeper VIX curve.

Gold has big support at $1050 and whilst we are bullish short term we are not expecting an aggressive, extended rally. Therefore we favour selling near term OTM put spreads. If you wish to find out what these trades are and gain access to our model portfolio, please subscribe via either of the buttons below.

If you wish to know the exact details of our trades and when they are executed, please visit www.skoptionstrading.com. For those considering subscribing to SK OptionTrader, please be aware that we are closing to new clients on February 20th to ensure that the quality of our service is not diluted. Therefore if you wish to become a subscriber, we recommend doing so sooner rather than later.

Sam Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

Disclaimer: www.gold-prices.biz makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is neither a guide nor guarantee of future success.

Sam Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.