Silver Price Workup

Commodities / Gold and Silver 2016 Feb 08, 2016 - 12:43 PM GMTBy: Dan_Norcini

Silver finally managed to push through its upside resistance just above the $14.50 level this week and attracted some additional upside follow through as the US Dollar weakness brought on the macro trade (Dollar down - BUY commodities). For that matter copper also rallied, as did platinum. Clearly the latter two metals are not moving higher based on signs of increasing demand but rather because of those macro trades just referenced. It is purely a matter of money flows related to the movements in the foreign exchange markets, especially considering that fact that the preference in the markets at the moment is generally RISK AVOIDANCE.

Silver finally managed to push through its upside resistance just above the $14.50 level this week and attracted some additional upside follow through as the US Dollar weakness brought on the macro trade (Dollar down - BUY commodities). For that matter copper also rallied, as did platinum. Clearly the latter two metals are not moving higher based on signs of increasing demand but rather because of those macro trades just referenced. It is purely a matter of money flows related to the movements in the foreign exchange markets, especially considering that fact that the preference in the markets at the moment is generally RISK AVOIDANCE.

Thus I am unsure how far these rallies can carry without fundamental underpinning but as long as the Dollar remains weak, there is nothing preventing the macro boyz from goosing them higher. Think about it for a moment... the fear among traders and investors is slowly global growth and worries about insufficient responses from the Central Banks to combat it. IN that environment, one in which demand is lagging why would copper, platinum and palladium be moving up? There is no fundamental answer to that... it is related to money flows tied to movements in the currency markets.

As noted, how far rallies based on this sort of thing can carry is unclear. It depends on the amount of repositioning that will take place and none of us know how long that will take.

Frankly, I am hoping for a move higher in the Dollar just to see if I can confirm this supposition. So far, I can see the movements in the commodity sector ( generally) tied to the US Dollar weakness but I can also see risk aversion trades occurring as well. I want to see how these metals would act in the event that the US Dollar started back up again. If they go back down, we will have definitive proof that these recent moves are purely the result of the macro traders. If they do not, then something else is at play and that is what we will then need to discover.

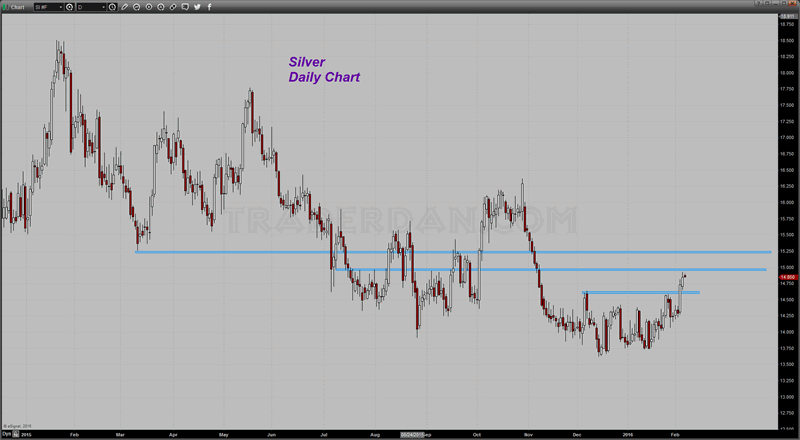

Silver Daily Chart

In the interim, when it comes to silver, the next test for the metal is at the $15.00 level. The market faded a bit off its highs on Thursday as it approached that level so today, Friday, will be more insightful as to what it wants to do next. On any subsequent retreats lower in price, it should first find buying support just above $14.50 (near $14.60) with better support down closer to $14.25.

A push through overhead resistance on a closing basis that takes out $15.00 sets up a legitimate shot for $15.25. Above that next stop would be near $15.60-$15.70.

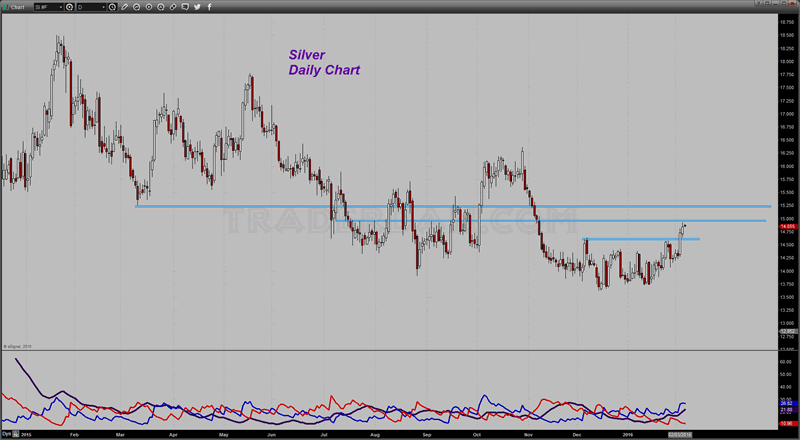

Silver Daily Chart 2

The ADX line is rising with the +DMI trading over -DMI indicating that the bulls have control of this market now on a short term basis and are putting pressure on the shorts. There is a pretty good base that has formed down between $14.50 and $13.75 which held this market for the better part of nearly two months time. That is providing a sort of springboard from which this latest move is launching as the breakout from this range, forced the shorts out of the market and has also attracted some new longs. It will be interesting to see how much of this recent move higher is due to short covering. Sadly the biggest move this week occurred on Wednesday, which is not included on this week's COT report, so we will have to wait until next week to get that info.

However, based on the happenings in the currency markets and the amount of repositioning that has been taking place in that arena, and based on the big spikes upward in many of the industrial metals as well, rest assured that a significant amount of this buying is coming from shorts who were squeezed out.

For now silver bulls have the wind at their back... as long as the US Dollar keeps weakening.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.