Gold in Zero-bound

Commodities / Gold and Silver 2016 Feb 29, 2016 - 06:37 PM GMT “When you have zero money for so long, the marginal benefits you get through consumption greatly diminish – but there’s one thing that doesn’t diminish, which is unintended consequences.” – Stanley Druckenmiller

“When you have zero money for so long, the marginal benefits you get through consumption greatly diminish – but there’s one thing that doesn’t diminish, which is unintended consequences.” – Stanley Druckenmiller

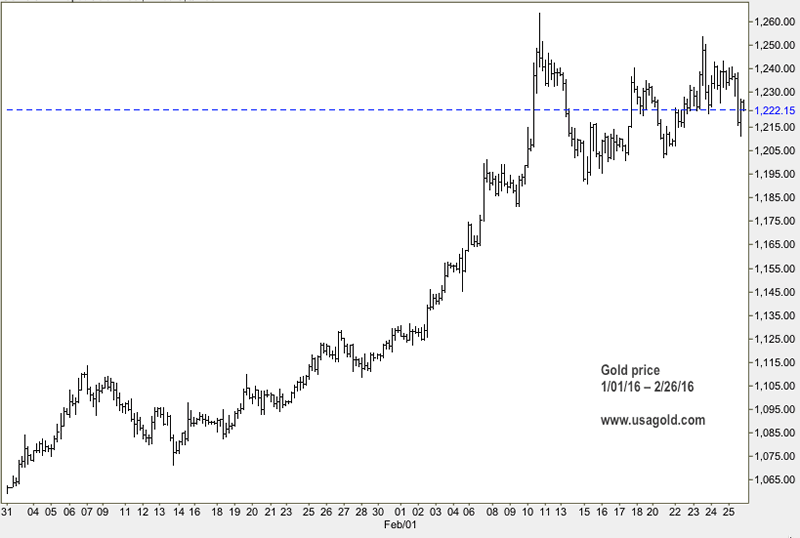

Something happened on the way to negative interest rates. Something unexpected. Gold and silver demand went through the roof. The first two months of business at USAGOLD were reminiscent of the 2009 run to gold. In London, where people have the additional concern of a potential exit from the European Union, investors were lining up around the block to purchase precious metals, and reports were circulating that “Some London banks are placing unusually large orders for physical gold.” For the first two months of the year, the U.S. Mint reported gold coin sales running double what they were for the same period in 2015.

So what’s behind the rush for gold at a time when the financial news is dominated with concerns about negative interest rates?

Worry over disinflationary/deflationary systemic risks is certainly one incentive, i.e., gold’s safe haven appeal, but there is something else at work here though – a set of circumstances that forces us to think outside the box. Typically, we are programmed to believe that we will benefit from an investment because it goes up in value. In the case of the zero-bound, though, when interest rates are near zero, threatening to go negative in some countries (like the United States) and having already gone negative in others (like Japan, Sweden, Denmark and Switzerland), smart money begins to think about simply staying whole.

You can do that by going to cash, but, even better, you can do that by going to gold and silver where you can at least hope for a return on your money. During the Great Depression of the 1930s, gold paid off handsomely not necessarily because it went up in value, but because its value was fixed by government mandate while the cost of just about everything else went down. As a result its purchasing power increased and it served effectively as a deflation hedge. Some fear we may be slowly moving toward a similar situation today. Marc Faber, the maverick investment advisor, put it succinctly: “Leave a million dollars with a bank, and in a year, you get only something like $990,000 back. I would rather want to own some solid currency, in other words gold.”

The more skeptical among us might also begin to consider what else might be implied by central banks pushing rates below the low water mark. Could the economy and financial markets be in worse shape than they appear? Have central bankers run out of policy options – save helicopter money – to fight off the economic doldrums? Last, if one were to start making a list of potential unintended consequences of negative interest rates, it could become very long and very worrisome in a hurry.

In a fit of exasperation, JP Morgan’s Bob Michele told CNBC, “There is a serious credit contraction underway, I think [Yellen] should acknowledge that. I think she has to look at the capital base being wiped off the banks in this downdraft and equities: that’s not supposed to be happening right now. They’re supposed to be bulletproof, and oh, by the way, gold at $1,200 an ounce, what does that tell you? It tells you that in a flight to quality, in a safe haven, people have more confidence in gold than in bank deposits or paper money. I think things have gotten out of control.”

Reader note: You are reading the lead article for the March, 2016 issue of USAGOLD’s NEWS & VIEWS. For open access to the rest of this month’s issue, we invite you to register at this link. You will also receive e-mail notification when future issues are published. Your subscription comes free of charge by e-mail and you can opt out of the service at anytime. Last, we will not deluge you with e-mails. Over 20,000 subscribe to this newsletter . . . Please register here.

State Street Global Advisors’ George Milling Stanley similarly put his focus on the rapid change of sentiment taking place among investors. “People have become complacent about risks,” he says, “whether it’s macroeconomic and geopolitical. What’s out of fashion may be coming back. That atmosphere of people feeling completely calm and untroubled, I think, is starting to go away. Gold is a very good risk-off trade, and I think people are starting to look very, very carefully at the risky positions that they have on a number of other markets.”

Volatility in the stock and bond markets early in the year has certainly pushed investment capital in the direction of gold and silver as indicated at the top of the page. Demand for the precious metals has been running strong for over a year now with little effect on the price. Now the demand has begun to translate to higher prices even in this disinflationary environment. Gold, as of this writing, is up 16% on the year and silver is up 6% – not bad in a zero-bound investment environment. Precious metals owners are not only holding their own, they are gaining wealth.

Note: Investopedia defines zero-bound as “A situation that occurs when the Federal Reserve has lowered short-term interest rates to zero or nearly zero. When interest rates are this low, new methods of economic stimulus must be examined and implemented.”

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.