Gold Price and Gold Stocks Launch!

Commodities / Gold and Silver Stocks 2016 Mar 05, 2016 - 12:17 PM GMTBy: Gary_Tanashian

While at near-term risk, the gold sector is launching, not blowing off

While at near-term risk, the gold sector is launching, not blowing off

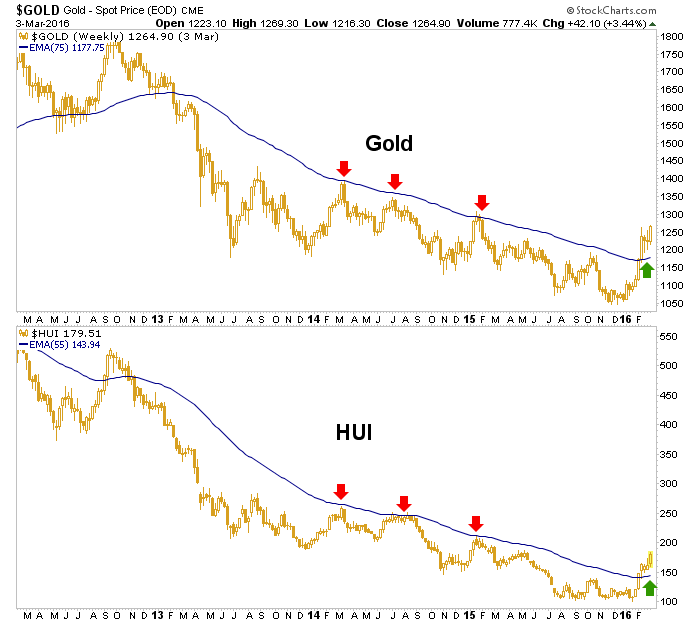

Okay, the title of the post is a bit of a joke at this late stage of the rally because it sounds like hype and we have actually been calling the move in the gold sector a potential launch for weeks now, since gold and HUI each busted through their bear market limiters, the EMA 75 and EMA 55, respectively.

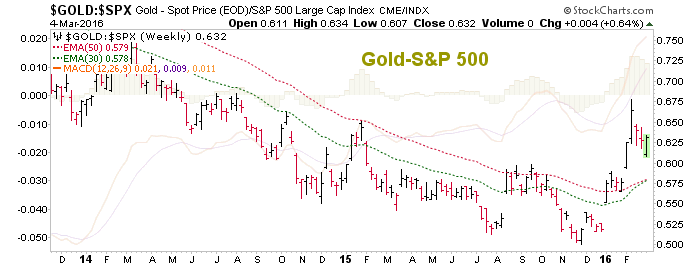

That was four weeks ago. Today the hype is all around and the sector is going vertical and is indeed at high risk now. Big money is pouring into the sector right in line with the story the chart below and many other macro indicators have helped define. We have been following myriad indicators since last summer when we began a theme of illustrating the proper ‘macrocosmic’ fundamentals needed to launch the sector. Gold vs. S&P 500 is just one of them and it is now bullish, despite the current consolidation.

Ah but we are at high risk now, right? Right. Some writers are on this theme and are probably correct in calling the sector’s “blow off” a terminal thing. But only if they are talking about it being terminal for this move, not for upcoming bull market potential. Although I think the odds have shifted significantly in favor of the prospect that a bull has already begun, that will only be proven later when more technical milestones have been achieved.

In recent NFTRH reports and updates we have been talking about bear market rules vs. bull market rules. For instance, the Commitments of Traders data are very bearish right now for gold and silver. But there is historical precedent, which we covered in detail in NFTRH 384, showing a similar setup at the start of the bull market early last decade.

Some analysts have advised to beware the “blow off” in gold, which will bring on new lows. But due to the fundamental view having improved greatly over the last few months and due to the technical milestones like EMA 75 and EMA 55 for gold and HUI above, a coming correction can be considered a launch phase to a new bull market as opposed to a blow off and blow out phase to a bull (ref. silver in early 2011).

Any coming pullback will be one of opportunity as it stands now, barring a complete undoing of the fundamentals that have gathered so firmly over the last several months. It is advised that gold sector aficionados have pullback levels (i.e. key support levels) plotted out in advance for when their favorite miners are inevitably traded out by the momentum players now buying in. That is what we will be doing.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.