Financial Markets Reeling from Fannie & Freddie Collapse and Evitable Government Bailout

Stock-Markets / Credit Crisis 2008 Jul 13, 2008 - 05:56 PM GMT

“Finance is the art of passing money from hand to hand until it finally disappears,” said Robert W. Sarnoff. This is certainly the way it looked last week as the fall-out of the credit crisis deepened.

“Finance is the art of passing money from hand to hand until it finally disappears,” said Robert W. Sarnoff. This is certainly the way it looked last week as the fall-out of the credit crisis deepened.

Markets had investors feeling dazed and confused after another roller-coaster week amid further evidence of the deteriorating health of the US financial sector and a renewed rise in oil prices. Adding to the pain, Barron's Randall Forsyth said: “Now that the bear market has officially arrived, it may stick around and gnash its teeth for a while – until it's scared away those who remain.”

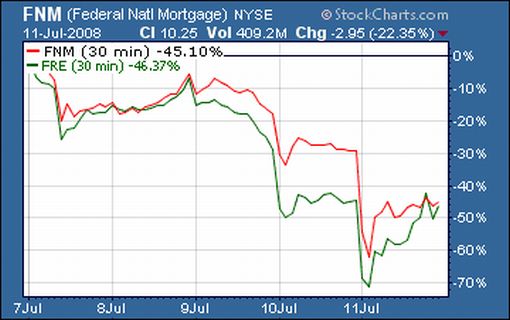

Government Sponsored Enterprises (GSEs) Fannie Mae (FNM) and Freddie Mac (FRE) were the main sources of volatility for the market, as speculation was rampant that they were destined for a government bail-out despite numerous assurances from government officials and their regulator that they were adequately capitalized. Between them, these enterprises own or guarantee about half of the $12,000 billion of outstanding US home loans.

Henry Paulson, Treasury secretary, downplayed a government takeover, saying: “Today our primary focus is supporting Fannie Mae and Freddie Mac in their current form as they carry out their important mission.” (And “tomorrow”, Mr Paulson?) Describing Fannie and Freddie as “very important institutions”, President George W. Bush said the nation's top economic officials would be “working this issue very hard”.

A Reuters report on Friday cited a source as saying that Fed Chairman Ben Bernanke had told the GSEs they would be eligible to borrow from the Fed's discount window. However, the Fed said there had been “no discussions” with Fannie and Freddie on access to the discount window.

Separately, Bernanke suggested that the “temporary” Term Auction Facility to Wall Street might be extended into 2009. Bill King ( The King Report ) did not find this particularly reassuring, asking: “… isn't this evidence that there is something very wrong in the financial system and it is troubling to solons?”

This is a nasty market and, irrespective of oversold and short-covering-induced technical rallies, one's emphasis should be on the return of capital rather than on the return on capital. There is an old and appropriate saying, “I'd rather be out of the market wishing I were in than in the market wishing I were out.”

GMO 's Jeremy Grantham echoed that the key to surviving bear markets was capital preservation. You want to “live to fight another day. You may see amazingly cheap asset opportunities in the next couple of years as distressed pricing might become more commonplace. It would be nice to have the money to take advantage.”

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

Economy

“… developed economies including the US, Europe and Japan are contracting moderately, while most developing economies are expanding moderately. On net, the global economy is growing, albeit barely,” reported the Survey of Business Confidence of the World conducted by Moody's Economy.com . “Pricing pressures spurted higher again last week and is approaching a new record high.”

Against the backdrop of what happened with GSEs, and the financial sector as a whole, US market participants paid less attention to fresh economic data. However, the past week's economic reports included the following notable releases:

• Pending home sales for May slipped 4.7% from April. The main message is that the bottom of home sales is not here after sales of existing homes peaked in September 2005. The fact that there is a large inventory of unsold homes in the market place suggests that additional declines of home prices should follow.

• Initial jobless claims fell by 58,000 to 346,000 during the week ended July 5. However, the sharp drop reflects the shortened week due to the July 4 holiday and distortions arising from auto retool shutdowns in the summer. The decline in initial claims is a distortion and is not an indicator of a marked improvement in labor market conditions.

• Chain store sales rose by 4.3% in June, well ahead of expectations, thanks to the spending of tax rebates. Rising gasoline prices also played a role in the strength, lifting sales at warehouse clubs. Discounters performed particularly well as financially pressed consumers focused on necessities and lower-priced goods.

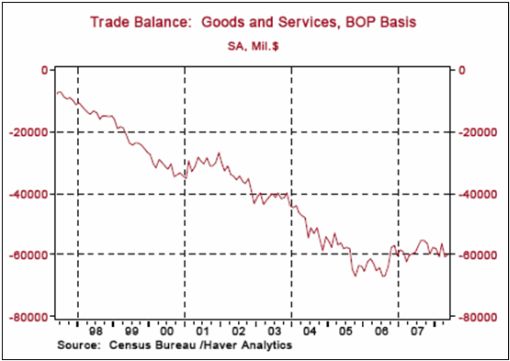

• The nominal trade deficit narrowed to $59.8 billion in May from $60.5 billion in April. In terms of the impact on GDP, the inflation-adjusted trade deficit of goods was nearly $90 billion in the April-May period compared with a $102 billion in the first two months of the first quarter, suggesting that trade will have a positive influence on the second quarter GDP.

• Prices of imported goods continued to advance in June, which is problematic for the Fed. The import price index rose by 2.6% in June, reflecting higher prices for petroleum and non-petroleum imports. The price index of petroleum imports moved up 7.4%, putting the overall quarterly gain at 24.4% and the year-on-year gain at 20.5%. Import prices excluding fuel rose by 0.8%, with the year-on-year gain at 6.6%.

David Rosenberg, Merrill Lynch's chief North American economist, warned in a research report that the US remained firmly in an economic recession in spite of economic growth figures to the contrary. Pointing to last week's news that employment has now declined for six months in a row, he said that “at no time in the past 50 years has this happened without the economy being in an official recession”.

Elsewhere in the world, the Bank of England's Monetary Policy Committee left the repo rate unchanged at 5.0% in the light of conflicting risks of rising inflation and slowing economic activity. The UK's annual rate of inflation hit 3.3% in May, whereas the Halifax House Price Index was down 9.6% since August 2007.

The economic slowdown under way in the Eurozone was highlighted by steep declines in industrial production across the 15-country region, raising the risk of technical recessions in at least some member countries.

Further afield, Japanese consumer confidence fell to an all-time low in June, reinforcing expectations that the Bank of Japan will announce an unchanged target interest rate on July 15.

WEEK'S ECONOMIC REPORTS

Date |

Time (ET) |

Statistic |

For |

Actual |

Briefing Forecast |

Market Expects |

Prior |

| Jul 8 | 10:00 AM | Pending Home Sales | May |

-4.7% |

- |

-2.8% |

7.1% |

| Jul 8 | 10:00 AM | Wholesale Inventories | May |

0.8% |

0.7% |

0.6% |

1.4% |

| Jul 8 | 3:00 PM | Consumer Credit | May |

$7.8B |

$5.0B |

$7.0B |

$7.8B |

| Jul 9 | 10:30 AM | Crude Inventories | 07/05 |

-5840K |

NA |

NA |

-1982K |

| Jul 10 | 8:30 AM | Initial Claims | 07/05 |

346K |

395K |

395K |

404K |

| Jul 11 | 8:30 AM | Export Prices ex-ag. | Jun |

0.9% |

NA |

NA |

0.3% |

| Jul 11 | 8:30 AM | Import Prices ex-oil | Jun |

0.9% |

NA |

NA |

0.7% |

| Jul 11 | 8:30 AM | Trade Balance | May |

-59.8B |

-$61.0B |

-$62.2B |

-60.5B |

| Jul 11 | 10:00 AM | Mich Sentiment-Prel. | Jul |

56.6 |

55.0 |

55.5 |

56.4 |

| Jul 11 | 2:00 PM | Treasury Budget | Jun |

$50.7B |

NA |

$34.0B |

$27.5B |

Source: Yahoo Finance , July 11, 2008.

In addition to the release of the minutes of the FOMC's meeting of June 24 and 25 (July 16) and Fed Chairman Bernanke's semi-annual monetary policy testimony in Washington (July 15 and 16), next week's economic highlights, courtesy of Northern Trust , include the following:

1. Retail Sales (July 15): Auto sales declined to an annual rate of 13.6 million units in June from 14.3 million in May. Price-related gains in food and gasoline will dominate the non-auto retail component of retail sales in June. Overall retail sales should post a 0.4% increase while non-auto retail sales should be stronger, mostly due to higher prices. Consensus : 0.5% versus 1.0% in May; non-auto retail sales: 1.0% versus 1.2% in May.

2. Producer Price Index (July 15): The Producer Price Index for Finished Goods is expected to have risen by 0.9% in June, reflecting higher food and energy prices. The core PPI is most likely to have risen by 0.2% after a similar gain in May. Consensus : +1.4%, core PPI +0.3%.

3. Consumer Price Index (July 16): A 0.4% increase in the CPI is predicted for June following a 0.6% gain in May. Once again a food and energy story is expected in June. The core CPI is expected to have moved up 0.2%, matching the gain reported in May. Consensus : +0.6%, core CPI +0.3%.

4. Industrial Production (July 16): The 0.5% drop in the manufacturing man-hours index in June points to a soft industrial production report in June. A reversal of four monthly declines in utilities production could raise the headline but the fundamentals remain weak. Consensus : 0.0%; Capacity Utilization: 79.3 versus 79.4 in May.

5. Housing Starts (July 17): Permit extensions for new single-family homes fell by 2.2% in May. The weakness in permits and inventories of unsold new homes are indicative of fewer housing starts in June (955,000 versus 975,000 in May). Consensus : 960,000.

6. Other reports : Inventories (July 15), NAHB Survey (July 16) and factory survey of the Federal Reserve Bank of Philadelphia (July 17).

Markets

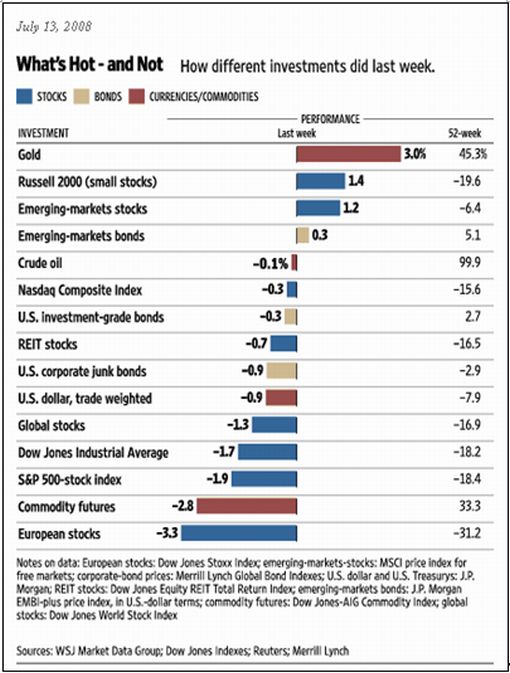

The performance chart obtained from the Wall Street Journal Online Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , Julie 13, 2008.

Equities

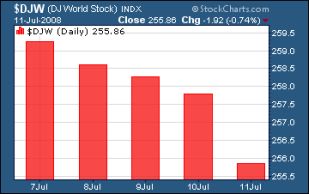

The MSCI World Stock Index experienced a full-house of down days and declined by 1.3% during the past week as concerns about further credit-related trouble, surging inflation and deteriorating corporate earnings intensified. The MSCI has declined by 20.1% since its high on October 31, 2007, thereby meeting the “official” bear market definition of a drop in excess of 20%.

Emerging markets (+1.2%) fared relatively well as a result of strong performances from the Shanghai Composite Index (+7.0%) and the Hong Kong Hang Seng Index (+3.6%). The MSCI Emerging Markets Index has given up 22.1% since its high on October 29, 2007, resulting in sideways relative performance compared with developed markets since October last year.

Emerging markets (+1.2%) fared relatively well as a result of strong performances from the Shanghai Composite Index (+7.0%) and the Hong Kong Hang Seng Index (+3.6%). The MSCI Emerging Markets Index has given up 22.1% since its high on October 29, 2007, resulting in sideways relative performance compared with developed markets since October last year.

The US stock markets all declined on expanding volume. The major index movements were as follows: Dow Jones Industrial Index -1.7% (YTD -16.3%), S&P 500 Index -1.9% (YTD -15.6%), Nasdaq Composite Index -0.3% (YTD 15.6%) and Russell 2000 Index +1.4% (YTD -11.9%).

The best-performing industry group was the Dow Jones Platinum & Precious Metals Index (+12.6%), whereas the DJ Mortgage Finance Index (-41.2%) performed catastrophically on the back of the Fannie Mae (FNM)/Freddie Mac (FRE) saga.

Dow components Alcoa (AA) and General Electric (GE) officially kicked off the second-quarter earnings reporting season with as-expected profit reports. The reporting season will kick up several notches next week with reports from a number of major financial and technology companies.

The final word on equities comes from Bill King ( The King Report ): “Stocks are grossly oversold on a short-term basis. But … in a bear market with a negatively charged environment, grossly oversold means the conditions are right for a major storm. Ergo, the stock market needs some grand act of capitulation to generate a significant rally. … the earnings reporting season might be the catalyst for capitulation. So for the time being, sit tight and wait for ‘blood in the streets' for a buy opportunity.”

Fixed-interest instruments

Government bonds around the globe ended the week little changed from the previous Friday's levels, although US yields kicked up on Friday as investors agonized about the prospect of increased bond issuance should the US government bring the GSEs onto the federal balance sheet.

The perceived safety of three-month US Treasury Bills resulted in rates falling sharply by 24 basis points to 1.57%. On the longer end, the ten-year US Treasury Note dropped by 5 basis points during the week to close at 3.94%. Similarly, the UK ten-year Gilt yield declined by 7 basis points to 4.90% and the German ten-year Bund yield by 4 basis points to 4.46%.

Mounting economic woes in New Zealand resulted in three-year bond yields declining by 35 basis points to 6.10% and nine-year yields by 22 basis points to 6.14%. (The All Blacks' rugby defeat against the Springboks on Saturday happened after close of trade!)

Currencies

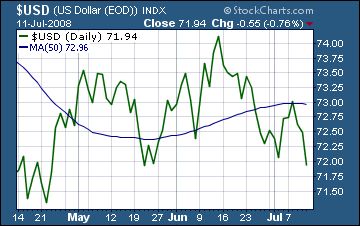

Concerns about the US financial sector and the realization that the Fed would not be able to raise interest rates any time soon put pressure on the dollar, causing the greenback to decline by 1.3% over the week against the euro, 0.4% against the British pound, 0.7% against the Swiss franc and 0.7% against the Japanese yen.

Efforts by the South Korean central bank to support the won resulted in the currency's biggest rise in ten years. The Bank of Korea said it would use its $258 billion of foreign exchange reserves to defend the won in an attempt to fight escalating inflation.

Commodities

Robert Barbera, the chief economist of ITG, said in an article in The New York Times : “Recession, we believe, is firmly in place in the US and is taking hold in Europe. And recession for developed world economies will burst the bubble for commodity prices.”

The performance of commodities was a mixed bag during the past week with agricultural commodities retreating from recent highs, industrial metals (with the exception of copper) moving higher, precious metals benefiting from safe-haven buying, and oil prices challenging $150 a barrel.

US dollar weakness, together with financial and geopolitical worries, resulted in gold bullion rising by 3.0% on the week, silver by 2.5% and platinum by 0.8%.

Oil prices experienced wide swings, with West Texas Intermediate crude touching $135.14 a barrel at its low on Tuesday before rallying back to a new record high of $147.27 on Friday. The price eventually settled for the week at $145.66 – little changed from its close the previous Friday. Reports discussing military posturing on the part of Iran and Israel, coupled with ongoing supply concerns, were at the heart of last week's trading action.

Now for a few news items and some words and charts from the investment wise that will hopefully assist in keeping head above (the very murky) water. It's best to remain cool and collected about these markets, and not take unnecessary risks.

Hat tip: Barry Ritholtz's The Big Picture

Barron's: The bear's back

“Now that the bear market has officially arrived, it may stick around and gnash its teeth for a while – until it's scared away those who remain. Barron's Online Editor Randall Forsyth warns investors about the bear wear. Keep cash ready, he suggests.”

Click here for the text version of this report.

Source: Randall W. Forsyth, Barron's , July 5, 2008.

Financial Times: Paulson stands by Fannie and Freddie

“The Bush administration on Friday attempted to quash suggestions that the US government might have to nationalize Freddie Mac and Fannie Mae, the giant mortgage companies that have unsettled the financial markets.

“Hank Paulson, Treasury secretary, said: ‘Today our primary focus is supporting Fannie Mae and Freddie Mac in their current form as they carry out their important mission,' signalling that the Bush administration was not contemplating a rescue takeover of the two groups and wanted public shareholders to continue owning them.

“Describing Freddie and Fannie as ‘very important institutions', President George W. Bush said Mr Paulson and Ben Bernanke, head of the Federal Reserve, would be ‘working this issue very hard'.

“Chris Dodd, Democratic chairman of the Senate banking committee, on Friday also said the Fed and the Treasury were considering opening the Fed's discount window to Fannie and Freddie.

“However, the Fed said there had been ‘no discussions' with Fannie Mae and Freddie Mac on access to the discount window.

“Fears that Fannie and Freddie could become victims of the credit crisis have gripped investors this week. The institutions are pillars of the financial system, holding or guaranteeing nearly half of the $12,000 billion in outstanding US mortgages and three-quarters of new loans.

“Shares in both companies opened sharply lower on Friday – with Freddie down as much as 50% – but rebounding following Mr Dodd's comments. Freddie ended the day 3.1% lower at $7.75 while Fannie fell 22.4% to close at $10.25.

“As house prices have fallen and foreclosures have soared, Fannie and Freddie have suffered deep losses, which they have tackled by raising more capital.

“Many observers believe a collapse of Fannie and Freddie could bring the US mortgage market to a complete standstill.”

Source: James Politi and Saskia Scholtes, Financial Times , July 11, 2008.

Reuters: Fed offers hand to Fannie, Freddie

“According to a Reuters source, Federal Reserve Chairman Ben Bernanke had told Freddie Mac chief Richard Syron that his company and sister firm Fannie Mae – two pillars of the American housing market – could take advantage of an emergency funding source known as the ‘discount window'.

Source: Reuters , July 11, 2008.

Charlie Rose: Conversation with JPMorgan's Jamie Dimon

Comments on video from Paul Kedrosky ( Infectious Greed ):

“After watching it, go read selectively from the viewer posts – including some scathing stuff from at least one ex-JPM employee – on the Charlie Rose site . For his part, and to his credit, Dimon explicitly takes on his critics, explaining why he thinks claims of ‘moral hazard' are wrong-headed and stupid, like refusing to save a drunk who was drowning. He also has a nice line justifying the $2 original Bear share price, saying that ‘buying a house and buying a house on fire' are different things.

“Somewhat surprisingly, Dimon gives considerable credence to rumors that the downfall of Bear Stearns was orchestrated. He says ‘Where there's smoke, there's fire', calls for an SEC investigation, and says it wouldn't surprise him if there was more to Bear's collapse than mere leverage.”

Source: Charlie Rose , July 7, 2008.

CNBC: Steve Forbes on the markets

Source: CNBC , July 7, 2008.

Ambrose Evans-Pritchard (Telegraph): Global shipping slowing drastically

“Jacques Saadé, the head of the French shipping giant CMA CMG, says the shipping cycle has turned with a vengeance.

“‘We're seeing ships leaving Asia that are not full. We are living through a real economic slowdown. It is a latent crisis that will take time to disappear. I don't see it getting better before the end of 2009.'

“‘America is importing less, so is Europe. After a record year in 2007, where we had more offers than we could take on our ships, traffic between Asia and Europe has now fallen to a 94% occupancy rate,' he said.

“Lloyds List said the shipping industry will know when the first Asian loads begin for the pre-Christmas season in a month as whether this is the start of a serious slump. The anecdotal talk is that the picture is deteriorating fast.

“Note too that the Baltic Dry Index measuring freight rates for coal, corn, grains and such has dropped 23% over the last month.”

Source: Ambrose Evans-Pritchard, Telegraph , July 4, 2008.

James Quinn (Telegraph): Merrill Lynch's David Rosenberg – US is in recession

“The United States remains firmly in an economic recession in spite of economic growth figures to the contrary, a leading economist has warned.

“Merrill Lynch's David Rosenberg, the first economist from a major bank to declare a US recession was underway back in early January, argues that recent unemployment figures show yet more evidence that the US economy is a deep recession.

“Pointing to last week's news that employment has now declined for six months in a row, Mr Rosenberg, Merrill's chief North American economist, says that ‘at no time in the past 50 years has this happened without the economy being in an official recession.'

“The typical definition of a recession is two consecutive quarters of negative gross domestic product (GDP) growth, something which the US has yet to have. However he argues that this is only a matter of time, given that all four recession determinants ‘have peaked and rolled over'.

“He points to widespread decline in economic activity, noting that real sales in manufacturing and retail, employment, industrial production, and real personal income – the four determinants – are all way below their peaks.

“The Merrill Lynch economist estimates that monthly GDP ‘peaked in January and has declined at a 2.2% annual rate since that time,' noting that he believes that the recession started between October and February.

“‘We expect the real GDP data are going to undergo massive revisions, and in fact, that we are going to be on the receiving end of what could be a significant revision on July 31,' Mr Rosenberg argues, suggesting that these revisions will point to the onset of recession.”

Click here for a full research report by Rosenberg.

Source: James Quinn, Telegraph , July 8, 2008.

Floyd Norris (The New York Times): Betting for recovery

“When people think their best hope for getting out of an economic hole is to head for the slot machines, you know things look grim. They are not betting on a recovery; they are betting for one.

“Merrill Lynch's David Rosenberg points out today that while consumer spending and income are up, thanks to the tax rebates, the consumer spending numbers show the way the money is being spent, and it is not very encouraging:

“‘In a real sign of despair, a good chunk of the spending went into lotteries (+0.9%) and casino gambling (+3%). And, they must have been at the blackjack table all night because spending on hotel rooms actually declined 1.6%. In this sense, very little of the spending went into anything that would represent a long-term commitment to the economy – motor vehicles, home furnishings, major appliances, clothing and jewelry either lagged the overall spending gain or declined outright. My favorite indicator for travel plans is luggage sales, and in a month where after-tax income surged 5.3%, buying of suitcases and the like fell 0.4%.'

“His conclusion: ‘What the consumers see is a very uncertain future when it comes to their wage-based income, and this ultimately drives real spending in the final analysis. Barring another positive fiscal shock, look for a significant retrenchment in consumer spending in the second half of the year and well into 2009.'

“In Europe, the latest surveys of business and consumer confidence look bad. ‘Manufacturing Recession Confirmed' is the title of a piece by Carlos E. Caceres, a London-based economist at Morgan Stanley.

“The great decoupling thesis, in which the rest of the world does just fine even if the United States is in recession, is looking less and less likely.

“Robert Barbera, the chief economist of ITG, offers this analysis and forecast: ‘Recession, we believe, is firmly in place in the US and is taking hold in Europe. And recession for developed world economies will burst the bubble for commodity prices.'”

Source: Floyd Norris, The New York Times , June 30, 2008.

Financial Times: Pessimism in US over prospects for growth

“Nearly 80% of senior executives at small and medium-size US manufacturing companies are pessimistic about the prospects for economic growth, according to a survey … Attitudes within the sector towards the benefits of globalisation have also deteriorated markedly since last year .

“The report by RSM McGladrey, the consultancy, suggests the outlook for the US economy may be even gloomier than expected. Manufacturing has so far held up better than the service sector: US manufacturers defied bearish forecasts last month by boosting production for the first time since January, the Institute for Supply Management said last week.

“Much of this was down to the resilience of companies that employ fewer than 2,000 workers. They account for about 40% of US manufacturing production and make up 99% of the country's manufacturers, according to the National Association of Manufacturers.

“However, the McGladrey report suggests the sector is bracing for worsening conditions. Fewer than 40% of respondents said their businesses were ‘thriving and growing' – down by 10% from last year and 19% from 2006. Meanwhile, the proportion who said their businesses were ‘declining' has tripled in the past two years.”

Source: Hal Weitzman, Financial Times , July 7, 2008.

Asha Bangalore (Northern Trust): Surprise narrowing of trade deficit in May

“The trade deficit narrowed to $59.8 billion in May from $60.5 billion in April. Exports of goods and services increased 0.9% in May after a 3.7% gain in April.

“In terms of the impact on GDP, the inflation adjusted trade deficit of goods was nearly $90 billion in the April-May period compared with a $102 billion in the first two months of the first quarter, suggesting that trade will have a positive influence on the second quarter GDP.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 11, 2008.

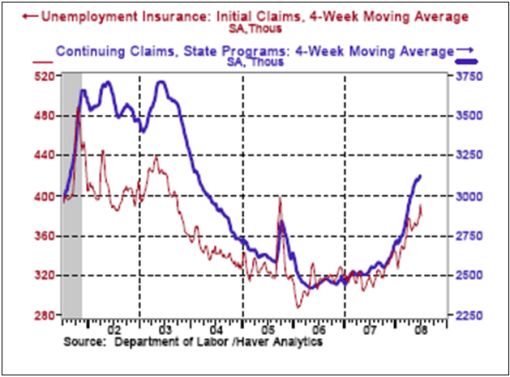

Asha Bangalore (Northern Trust): Jobless claims – seasonal factors distort underlying fundamentals

“Initial jobless claims fell 58,000 to 346,000 during the week ended July 5. The sharp drop reflects the shortened week due to the July 4 holiday and distortions arising from auto retool shutdowns in the summer. A good bet is 4-week moving averages of claims to evaluate the labor market.

“Moreover, economic data of the past six months suggests that firms have stopped hiring and robust demand for labor is unlikely to emerge at this stage of the business cycle. In addition, the Labor Department has indicated that a sharp jump in jobless claims, to account for the auto industry shutdowns, is likely to follow soon.

“The noticeable decline in initial claims is a distortion and is not an indicator of a marked improvement in labor market conditions.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 10, 2008.

RealtyTrac: Foreclosure activity 53% up from June 2007

“RealtyTrac, the leading online marketplace for foreclosure properties, today released its June 2008 US Foreclosure Market Report, which shows foreclosure filings – default notices, auction sale notices and bank repossessions – were reported on 252,363 US properties during the month, a 3% decrease from the previous month but still a 53% increase from June 2007. The report also shows one in every 501 US households received a foreclosure filing during the month.

“‘June was the second straight month with more than a quarter million properties nationwide receiving foreclosure filings,' said James Saccacio, chief executive officer of RealtyTrac. ‘Foreclosure activity slipped 3% lower from the previous month, but the year-over-year increase of more than 50% indicates we have not yet reached the top of this foreclosure cycle. Bank repossessions, or REOs, continue to increase at a much faster pace than default notices or auction notices. REOs in June were up 171% from a year ago, while default notices were up 38% and auction notices were up 22% over the same time period.'”

Source: RealtyTrac , July 10, 2008.

Yahoo News: Fed plans new rules to protect future homebuyers

“The Federal Reserve will issue new rules next week aimed at protecting future homebuyers from dubious lending practices, its most sweeping response to a housing crisis that has propelled foreclosures to record highs.

“Fed Chairman Ben Bernanke spoke of the much-awaited rules in a broader speech Tuesday about the challenges confronting policymakers in trying to stabilize a shaky US financial system. To that end, Bernanke said the Fed may give squeezed Wall Street firms more time to tap the central bank's emergency loan program.

“To prevent a repeat of the current mortgage mess, Bernanke said the Fed will adopt rules cracking down on a range of shady lending practices that has burned many of the nation's riskiest ‘subprime' borrowers – those with spotty credit or low incomes – who were hardest hit by the housing and credit debacles.

“The plan, which will be voted on at a Fed board meeting on Monday, would apply to new loans made by thousands of lenders of all types, including banks and brokers.

“Under the proposal unveiled last December, the rules would restrict lenders from penalizing risky borrowers who pay loans off early, require lenders to make sure these borrowers set aside money to pay for taxes and insurance and bar lenders from making loans without proof of a borrower's income. It also would prohibit lenders from engaging in a pattern or practice of lending without considering a borrower's ability to repay a home loan from sources other than the home's value.

“‘These new rules … will address some of the problems that have surfaced in recent years in mortgage lending, especially high-cost mortgage lending,' Bernanke said.”

Source: Jeannine Aversa, Yahoo News , July 8, 2008.

Bill King (The King Report): Inflation does not necessarily ebb during recession

“John Williams ( Shadow Government Statistics ) debunks the notion that ‘inflation always ebbs during recession'. The severe downturn of 1973/1975 was accompanied by high inflation, per official CPI reporting, with annual inflation averaging 5.2% for the year leading up to the recession, 10.7% during the 16 months of the downturn, and 7.9% in the year following.

“The next recession, from January through July 1980, saw even higher inflation, with annual CPI averaging 11.6% in the year leading up to the downturn, 14.3% during the six months of economic contraction, and 11.4% in the 12 months that followed, through to the onset of the next recession. This was a period that again saw significant oil price increases, near-double-digit annual growth in M3 and mixed dollar pressures.”

Source: Bill King, The King Report , July 11, 2008.

Bloomberg: Bernanke says Fed may extend Wall Street lending access

“Federal Reserve Chairman Ben Bernanke speaks about the state of financial and credit markets, the collapse of Bear Stearns, and the oversight of securities firms. Bernanke speaks at the Federal Deposit Insurance Corp's Forum on Mortgage Lending for Low- and Moderate-Income Households in Arlington, Virginia.”

Source: Bloomberg , July 8, 2008.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.