SPX Stocks Index At Tipping Point

Stock-Markets / Stock Markets 2016 Mar 13, 2016 - 06:01 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend: Severe correction underway.

SPX: Intermediate trend – .618 retracement reached as well as total projection. End of rally likely.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com

SPX AT TIPPING POINT

Market Overview

Last week’s headline was: “MAX. PROJECTION 95-100% COMPLETE…” At the time, the SPX had registered a high of 2009 (95% of the count) and was starting to correct. That correction lasted until it had reached 1970 on 3/10, at which time traders decided that they should go for that extra 5%. Last Friday, SPX closed at 2021.94, just a few points shy of reaching the full projection.

Intermediate and long-term P&F counts have been accurate the great majority of the time and should be taken seriously. At what point would the current forecast be wrong? If the index continues to rise beyond 2043, the premise that we are in a “bear market” would begin to face a challenge.

When we reached 2009 and started down, some technical conditions which normally occur at a top and warn that a serious reversal is about to occur were still missing. Namely, negative divergence in the daily indicators! This condition is now in place -- as we will see when we analyze the charts. We will also see that the hourly indicators are running out of steam. And, another important feature may have been added: the creation of an exhaustion gap which occurred on Friday at the opening. It will be confirmed as such if we reverse and close it in a few days.

I have hesitated calling the current downtrend a bear market, preferring to label it as a “severe correction”. My reason is that the distribution pattern which was formed between May and August 2015 has a “strong” count which could result in a decline to about 1500. If we stop there, we would only have retraced a little more than .382 of the entire bull market! However, if we take into consideration the distribution phase (weak count) which occurred prior to the May peak of 2135, the decline could extend another 450 to 1050 points. In other words, the worst case scenario could have us retrace 70.7% of the bull phase, with a good possibility of stopping at a 50% retracement (about 1388).

SPX Chart Analysis

Daily chart (This chart, and others below, are courtesy of QCharts.com.)

The chart below focusses on the current countertrend so that we can examine it more closely. Since last week, the index traded outside of its original wedge pattern, but the rally of the past two days has created a larger wedge with Friday’s move back-testing the original lower trend line. The move also stopped at the bottom of the second layer of overhead resistance which was discussed last week. Perhaps more relevant, the entire pattern from the 1810 low has now taken the form of the wave formation that I original proposed: 3-3-5, which now looks complete. If that’s the case, we have to consider the larger formation, with 1810 representing the end of A (from 2116) and now B complete, or nearly complete, inferring that C is ready to begin and go below A (1810).

Note that wave 3 of c ended without decelerating, which is the reason why at the end of last week, the daily momentum indicators were not showing deceleration either. Only the A/D oscillator did! This past Friday’s move went to a new high but the momentum oscillators did not, which gave us the negative divergence which had been missing while at the same time, the A/D oscillator is showing even more negative divergence.

We’ll discuss the “exhaustion” gap in our analysis of the hourly chart where it is much more visible.

Hourly chart

A couple of things can be seen on the hourly chart that are not possible to see on the daily. One is that the last wave of the structure (which starts at 1970) already has 5 waves in place. It’s only a question of whether wave 5 is complete. On the 3m chart, it looks like it is since you can break it down into 5 smaller waves. In that case, there would be no reason why we could not start Monday morning with a declining market. We may get an indication from the Globex futures on Sunday evening.

The other thing is the gap opening on Friday morning. It is marked on the chart in light blue. For confirmation that we have a reversal of the trend from 1810, we not only have to close it, but we have to decline below 1970.

A sign that the rally from1970 is coming to an end (as the structure indicates) is that all the oscillators are already showing some significant deceleration, some of which could even be categorized as negative divergence. When all three show a bearish cross of their MAs, it will be a confirmed short-term sell signal.

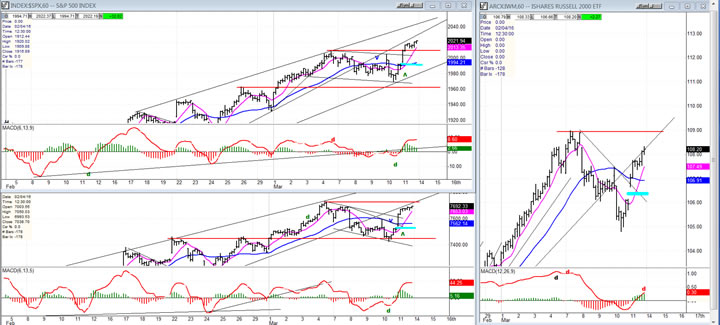

- SPX vs. TRAN (Dow Jones Transportation average) and IWM (Russell 2000 ETF)

- To our habitual comparison of the SPX with the TRAN, I have added one more chart on the right: that of the Russell 2000 ETF (IWM). The latter is also one of the most sensitive leading indexes when compared to the SPX. All three charts are 60m charts. In these charts, we are looking at the SPX from another perspective, to see if relative weakness is beginning to show in some of the prime leading indexes -- something that appears regularly at the end of significant market trends. And indeed it is!

- We have already discussed the propensity for the TRAN to lead as a matter of course. At the top of this market cycle, the disparity was enormous issuing a warning of the coming decline by several months. At the 1810 low, the TRAN reversed its downtrend well before SPX. Presently, the contrast is not as pronounced (perhaps a matter of comparing waves of different degrees), but apparent nevertheless. The last minor downtrend went a little lower than SPX and, in the current minor uptrend, TRAN has not even risen above its former short-term high, while SPX has exceeded it.

- The contrast is more pronounced in IWM. The degree by which it is underperforming the SPX is more substantial, even though it also appears to have completed the same five waves as the other two in the last uptrend. The divergence is even more noticeable in the IWM momentum oscillator.

- The relative weakness of these two leading indexes to the SPX adds to the case being made for the rally from 1810 to be coming to an end. Both of them appear to be making truncated 5th waves, which is also a sign of weakness.

UUP (dollar ETF)

UUP has turned down again, extending its intermediate correction which is now about one-year long. This is only a cursory analysis, but it appears that the index may be close to completing its correction. If it holds around the 200-DMA and starts up, this could be the beginning of a genuine uptrend. The indicators may be in a position to establish some positive divergence. Let’s give it a few more days.

GLD (SPDR Gold Trust)

GLD has been stuck at the top of its green channel, and was recently repelled by the larger red channel. The indicators have developed some significant negative divergence and even begun to turn down. There may be one last chance for one more try before beginning to correct.

USO (US Oil Trust)

I can’t see USO going past the declining red trend line, at this time. The MACD has flattened out and the SRSI unsuccessfully tried to start a downtrend recently. The next time it turns down, it may keep going. Oil turning down would be a good excuse for the market to do the same.

Summary

The SPX may have decided to go for the last 5% of its intermediate base count, and may even have completed it on Friday. But, as the saying goes: “The proof of the pudding is in the eating”. So, in spite of all the logical technical reasons given above for having completed its countertrend rally at this time, we need to wait for confirmation that it has indeed done so!

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.