Fannie Mae and Freddie Mac Crisis Means Faster Decline of Foreign Currency Inflows

Stock-Markets / Credit Crisis 2008 Jul 15, 2008 - 02:55 AM GMTBy: Ashraf_Laidi

Almost 4 months to the day after the Fed backed the JP Morgan rescue of Bear Stearns, the Fed and the US Treasury intervene to provide a 3-part rescue plan for US Government Sponsored Enterprises Fannie Mae and Freddie Mac. The US Treasury will increase its existing $2.25 bln lines of credit to the two entities, and will assume temporary authority to purchase shares in their equity if the need arose. The Federal Reserve will extend emergency borrowing via the "discount window" to the two entities in return for collateral.

Almost 4 months to the day after the Fed backed the JP Morgan rescue of Bear Stearns, the Fed and the US Treasury intervene to provide a 3-part rescue plan for US Government Sponsored Enterprises Fannie Mae and Freddie Mac. The US Treasury will increase its existing $2.25 bln lines of credit to the two entities, and will assume temporary authority to purchase shares in their equity if the need arose. The Federal Reserve will extend emergency borrowing via the "discount window" to the two entities in return for collateral.

Freddie/Fannie are Key in Drawing Foreign Inflows

The chart below shows that even though net foreign inflows into US Agency securities fell to 35% in of total inflows in 2007 from 44%, they made up a significant share of total foreign purchases of US assets. The importance of GSEs is highlighted by the fact that in 2006 and 2007, they drew the second biggest share of total foreign inflows (behind corporate bonds in 2006 and 2007). The 2007 decline as well as the current slump in Fannie Mae and Freddie Mac means faster declines of foreign flows in Agencies and the erosion of a vital share of the foreign financing of the U.S. current account deficit.

The chart also shows that US stocks and treasuries were the only asset class that saw an increase in net foreign purchases as a percentage of total foreign purchases in 2007, in contrast to purchases of US corporate bonds and GSEs. The 20% decline in US equities from their October highs implies falling foreign demand for US equities and equities, which leaves Treasuries as the only asset class with fundamentally viable outlook . Nonetheless, if US inflation remains on the rise, the prospects for US treasuries could be questionable .

Will Another Rescue Plan Help Equities?

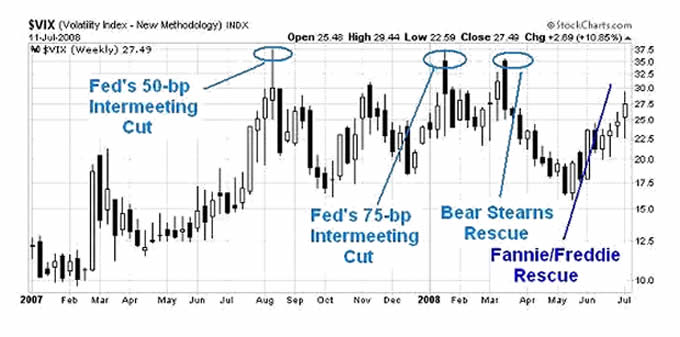

On the positive side, the government's weekend announcement to back Freddie and Fannie has so far helped to stabilize the declining dollar and support US equity futures. Would another historic rescue plan from do the trick in stabilizing the recent rapid sell-off in US equities and run-up in the VIX? The chart below shows that each of the last major four peaks in the VIX resulted by unexpected or historic interventions by the Fed of the Fed government . The August 2007 and January 2008 peaks in the VIX occurred after intermeeting rate Fed cuts of 50-bps and 75-bps respectively. The March peak emerged after the Fed backed JP Morgan in buying out Bear Stearns.

This Time Is Different

The latest government intervention may not succeed in providing the required confidence in US equities as it is not accompanied by a reduction in interest rates . Providing backstops to the biggest buyers of US mortgages neither helps reduce unemployment, nor props consumer demand or boosts industrial production. As in the case of the Bear Stearns rescue, the Feddie/Fannie package coincides with the beginning of US corporate earnings. But the previous earnings season was largely boosted by a falling dollar and more robust foreign demand . This is not the case for the unfolding earnings season . The dollar was up against GBP and JPY in Q2 and all overseas economies came grew weaker than in Q1 .

FX Outlook

Due to these distinctions, we do not expect any marked recovery in the dollar. But Fed Chairman Bernanke's testimony to Congress tomorrow may alleviate dollar losses on the argument of renewed assurance from the central bank. The currency's best chances of recovery remain against JPY and CAD, but these are likely to remain temporary. USDJPY capped at the trend line resistance of 107.10, before renewed weakness emerges back to 106.20. EURUSD is supported at 1.5820 and 1.5780, which remains well above the increasingly important support of 1.5620. Upside capped at 1.5970. Tuesday's German ZEW survey (5 am EST) may well further drag the pair towards 1.5700. AUD remains our preferred currency against USD (0.9740), NZD (1.2830) and GBP (0.4950).

By Ashraf Laidi

CMC Markets NA

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.