Gold And Silver – Qrtly, Monthly Charts. No Change In Trends

Commodities / Gold and Silver 2016 Apr 02, 2016 - 12:56 PM GMTBy: Michael_Noonan

“Nothing ever changes on Wall Street. Speculation is as old as the hills. What has happened before in the markets will happen again.” Jesse Livermore

“Nothing ever changes on Wall Street. Speculation is as old as the hills. What has happened before in the markets will happen again.” Jesse Livermore

Despite taking his life at the Sherry Netherland Hotel in 1940, at the age of 63, [he considered himself a failure], Livermore is revered by many as the consummate trader.

We often comment on the importance of rules, and our adherence to rules does not come from Livermore, but he always attributed his losses to the times when he failed to follow his rules.

Our point is that markets never change, and as it turns our, neither do people, and certainly not when it comes to trading/investing in the markets, stock, commodities, etc. Most people do not have a set of written rules that they follow at all times. A lack of discipline would have to be next in rank. It can be hard to be successful in the markets with rules and discipline. It is impossible to succeed without them.

The greatest credibility for market analysts is given to those who talk a great deal about fundamentals. On the opposite end of the spectrum, those to whom the least amount of credibility is given, are technical analysts and chart readers. We fall in the latter, reading

the markets through developing activity in the form of price and volume.

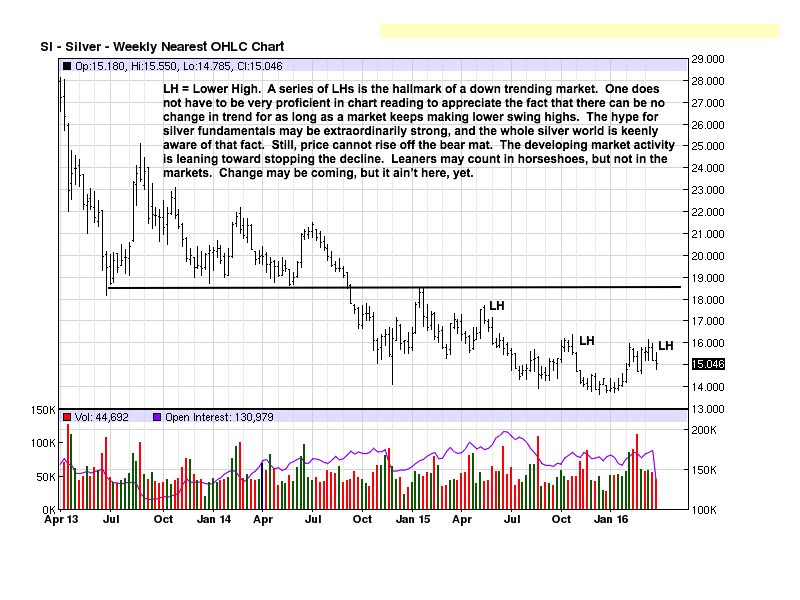

The one constant we have delivered in our commentaries is the importance of knowing the trend, first and foremost. Since the 2011 market highs in PMs, the trend has been down, and the trend for both gold and silver remains down to this day. We also have made the distinction between buying and holding physical gold and silver and not being long in the futures market. seemingly related, [only now tenuously by price], but very different in purpose.

Buying and holding physical gold and silver is for the purpose of wealth preservation based upon the historical relationship of the PMs and maintaining one’s purchasing power, recognizing there are times when the opposite is true. Buying or selling in the paper futures market is purely for speculative purposes, and the rigged COMEX and LMBA exchanges have just about ruined that venue. Whether the Shanghai exchange successfully picks up that mantle remains to be seen, at least in the West.

Because markets never change, there is a consistency about them, if one can learn from past behavior. The consistency loses traction when fundamentals are overlaid as a template for how to invest or trade, and that has been so true for gold and silver. To this day, despite the trend still confirmed as down, there have been numerous calls for huge moves to the upside, diminishing supply coupled with unabated growing demand being the reason, albeit a very misplaced one.

People devour that kind of reporting, mostly because it comports with one’s thinking/ wishing/desiring for the markets to go higher, and it supports unmet expectations for higher prices. In today’s globalist-driven markets, fundamentals simply do not apply, at least based on current market results, and current price levels are reality. People like to talk about the markets and want to know what the markets are going to do, unless the news about the markets goes against expectations.

We have fully advocated the purchase of physical gold and silver over the last five years, and at any price, so we cannot be accused of being bearers of bad news about the PMs market. We are market realists, and the reality is neither gold nor silver are about to launch into the upper reaches of higher prices for the near term. Near term can be three months, it can be a year. We said in 2013 to expect the same for 2014, then 2015, now 2016. No one knows when the change will come.

Here is our current reasoning…

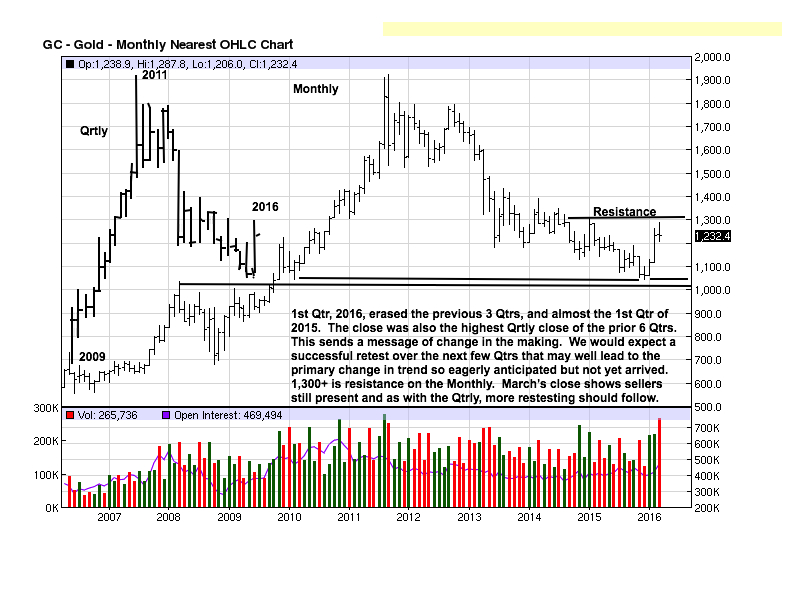

The Quarterly chart has been loosely [for accuracy] drawn in on the right side of the chart below. It is postulated that controlling market makers, also strong hands, look at these longer term charts as key to their strategy[s]. Most people never look at them, except for when we present them.

What that chart shows, at least since the market high in 2011, is a down trend with no change. The first Qtr of 2016 may have changed that outlook for it is the most significant rally since the high. It erased most of the efforts of the last six Qtrs. It is the highest close since the 3rd Qtr of 2014. While it is not a trend changer, it is a red flag for bears.

If this analysis is correct, then we should begin to see a change in market behavior, more in the lower time frames, first. This last Qtr could mark an important turning point. We have talked about December 2015 as a possible low, in hindsight by us, and the rally on the monthly chart lends credence that view. It is no accident that the December low was a small range bar that held right at the bullish spacing area, noted by the two horizontally

drawn bars, the lower from the 2008 swing high, and the space left from the lowest swing low in 2010.

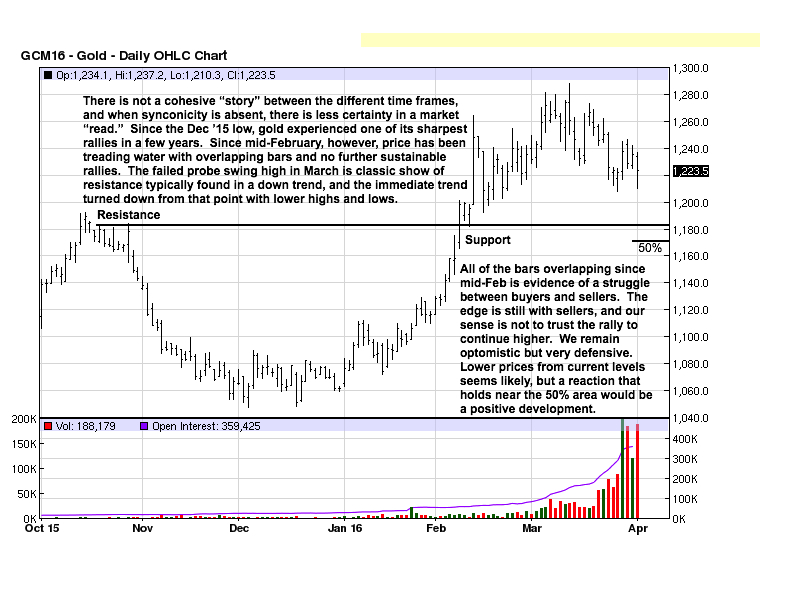

Note how small the range was for March as compared to a range about twice as large for February’s strong performance. Mention was made that both time frames suggest sellers were present and a retest reaction lower is likely. The smaller range for March resulted from sellers overcoming the effort of buyers, near an area of resistance, and buyers were prevented from extending the rally higher.

A reaction lower is inevitable, but if it is a weak reaction, that will be positive news for the exasperated and waiting bulls. Forget about reading positive news or reports about how bullish the factors are for gold [silver more so]. That has been known for a few years, now, and the price direction has not changed based on the news.

Do not listen to what people are saying about the markets. Look at what the markets are

saying as a reflection of people who are actually buying and selling. It is a much more reliable guide.

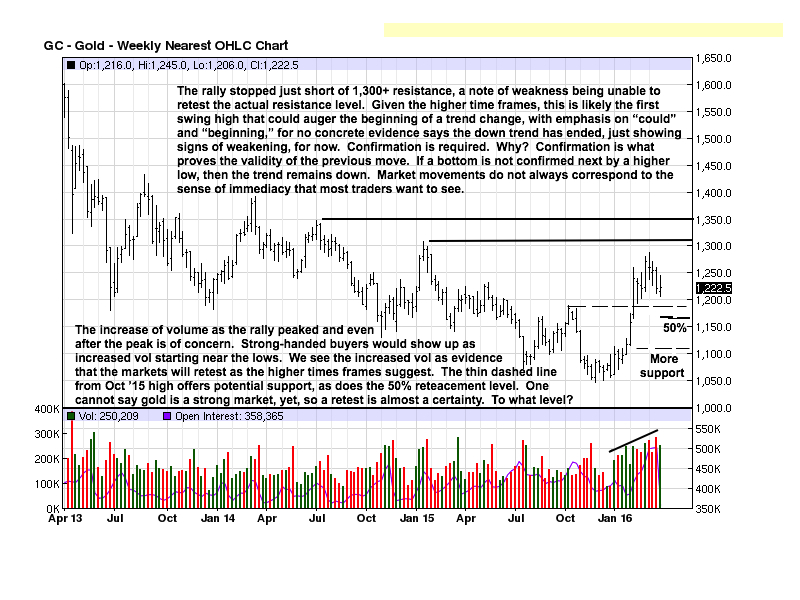

The rally of February was impressive, and it broke the pattern of lower highs for the first time. That is a concrete message from the market that is reliable. The reaction from the current swing high to the downside has been weak, so far. We think there will be more

downside in the weeks ahead, but we view it as normal market behavior, [remember, markets never change. They repeat pattens over and over, all the time.]

These patterns are messages from the market. If the correction holds around a 50% retirement area, even down to the 1120 area, and then turns around, it will be great news for the growing probability for the trend change so widely anticipated since 2013, and counting.

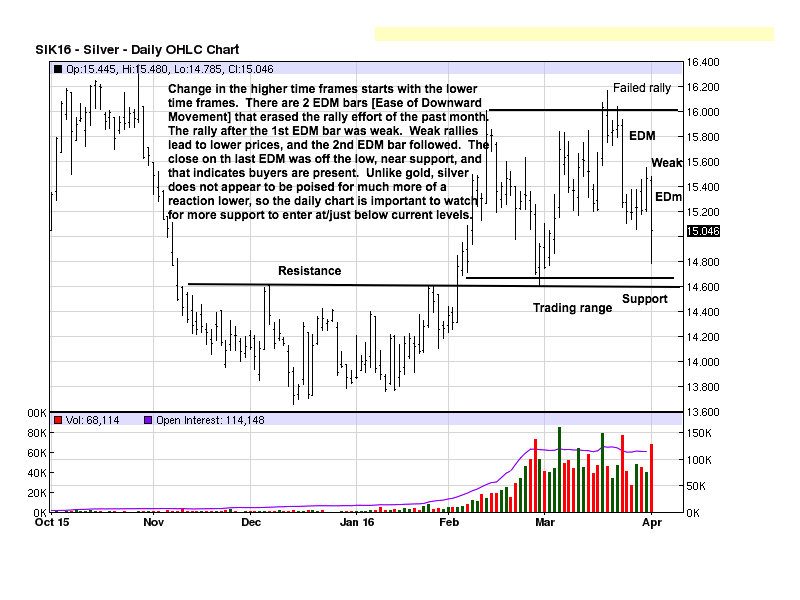

The chart comments are apt. Any change will begin to show up on the daily chart ahead of the weekly, monthly and quarterly charts. The perceived change we noted for 1st Qtr 2016 now makes the activity on the daily more pertinent for any sign[s] of change.

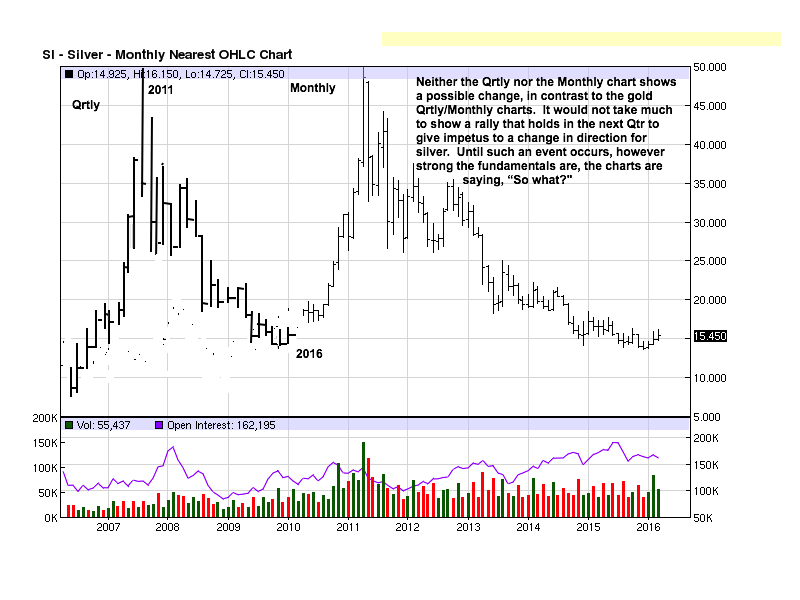

The picture for silver is markedly different from gold’s. Forget about how positive the outlook is for silver, fundamentally. It makes sense as a basis for making that stack higher and higher, but chart-wise, silver remains in the doldrums. It can be subject to change in any given week or month, but unless and until such a change is evident, silver will remain in its flagging [as in weak] status moving forward.

The mid-range close for 1st Qtr 2016 shows a draw between buyers and sellers, and the same can be seen by the two poor closes for the last two monthly bars. It would not take much to tip silver’s direction to the upside, but so far, it has not happened.

When change does come, it will be quite apparent, something even Helen Keller might see, so be patient and keep an eye on the daily, as explained.

In the past, one trading range developing on top of a prior trading range led to higher prices. The last 9 weeks of trading is all above the prior TR from November 2015 through January 2016. What silver lacks is some trigger-type activity to the upside.

The two TRs discussed on the weekly are more evident on the daily. There is zero confirmation for a change in trend in silver, to date. We see the possibility for one developing here, but there needs to be some kind of confirming activity, some kind of ending action that will signal an important change in market behavior.

Will 2016 be any different, in terms of directional price change, from 2013, 2014, and 2015? Not so far, but the reasons are beginning to be more credible, maybe in the second half of the year?

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.