Stronger Reasons For Buying Gold/Silver Right Now

Commodities / Gold and Silver 2016 Apr 16, 2016 - 06:06 PM GMTBy: Michael_Noonan

Almost all of those in the precious metals community are avid consumers of news and statistics pertaining to gold and silver [PMs], such has how many tonnes of gold are being purchased by China, mostly. How much gold does China really own, certainly far more than the "official figures" provided by the Chinese, and certainly far less than that country admits.

Almost all of those in the precious metals community are avid consumers of news and statistics pertaining to gold and silver [PMs], such has how many tonnes of gold are being purchased by China, mostly. How much gold does China really own, certainly far more than the "official figures" provided by the Chinese, and certainly far less than that country admits.

Then there are the ongoing published figures of how many gold and silver coins that are being purchased each month, one record month leading to another. "Demand is going through the roof!!" Coupled with those figures are mining supplies v world demand, especially bullish for silver, almost beyond imagination. Added to the mix are the COMEX and LMBA, paper perpetrators of fraud, ruled by the moneychangers and not by the exchanges themselves. These now illegitimate exchanges no longer function as exchanges where one can take delivery on the contract[s] owned.

"What?!! You want actual delivery of the underlying metal? Sorry. Read the fine print. All we can offer is a cash payout [read that as being offered worthless fiat paper], instead of the physical metal you really wanted."

The COMEX and LMBA have become the elite's casinos to control and suppress the prices for gold and silver so as not to compete with their massive issuance of worthless fiat paper. The last thing the moneychangers want is for the masses to realize that the only true money, [not currency], is gold and silver, for it would destroy their literal fiat house of [paper/now mostly digitalized currency] cards.

Of course, those steeped in buying and owning PMs already know this, but we are such a minority with little hope of competing with the existing fictitious nations. [We were going to say "sovereign" nations, but none exist. All countries are corporate entities, and corporation are, by definition, fictional, something lost on most people who still [mistakenly] believe in their "government."].

For example, there is no United States, per se. Rather, the UNITED STATES is a corporation, and each and every state is also a corporation controlled by the primary federal government. Within each state, there are multiple corporations known as counties, cities, towns, courts, municipalities, etc, etc. The US is a series of interconnected corporate entities and not "one nation under God." You can dispense with that notion.

The same is true for Europe. It has devolved into a fiction known as the European Union [EU]. The intent, by the elites, is to destroy individual nationalities and borders, to be replaced by EU "police," "troops," all loyal not to the "nations" being served, but only to the unelected heads located in Brussels. The EU is a farce, yet the elected heads of state from the component countries do everything in the EU's service, always at the expense of the people, be they French, Italian, German, etc.

The global elites will not stop until national boundaries, even national identities are erased. That is being accomplished by the Brussels unelected but ruling sycophants. The destruction and dismantling of the Middle East, led by the US, is by planned design from decades ago by the elites. The forced "immigration" of so many displaced people from the Middle East, being financed and led to migrate into Europe, [Why does the name George Soros keep popping up in these discussion?!] is by design not by accident.

Always remember the elite's driving anthem, Problem, Reaction, Solution. Look how the people in each European nation are uprising against the forced acceptance of migrants that are creating all kinds of havoc. This is the Reaction to the Problem of so many Middle Easterners being funneled from one state of homelessness to another, now in Europe, and the public is being threatened by physical abuse by roaming gangs, rape of women and even children, murder, theft, you name it.

The globalists created the Problem. [Somebody financed the literal shipping and transporting of all these otherwise homeless and broke families and individuals.][The name Soros pops up again. Surely an {inescapable} coincidence.] Having created the Problem, they watch the [anticipated] Reaction by the people. Guess who is going to sweep in with a Solution? What kind of solution?

EU troops [loyal only to the elites] are needed to control the [desired] mayhem and prevent more rape and pillaging within the communities. The troops will be impervious to national borders. Who needs borders any more, anyway? [A planned part of the Solution]. Of course, more individual liberties and freedoms will have to be given up to these globalists in order to "protect" the people from the [always planned] chaos.

Take German chancellor "Ankara" Merkel, for example. When has she last served the interests of the German people? US demanded sanctions against Russia, despite them hurting the German economy and loss of business. "Jawohl, Mein President Barack," was her response as a de facto 51st governor of the US. "Was Sie sagen!" [Whatever you say.] She served the interests of a belligerent US over that of the German's interests.

"Taking in all those migrants is my damn responsibility," in so many words, again at the expense of the German people who vociferously opposed taking in the migrants. "Schade, deutsche." [Too bad, Germans]. Guess whose side "Ankara" Merkel is taking in accommodating Turkey's sending all of theses migrants, not a few of whom are surely ISIS trained terrorists-in-waiting?

Just recently, Merkel threw a German comedian, Jan Böhmermann, under the bus when Turkish renegade imperialist Erdogan declared Böhmermann had insulted him and should be criminally prosecuted. "Warum nicht?" was the globalist's chancellor's response. Let the courts decide. Böhmermann's comedy skit did not portray Erdogan in a positive light, to be sure, but he is still a German citizen and deserving of being protected as one, especially from some foreign dictator who has no right to impinge upon a citizen of another country. Sticks and stones, Recep, sticks and stones.

In the English-speaking world, "Sticks and stones may break my bones, but names will never hurt me, " is the equivalent of saying, in response to an insult, "You might be able to hurt me by physical force but not by insults". Obviously, the resident president dictator has thin Turkish skin, [except for when it comes to bombing and killing innocent Kurds.]

In a not so unrelated event, [we firmly believe there are no accidents], Japanese prime minister and globalist sycophant Shinzō Abe decided to meet with Russian president Putin at the G20 meeting in Turkey. Barack Obama takes exception to this and telephoned Abe to have him cancel the meeting. Abe said, "No, thanks. I will be meeting with president Putin, [like it or not]."

This begs the question, why does Barack Obama believe he has the right to interject himself between two other heads of state?

Globalist puppet and federal corporate president Obama does not like to be disappointed, [read that as the elite's do not like to be disappointed], and wouldn't you just know it, soon after, Japan was just struck with a massive aftershock in the form of a magnitude 7.0 earthquake, which means it was roughly 10 times stronger than yesterday's tremor. Will the coincidences never end?

First, there was Fukashima, a man-made event, [man-made sounds more acceptable than US-created], when Japan refused to cooperate with the US regarding some destructive, for Japan, financial dealings. After Fukashima, for some reason, Japan changed her mind and decided to cooperate with the US. That's what friends are for, after all. "You help us, we won't destroy you."

So, for the PM crowd, they want to buy/hold gold and silver due to the strong underlying fundamentals that have always been strong, have continued to get stronger, but have had zero impact on the prices of gold and silver. How has that been working for the past five years? Apparently few have gotten the memo because those same time-worn "fundamentals" continue to be cited week after week, month after month, as though they were relevant. So much for PM-related fundamentals for owning gold and silver.

Additionally, what has been the impact on prices with China buying every available tonne on the market, and now including acquiring gold/silver mines whenever and wherever possible around the world? None. Why not? China is just as implicit in seeing that PMs are suppressed, and, in fact, it is probably China that has told the Western elites to keep the price low while she accumulates tonne after tonne after tonne, as a favor for not dumping worthless US Treasuries onto the market.

As we have maintained for the past few years, none of the available information has impacted prices in any positive way, and during that time, central bankers have openly driven the price of gold down with impunity. Therefore, the reasons for acquiring and holding physical gold and silver goes way beyond the strong fundamental picture that has had no effect. That message, alone, tells you how critical it is to hold either or both physical metals.

When the hidden factors start to come into play, when the manipulators have run their course into the ground with nowhere to turn, prices for gold and silver should have a dramatic move higher. How much higher? Almost everyone has heard figures like $4,000 gold, $10,000, $20,000, even as high as $50,000 the ounce. For silver, $200, $400, $1,000, a few even much higher.

We simply do not know, and interestingly, we do not need to know. Why? Anyone in a position to know, if there is anyone or any group, is not telling us, and frankly, we do not care. What we know for certain, and all that matters is , and the same holds true for everyone else, wherever the price goes for silver and gold, we are in a position to benefit by already owning both, as is everyone else who already owns and holds the physical metal[s].

Forewarned is forearmed, and however trite that may be, it is a very powerful position in which to be. If there is a gradual price increase, no problem, one can still keep adding, as able. If there is a surprise reset overnight, and price doubles, triples or greater, no problem, we and many others are already positioned to reap the benefits of patience and prescience, always knowing all fiats fail, and this time is no different, in the end.

Also in the end, the fundamentals will not have mattered because the reality of decades of suppression and no other recognized alternative to function as a form of money will dwarf the fundamentals, and a huge shift in perception is what will catapult prices to whatever final level they will realize.

For those who recall the collapse of the stock market in 2008, it altered the perception of all fundamentalists and value investors as their world was turned upside down as they discovered price bore no relationship to fundamentals or "value." Conventional "value" association disappeared.

Gold and silver may ultimately be in a similar position, not collapsing in price but in reaching a level that may shock the senses of everyone. If you do not have gold or silver, you are playing the elite's paper game, and all paper assets will reach their intrinsic value, zero.

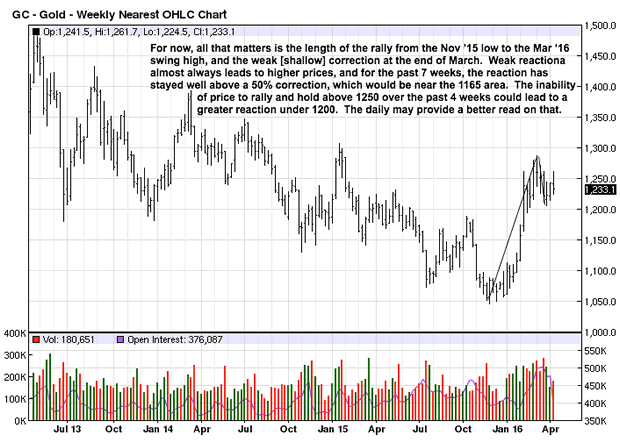

We keep looking at the charts which are the most reliable barometers for a current read of where price is and if there are any signs of change that says price will go no lower and will start to go higher.

The current focus is on the weak reaction since the rally off of the Dec '15 lows. The bars overlap, indicating a battle between buys and sellers, and volume picked up notably which adds to the weak correction likely leading to higher prices.

Nothing is ever a given, but the current market development continues in a positive manner not seen in a few years.

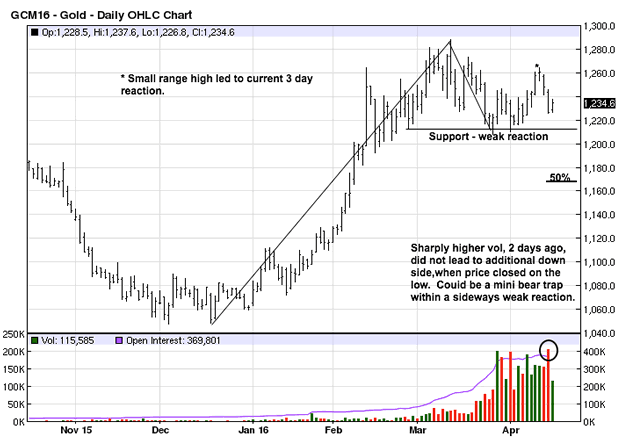

The daily affirms the weak nature of the current reaction, now in its second month of a sideways movement instead of one lower. The high volume down bar from Thursday had the appearance of a minor bear trap and a place to buy with a relatively low risk.

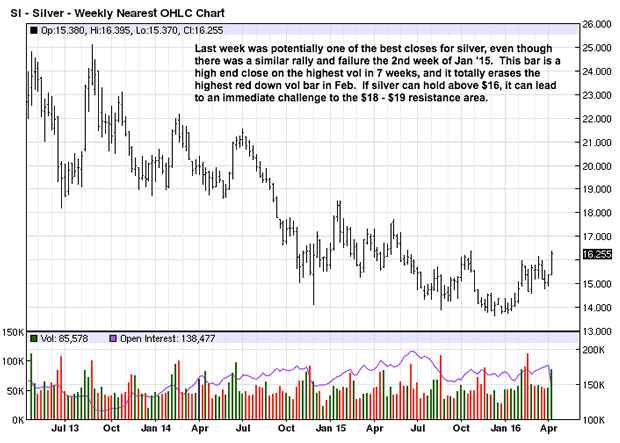

Last week was one of silver's better performances in a few years. It comes after a minor lower low in November '15, retesting the lows from August '15 and a more obvious low from November '14. It would be nice to see this mark a turning point for silver.

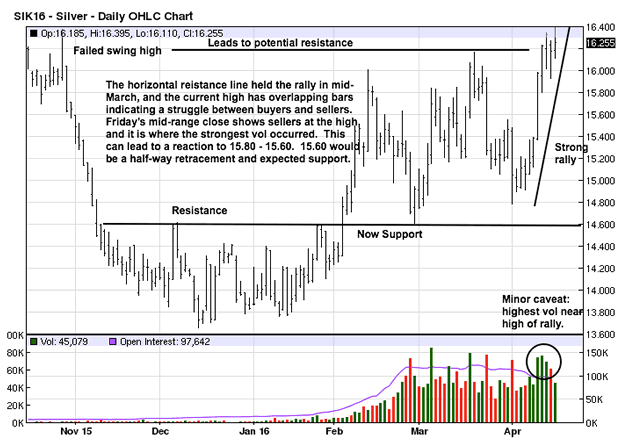

We often mention how markets are continually testing and retesting previous support or resistance areas, and that is apparent from the failed swing high in late October '15. While the last two-week rally has been impressively strong for silver, the bars overlapped at the last mid-March resistance and volume increased. It can only be determined after the fact if this is buyers absorbing the effort of sellers or the other way around.

Should it lead to a natural correction, the character of the correction will provide even more insight into this potential change of trend direction.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.