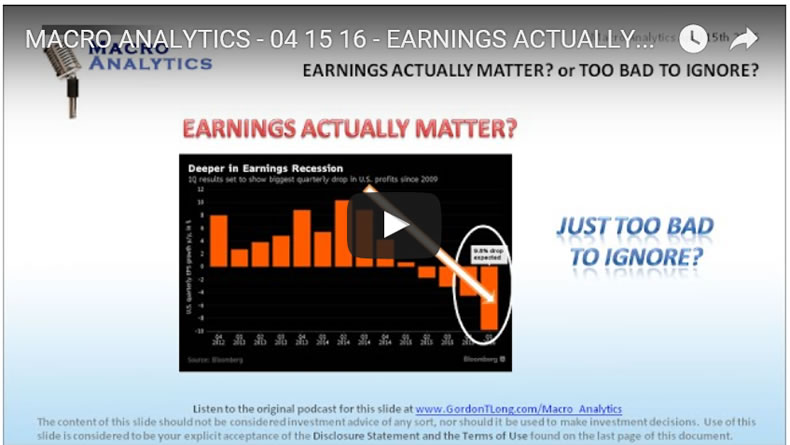

Corporate Earnings Actuall Now Matter? or Are They Too Bad To Ignore?

Companies / Corporate Earnings Apr 20, 2016 - 08:59 AM GMTBy: Gordon_T_Long

With John Rubino & Gordon T Long

With John Rubino & Gordon T Long

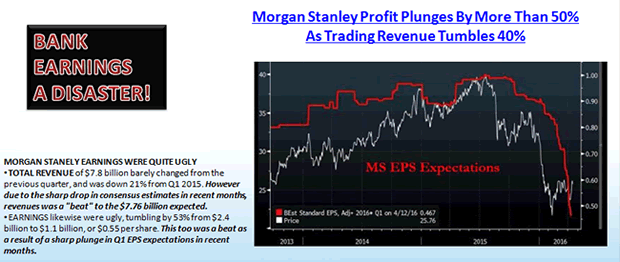

Bank profits are in trouble!. Don't be fooled by the "beat analyst estimates" charade, because that is exactly what it is. First quarter bank earnings can only be described as an unmitigated disaster.

With the aid of 24 charts, John Rubino and Gordon T Long discuss what they see in this 32 minute video, what is important to be aware of and what is being hidden from public scrutiny.

The Earnings' Season Charade

John Rubino recaps the situation as:

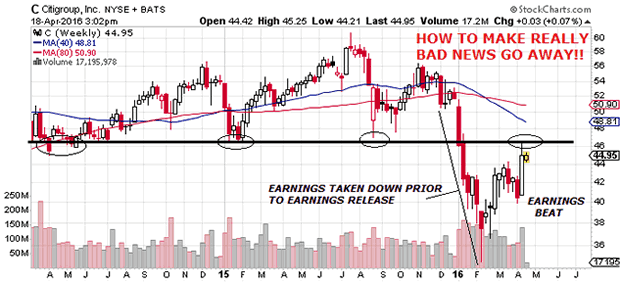

"I think this is hilarious so far! It is the season where banks are reporting earnings and they are reporting really bad numbers Y-o-Y. Citigroup's earnings were down 28% Y-o-Y with a double digit drop in revenue. It is pretty well the same for the Bank of America, JP MorganChase, Wells Fargo BUT the headline in Bloomberg and other major media outlets are oh "Citigroup beats expectations!"

That is the headline because Wall Street plays this game with their big client accounts where when things are headed south the analysts on Wall Street lower earnings projections even faster than earnings are actually dropping, so the companies can say "yes, we lost money and made less money than we did a year ago BUT we beat Wall Street expectations!". THAT becomes the headline.

The only positive headline out there for the big banks are when the results are horrendous! "

John goes on to say that:

"Year seven in a recovery banks should be reporting phenomenal numbers - they should be reporting 'blowout numbers! This is the point of the cycle when lots of people are borrowing, interest rates are down, funding is cheap for the banks - the bankS should be doing really well!" Instead, the banks are rolling over big time. Their earnings are probably (when all is said and done), they are going to be looking at a low single digit decline in Y-o-Y earnings."

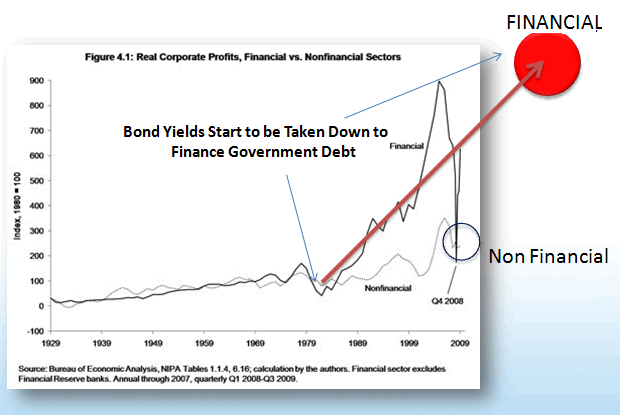

"Finance at this late stage of Capitalism is now the biggest part of the economy, so you can't have banks shrinking, reporting losses or lower numbers Y-o-Y, laying people off or pulling back on lending and at the same time have a growing economy! They are mutually exclusive when banks are such a large part of the economy."

The Financialization 'Gig" is Up!

Gordon T Long illustrates that through the growth of Financialization, 45% of the equity markets today are Financials. Their spectacular earnings growth is historic and unprecedented and now excessive debt lending, encumbered collateral and rapidly growing non-performing loans are signalling troubles are looming.

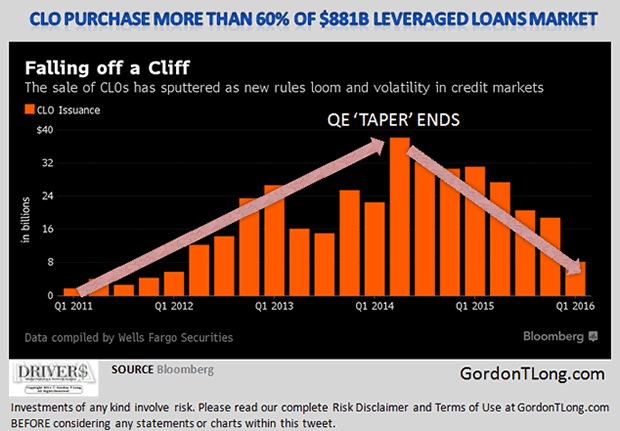

Of particular concern to Gord is problems in the Leveraged Loans area which is critical to sustaining the growth in Collateralized Loan Obligations (CLOs) which has been steradily weakening. The Shadow Banking industry and bank earnings are critically tied to CLO growth and their extremely profitable fees.

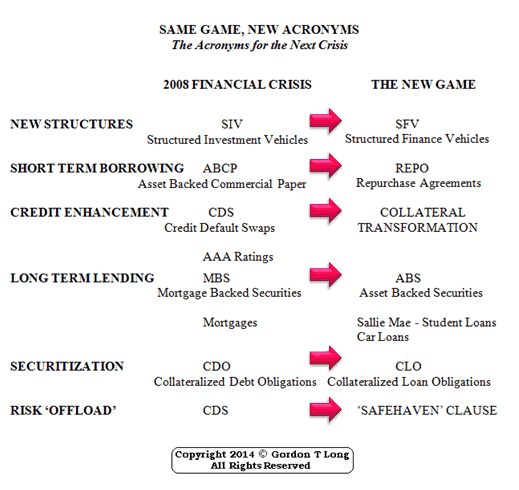

Gord points out that it was the collapse of CDO's that brought the banking industry to its knees in 2008. One the acronyms have changed and the loan problem. It isn't CDO mortgages today but rather CLOs and Student Debt, Auto Debt and Corporate Leverage Debt.

.... there is much, much more in this fascinating 32 minute video exchange..

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.