Donald Trump Will Fire Janet Yellen and Be Trapped

ElectionOracle / US Federal Reserve Bank Apr 27, 2016 - 02:19 PM GMTBy: Michael_Swanson

Donald Trump has made statements to the effect this week that if he were to become President he would fire Janet Yellen.

Donald Trump has made statements to the effect this week that if he were to become President he would fire Janet Yellen.

His statements are important because just yesterday he demolished his opponents in a series of primaries that increase his odds to get the Republican nomination. His chief opponent Ted Cruz posted a dismal failure and has been unable to convince people that he can be a viable national candidate against the Democrats.

The Donald met with a group of editors at Fortune magazine and told them that he “would be more inclined to put other people in” to lead the Federal Reserve.

He also said that he supports Congressional moves to audit the Federal Reserve and have more oversight over it.

However, he also said that he is very happy with the low interest rate policies that the Federal Reserve has enacted.“The best thing we have going for us is that interest rates are so low,” said Trump, “there are lots of good things that could be done that aren’t being done, amazingly.”

The tough thing about low interest rates though is that it has made it impossible for people to make any money from their savings in CD’s or in their bank accounts.

It has simply made buying debt instruments such as Treasury bonds that yield nothing crazy.

And it has caused many people to risk all of their money on stock market speculations or simply sit there in fear doing nothing with their money.

The problem now is that low rates pushed so much money into the stock market over the years that it became so highly valued by 2014 that it simply is no longer going anywhere.

In fact Donald Trump sold out of many of his stock investments in 2014 and 2015 thinking that the market had become a “giant fat bubble.”

He in fact warned that this was creating a dangerous situation for the economy back on this August, 2015 interview on Bloomberg:

Trump told Fortune magazine this month that “the problem with low interest rates is that it’s unfair that people who’ve saved every penny, paid off mortgages, and everything they were supposed to do and they were going to retire with their beautiful nest egg and now they’re getting one-eighth of 1%. I think that’s unfair to those people.”

Zero rates have caused distortions in the financial markets and are now causing problems inside the stock market.

This is why the current rally in the stock market has been unable to go through last year’s highs and has stalled out. And now we are seeing high profile earnings blow ups from companies such as Apple, Twitter, IBM, and Google that shows that the highs are not justified.

Janet Yellen bears a huge responsibility for this, because she has created an overinflated stock market by trying to control things too much.

But even if Trump does become President and fires her he will not really abandon her policies, because he would be trapped by them.

The United States is simply so far in debt now that any rate increases would wreck the economy.

Trump told Fortune magazine that “people think the Fed should be raising interest rates. If rates are 3% or 4% or whatever, you start adding that kind of number to an already reasonably crippled economy in terms of what we produce, that number is a very scary number.”

So Trump knows he cannot do much to change Federal Reserve policy and won’t really be able to change things.

The problem is that most stock market investors are also stuck in this situation and so are no longer making any real money in their investment accounts.

The thing is there are things changing in the financial markets now that does enable people to benefit who recognize what is happening.

The number one thing that is happening so far this year is a new bull market in gold and gold mining stocks.

People need to become players in the gold market now not only to protect themselves from a future debt mess by diversifying their portfolio properly, but to simply benefit in what is now the sector that is simply going to continue to go up faster than any other sector of the stock market.

They say a new bull market starts somewhere and this year it is in gold and mining stocks.

I am now investing in new mining stocks almost every single week and doing everything I can to help people learn how to get involved in this sector.

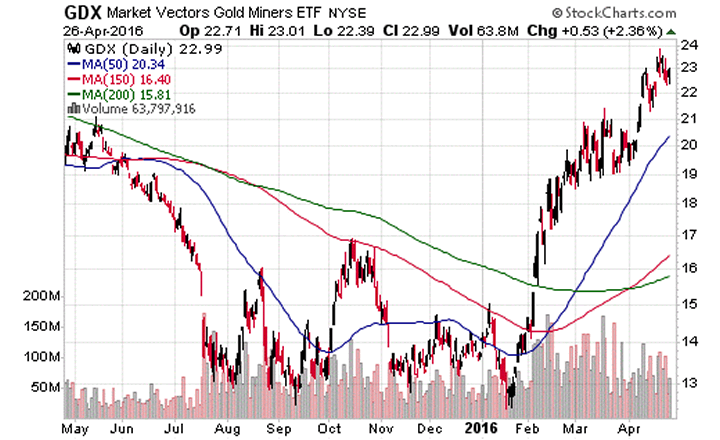

Take a look at the GDX gold stock ETF, because the gains in it have been huge so far and are only just starting.

It broke through its 200-day moving average and completed its transition from a stage one base and into a full blown stage two bull market.

The reason why gold and mining stocks are doing this is because people are slowly realizing that the Federal Reserve has trapped the nation with low interest rates and is not going to be able to raise them, because corporate and government debt has skyrocketed.

In December the Fed raised rates once and predicted that they would raise rates four times in 2016.

Then after the stock market dipped in January and February they took those predictions back and now they are saying they hope they will be able to do it twice by the end of the year.

But if the market dips again they’ll even stop talking about those potential rate hikes.

So we are going to see more money printing going forward and that means a weaker US dollar and more rising gold prices.

And more rising gold prices means more explosive moves are coming in mining stocks.

It's as a simple as that.

For more from Michael Swanson go to his website www.wallstreetwindow.com.

© 2016 Copyright Michael Swanson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.