Stocks Bounce as Fannie and Freddie Looking for Fresh Capital

Stock-Markets / Financial Markets Jul 18, 2008 - 05:01 PM GMT July 18 ( Bloomberg ) -- Freddie Mac , the second-largest U.S. mortgage-finance provider, is close to removing an obstacle that limited its ability to sell common stock and to increase its holdings of mortgages and securities backed by home loans.

July 18 ( Bloomberg ) -- Freddie Mac , the second-largest U.S. mortgage-finance provider, is close to removing an obstacle that limited its ability to sell common stock and to increase its holdings of mortgages and securities backed by home loans.

The company is likely to get clearance today to register with the U.S. Securities and Exchange Commission, according to people with knowledge of the plans, who declined to be identified because the decision is confidential.

Freddie Mac may raise as much as $10 billion selling new shares to investors, avoiding an immediate government rescue and stricter oversight that would come with a bailout, the Wall Street Journal reported today, citing people it didn't identify.

Will it be enough?

Lawmakers want nothing to do with a bailout, since estimated losses in Fannie and Freddie may exceed $1 trillion. The federal debt ceiling was set at $9.85 trillion last spring and as of April, it had already exceeded $9.5 trillion. Taking on Fannie and Freddie will undoubtedly force the debt ceiling higher and that won't fly in an election year. The last time congress raised the debt ceiling, we found the only news release about it in the China People's Daily. Do you think someone doesn't want us to know about it?

Now lawmakers want to tie any aid to Fannie and Freddie to the public debt limit. This is in direct opposition to the wishes of Secretary of the Treasury Henry Paulsen's wish to have unlimited powers to lend money to or buy stock from Fannie and Freddie. House Financial Services Committee Chairman Barney Frank told reporters that t he constraint is a cap in effect on the amount of taxpayer funds officials can use to help finance the mortgage firms. Frank's comments reflect lawmakers' concern that the Paulson proposal may expose the taxpayer to unlimited risk and confer unprecedented authority .

A quick rally up. Will the trend resume?

The markets finally found a bottom on Tuesday and rallied strongly for two days. Already the rally appears to have spent itself out as earnings disappointments at Citigroup, Merrill Lynch and Microsoft overshadowed the positive report from Big Blue (IBM). The problem is, this is the month for quarterly earnings reports. With high fuel and basic material costs, don't count on too many more reports as positive as IBM's.

Will money fleeing stocks go back to bonds?

Sovereign wealth funds and foreign central banks have increasingly bought mortgage-agency debt in its many forms for their reserves over the past year because the debt is considered a relatively safe investment but pays higher yields than U.S. Treasuries.

Sovereign wealth funds and foreign central banks have increasingly bought mortgage-agency debt in its many forms for their reserves over the past year because the debt is considered a relatively safe investment but pays higher yields than U.S. Treasuries.

In the Fed's custody data, agency debt includes securities sold by the Federal Home Loan Banks and Fannie Mae and Freddie Mac, two government-run home loan guarantors.

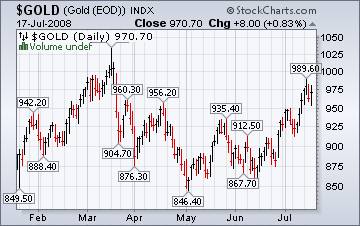

What might make the price of gold go down?

The price of gold has been tied to the anxiety levels of the market, so it makes sense that gold would decline this week as the market rallied. The press only has it partially correct, because the reality is that there has been a lot of liquidity sloshing around in the market.

The price of gold has been tied to the anxiety levels of the market, so it makes sense that gold would decline this week as the market rallied. The press only has it partially correct, because the reality is that there has been a lot of liquidity sloshing around in the market.

The interesting thing to observe is when money flows out of both asset classes. Then what? To some, this may be a classic case of a liquidity squeeze. Where formerly there was too much money chasing too few assets, we may be entering a period of less money chasing all assets.

The Nikkei is not in a mood to rally.

Today's loss in the Nikkei Index caps seven consecutive weeks of declines, the longest stretch of its kind in seven years. The problem is, the little hook you see at the bottom of the chart is all that we have to show for this week's rally. The Nikkei recorded a 1.8 percent drop in the last five days, while the Topix fell 2.6 percent. Both gauges have declined for the past six weeks, which is the longest stretch of losses for the Topix since September 2001.

Today's loss in the Nikkei Index caps seven consecutive weeks of declines, the longest stretch of its kind in seven years. The problem is, the little hook you see at the bottom of the chart is all that we have to show for this week's rally. The Nikkei recorded a 1.8 percent drop in the last five days, while the Topix fell 2.6 percent. Both gauges have declined for the past six weeks, which is the longest stretch of losses for the Topix since September 2001.

When smog gets in your eyes…

Beijing Olympic organizers said pollution and algae won't be a concern at next month's Summer Games, unless ``extreme'' weather conditions strike. The city's $17 billion program to clear smog, together with measures to curb car and factory emissions from this weekend, will make the air safe for athletes, Du Shaozhong, deputy director of Beijing 's environmental bureau, told reporters.

Beijing Olympic organizers said pollution and algae won't be a concern at next month's Summer Games, unless ``extreme'' weather conditions strike. The city's $17 billion program to clear smog, together with measures to curb car and factory emissions from this weekend, will make the air safe for athletes, Du Shaozhong, deputy director of Beijing 's environmental bureau, told reporters.

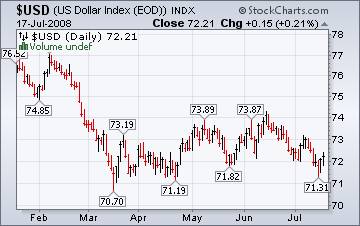

The dollar is struggling with support.

The U.S. dollar hasn't dropped as much as the dire predictions have foretold. On the other hand, it hasn't rallied, either. It appears that the dollar is on hold, waiting for something to happen.

The U.S. dollar hasn't dropped as much as the dire predictions have foretold. On the other hand, it hasn't rallied, either. It appears that the dollar is on hold, waiting for something to happen.

The few dollar bulls that are left would call this “building a base.” The bears…well, they're sticking to their guns that the dollar will collapse. The pattern since March is positive and the cycles call for a rise in the dollar. What we need now is follow-through.

Bailout plan eases tensions in housing market, but opposition grows.

WASHINGTON — The Bush administration's plan to rescue the nation's two largest mortgage finance companies ran into sharp criticism in Congress on Tuesday as some lawmakers questioned the open-ended request for money that could be used to help the companies.

WASHINGTON — The Bush administration's plan to rescue the nation's two largest mortgage finance companies ran into sharp criticism in Congress on Tuesday as some lawmakers questioned the open-ended request for money that could be used to help the companies.

The bailout plan was hastily prepared and ill-conceived, according to some. Many Republicans are raising their voices against it to distance themselves from the President, who is urging Congress to adopt the plan in its entirety. Even Democrats are beginning to wonder what they might be getting into. But will they hold firm or collapse when the going gets tough?

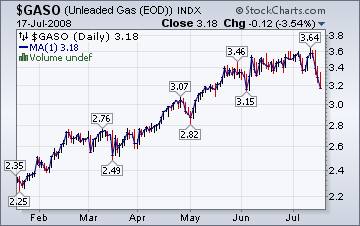

The tide has turned for gasoline prices.

U.S. retail gasoline demand plummeted more than 5 percent last week compared to the same week last year as high gasoline prices kept drivers off the road, MasterCard Advisors said Tuesday.

U.S. retail gasoline demand plummeted more than 5 percent last week compared to the same week last year as high gasoline prices kept drivers off the road, MasterCard Advisors said Tuesday.

Summer is the peak driving season in the United States , the world's largest energy consumer, but gasoline demand has slumped this year as gasoline prices have jumped over $4 per gallon.

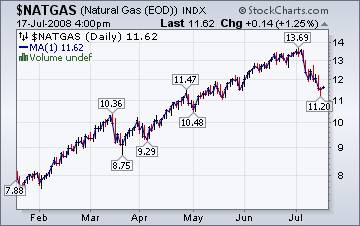

Natural gas ready to roll over?

The Energy Information Agency's Natural Gas Weekly Update states that, “ The report week ended July 16 registered significant price declines at virtually all market locations in the Lower 48 States, with the largest decreases occurring in the Arizona/Nevada, California , and Louisiana trading regions. On the week, the Henry Hub spot price decreased 94 cents per million British thermal units (MMBtu) to $11.15 as of yesterday.”

The Energy Information Agency's Natural Gas Weekly Update states that, “ The report week ended July 16 registered significant price declines at virtually all market locations in the Lower 48 States, with the largest decreases occurring in the Arizona/Nevada, California , and Louisiana trading regions. On the week, the Henry Hub spot price decreased 94 cents per million British thermal units (MMBtu) to $11.15 as of yesterday.”

Comments on Fannie and Freddie's bailout proposal.

There is no end to the comments about the proposed bailout. I thought I would share some of the articles that I have reviewed. All of them have insights that will help us to be more informed.

First, we have our friend, Mish in his article entitled, “Contact Your Senator: Say No To Fannie Bailout. ”

Another interesting view is from Michael Rozeff at LewRockwell.com saying, “Terminate Fannie Mae and Freddie Mac.”

Or David Ignatius at the Washington Post, with his column entitled, “Bailing Hard and Getting Soaked.”

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.