Gold : Just the Facts Ma’am

Commodities / Gold and Silver 2016 May 25, 2016 - 11:30 AM GMTBy: Dan_Norcini

It wasn’t much, a bit less than 4 tons to be exact, but today marked the first day in nearly a month that GLD reported a drawdown in gold holdings.

It wasn’t much, a bit less than 4 tons to be exact, but today marked the first day in nearly a month that GLD reported a drawdown in gold holdings.

The last such occurrence was all the way back on April 25.

Considering the amount of gold that has been added since that time (66 tons), a 4 ton reduction is minor. What we will not want to see however is a PATTERN of falling reported gold holdings. That has been the one bright spot for gold that has held steady even in the face of weakness on the gold chart at the Comex. If this changes, then we have an issue.

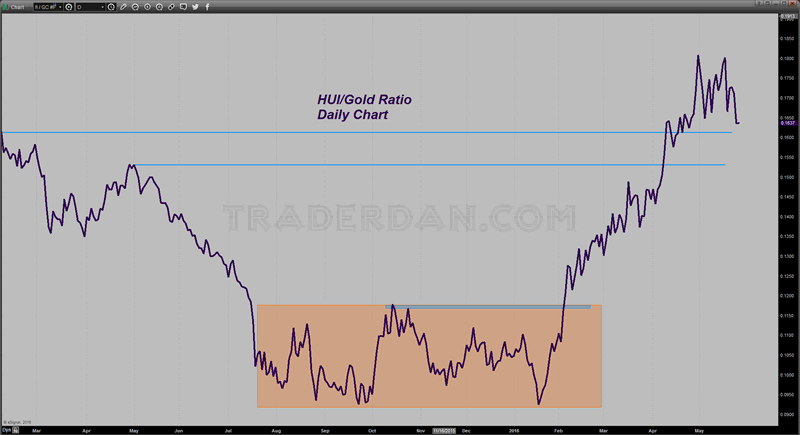

Also, the mining shares were whacked so hard today that the HUI/Gold ratio took a pretty big hit. We will want to see how this fares as well.

Let’s recap what we have so far:

1.) gold chart for Comex gold is bearish based on the indicators and the fact that it is trading well below its 50 day moving average

2.) The HUI to Gold ratio has fallen the last two days in a row.

3.) the HUI is sitting right on top of its 50 day moving average with its technical indicators in a sell mode

4.) GLD has just reported its first drop in gold holdings in a month.

These are objective facts that need to be considered by anyone trading the metal. Obviously, both gold and the mining shares have had a stellar run since January. That has come to an end for the time being. Whether this is just a correction in a larger trending move higher is unclear.

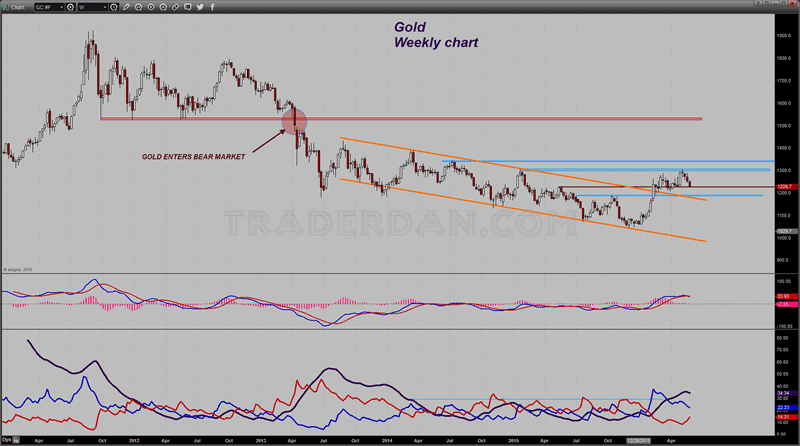

Look at the weekly chart and you will see why I am saying this.

Even after its sharp fall the past three weeks, it still remains above $1200 and above the former downtrending price channel that contained it for nearly three years. That is a positive.

The flip side is that the weekly ADX, which had been steadily rising since earlier this year, has now turned lower indicating that this is now a pause in the uptrend. The DMI lines still show the bulls in charge with +DMI remaining above -DMI. The two lines are moving towards each other which can now be expected since the ADX has turned lower.

We will get a better sense of the intermediate term prospects based on what those two DMI lines do should they come close to each other. If the +DMI reverses higher and the -DMI reverses and moves lower, then the uptrend stands a good chance of renewing. If not, well, that is another story.

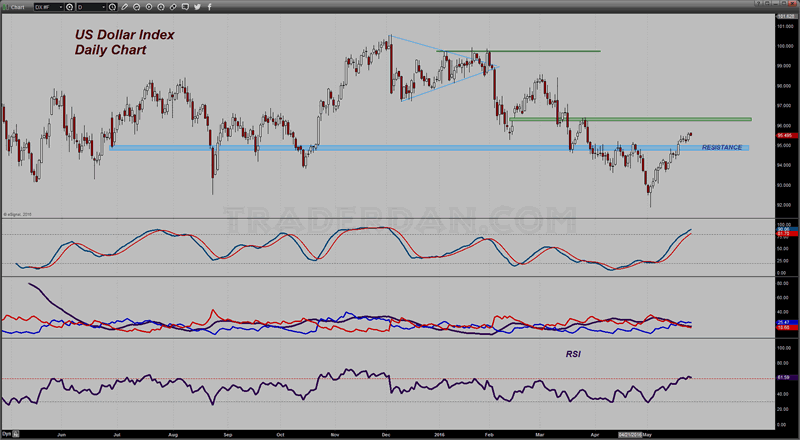

I would say much depends on what the Forex markets do with the US Dollar. If the market becomes convinced that the Fed is indeed going to hike, that will support the Dollar and it should pressure gold. However, it is not just whether or not the Fed hikes; it is the tone they adopt and whether or not the market believes that the Fed has indeed made the transition into an interest rate raising posture moving forward.

Keep in mind that the Fed hiked rates for the first time in almost 7 years back in December. But look at what happened to the gold price. The reason?

Market players were convinced that it was a “ONE AND DONE” move for a while. In other words, the interest rate hike was over and done with and that was that. No one expected a sudden barrage of interest rate hikes in succession because the Fed said it was going to be data dependent. While they did state that they would like to get 4 hikes done in 2016, hardly anyone believed that was going to happen because the economic data was not strong enough. Even the Fed said as much!

Additionally, there were cross currents from overseas in the form of Emerging Market concerns, China woes, ECB woes and Japan woes, just to mention some! In that environment many believed that the Fed could not run the risk of sounding too hawkish because of where the US Dollar was trading. A strong Dollar, one up above the 100 level basis the USDX was causing problems.

Anyway, the big question the market is going to be asking is can the Fed indeed hike rates at a pace that would send the Dollar higher with all the negative side effects from that or will any potential rate hike be it for a while once again? If the answer to that question becomes one in which the market believes a slow but steady tightening cycle has arrived, then it is difficult for me to see gold moving higher mainly because of the impact of a stronger Dollar and higher rates. If the answer to that question is the latter, then gold should recover as it did in December of last year when the Dollar actually began to weaken after that December rate hike.

The big thing to remember through all of this is something I have been saying over and over again” DO NOT GET MARRIED TO ANY VIEW OR POSITION”. Stay objective and keep your emotions out of things. Gold is an investment. it is an asset class that sometimes is in favor and sometimes it is not. Trading/investing is about making wise decisions to attempt to increase your wealth. It is not about joining in some sort of movement. Leave that for those who are more interested in “being right about things” ( in their own minds) rather than being successful. Do not forget this.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.