Commercial Bankruptcies Soar as BLS Jobs Data Shown as Worthless

Economics / US Economy Jul 20, 2008 - 04:50 PM GMTBy: Mike_Shedlock

The McClatchy Washington Bureau is reporting Commercial bankruptcies soar, reflecting widening economic woes .

The McClatchy Washington Bureau is reporting Commercial bankruptcies soar, reflecting widening economic woes .

Commercial filings for the first half of 2008 are up 45 percent from last year, as the national climate for commerce continues to deteriorate amid rising energy and food costs, mounting job losses, tighter credit and a reticence among consumers to part with discretionary income.

From April through June, 15,471 U.S. businesses called it quits, according to data from Automated Access to Court Electronic Records, an Oklahoma City bankruptcy management and data company.

It was the 10th straight quarter that business bankruptcy filings have increased. Nearly 29,000 companies filed in the first half of 2008. Another 60,000 to 90,000 others probably have closed, because roughly two to three businesses fold for every one that files for bankruptcy, said Jack Williams, resident scholar at the American Bankruptcy Institute.

More than 20 percent of the newly shuttered businesses were in California, which logged 3,141 bankruptcies in the second quarter.

Texas fielded the next highest number of bankruptcies with 1,168, followed by Michigan with 702 and Florida with 635. New York was next, with 618 petitions, and Colorado had 547.

Commercial bankruptcy filings reported by Automated Access to Court Electronic Records are typically higher than official government figures due to a more thorough reading of the petitions.

BLS BS

With the above in mind, let's take another look at my July 3rd post: Jobs Decline 6th Consecutive Months .

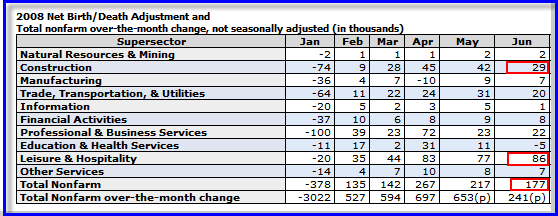

Birth/Death Model From Alternate Universe

This was a very weak jobs report. And once again the Birth/Death Model assumptions are from outer space.

Every month I say the same nearly the same thing. The only difference is the numbers change slightly. Here it is again: The BLS should be embarrassed to report this data. Its model suggests that there was 29,000 jobs coming from new construction businesses, 22,000 jobs coming from professional services, and a whopping 177,000 jobs in total coming from net new business creation. The economy has slowed to a standstill and the BLS model still has the economy expanding quite rapidly.

Repeating what I have been saying for months now, virtually no one can possibly believe this data. The data is so bad, I doubt those at the BLS even believe it.

....

This report was the 6th consecutive contraction. Service jobs were only positive because 29,000 government jobs were created. Yesterday in Downward Spiral In Jobs I commented on interesting stats from the ADP Small Business Report giving a breakdown of jobs by size of firm. Inquiring minds will want to take a look.

American Bankruptcy Institute

It was the 10th straight quarter that business bankruptcy filings have increased. Nearly 29,000 companies filed in the first half of 2008. Another 60,000 to 90,000 others probably have closed, because roughly two to three businesses fold for every one that files for bankruptcy, said Jack Williams, resident scholar at the American Bankruptcy Institute.

BLS

The BLS reported net expansion of new businesses in all but 3 of the past 15 months. January and July are months in which they partially correct for the ridiculous assumptions made in the other months.

I expect a huge downward revision in the July data which will be published on August 1.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.