Federal Reserve Quantifornication Revisited

Interest-Rates / US Federal Reserve Bank Jul 04, 2016 - 05:10 PM GMTBy: Richard_Mills

Californication is a brilliant 1999 song by the Red Hot Chili Peppers. Many of the lyrics reference the often insane, unrealistic, impossible dream images Hollywood sells to the world.

Californication is a brilliant 1999 song by the Red Hot Chili Peppers. Many of the lyrics reference the often insane, unrealistic, impossible dream images Hollywood sells to the world.

"Space may be the final frontier but it's made in a Hollywood basement."

Quantifornication is the term I coined for what the Federal Reserve is selling to the world - the unrealistic, insane fiat dream that the monetary policy employed by the Fed can fix the predicament we are in.

In the movie the Matrix, Neo is given a choice by Morpheus, if he takes the blue pill he will return to sleep unaware of the truth, if he takes the red pill he will wake from the dream and become aware of the illusion, created by the AI entity, and fed to the humans in their pod dream world.

The Blue Pill

The Red Pill

The civilian labor force participation rate is the number of employed and unemployed but looking for a job as a percentage of the population aged 16 years and over.

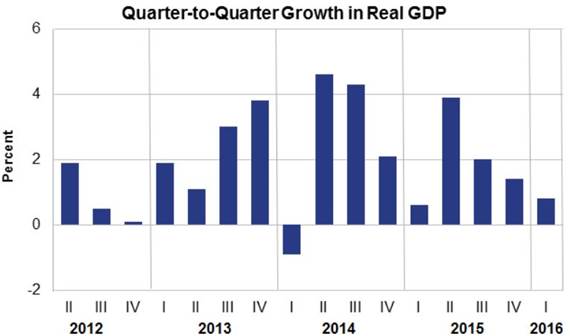

Real gross domestic product -- the value of the goods and services produced by the nation's economy less the value of the goods and services used up in production, adjusted for price changes

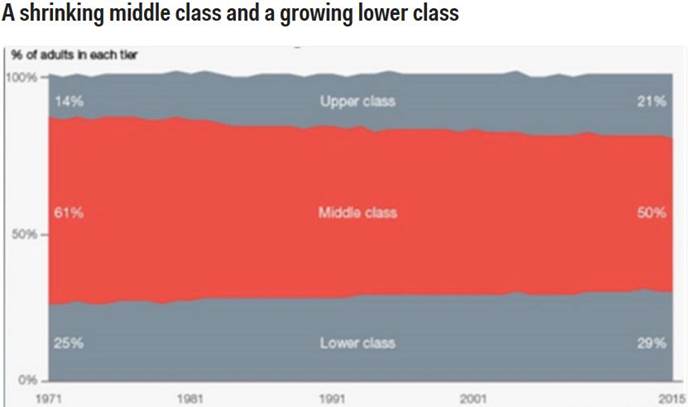

The middle class has shrunk to just under half the US population for the first time in decades, with more of the population shifting to the extremes both above and below the middle.

Allianz’s Global Wealth Report 2015 dubs the U.S. the ‘Unequal States of America’ because the U.S.’s wealth inequality is even more gaping its income inequality.

Allianz calculated each country’s wealth Gini coefficient — a measure of inequality in which 0 is perfect equality and 100 would mean perfect inequality, or one person owning all the wealth. It found that the U.S. had the most wealth inequality, with a score of 80.56, showing the most concentration of overall wealth in the hands of the proportionately fewest people.

When the Organization for Economic Cooperation and Development (OECD) examined income inequality, it found that the U.S. has the fourth highest income Gini coefficient — 0.40 — after Turkey, Mexico, and Chile.

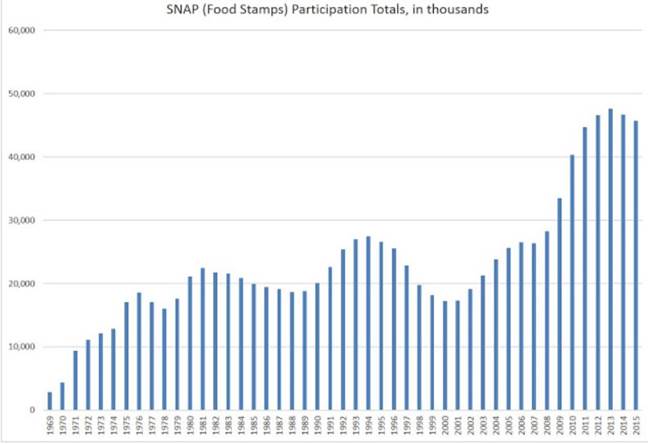

Supplemental Nutrition Assistance Program (SNAP). Food stamp use remains near record highs, up by 78 percent over the past ten years.

The U.S. Federal Reserve ended their quantifornication program in 2014.

The S&P has more than doubled since 2009, while the Dow Jones has actually tripled.

Stock buyback programs, fueled by CEOs borrowing hugely from the bond market, have supported the market since the Federal Reserve stopped pumping money into the system.

Here’s a must read on the current, and future state, of stock buybacks from Wolf Richter over on Wolf Street:

“Share buybacks have been a key part of the well-oiled Wall-Street machinery of financial engineering. They hide the dilutive effects of stock compensation programs and stock-based mergers and acquisitions. And they inflate earnings per share by lowering the number of shares outstanding…buyback announcements are suddenly plunging…But that plunge in buyback announcements hasn’t made its way to reality yet, and the waves of prior buyback announcements are still being implemented and are still propping up the S&P 500 at this point. But gradually, that plunge in announced buybacks is going to translate into plunging actual buybacks.” Share-Buyback Announcements Plunge, Stocks Risk Getting Clocked

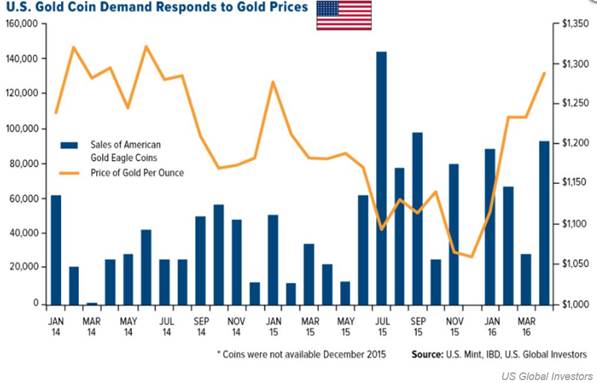

The Great Gold Rush

Think Central Banks, gold bullion buyers and precious metal ETF purchasers are onto something?

“Data from the World Gold Council showed that central banks scooped up a net 45 tonnes of gold during the first quarter. According to Capital Economics' commodities economist, Simona Gambarini, central-bank demand in the first quarter climbed 28% versus a year ago.

Of the buyers, Russia (+46 tonnes), China (+35 tonnes), and Kazakhstan (+7 tonnes) were the most active in the market, Capital Economics says. As for why the central banks are buying, here's the research firm:

The primary driver of central banks' gold buying continues to be diversification away from the US dollar with some also looking for a hedge against currency volatility more generally. Indeed, historically gold is negatively correlated with the US dollar, the main asset held by central banks across the world, making it an effective hedge against future dollar weakness. What's more, gold tends to have little or no correlation to other traditional or alternative reserve assets, like government bonds.”

Jonathan Garber, China Destroys the Dollar, Business Insider

Conclusion

Are you a blue pill person or a red pill type of person?

The rocky shores of awake reality are far different than our political masters, and the mainstream media, would have you believe.

What’s playing in your pod?

The ending of Fed quantifornication, the coming end to share buybacks, and perhaps owning some gold, should be on all our radar screens, are they on yours?

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2016 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.