Deutsche Bank or Dumb Bank?

Companies / Credit Crisis 2016 Jul 09, 2016 - 12:50 PM GMTBy: Chris_Vermeulen

Deutsche bank (DBK) shares dropped to fresh new lows with the various news announcements, as well as a feeling that Germany will not be capable of bailing out the bank. The imminent outcome for DBK is ‘bankruptcy’ while the world will have to bear the brunt of the fallout from all of the complicated ‘derivatives’ which are being held by Deutsche Bank.

Deutsche bank (DBK) shares dropped to fresh new lows with the various news announcements, as well as a feeling that Germany will not be capable of bailing out the bank. The imminent outcome for DBK is ‘bankruptcy’ while the world will have to bear the brunt of the fallout from all of the complicated ‘derivatives’ which are being held by Deutsche Bank.

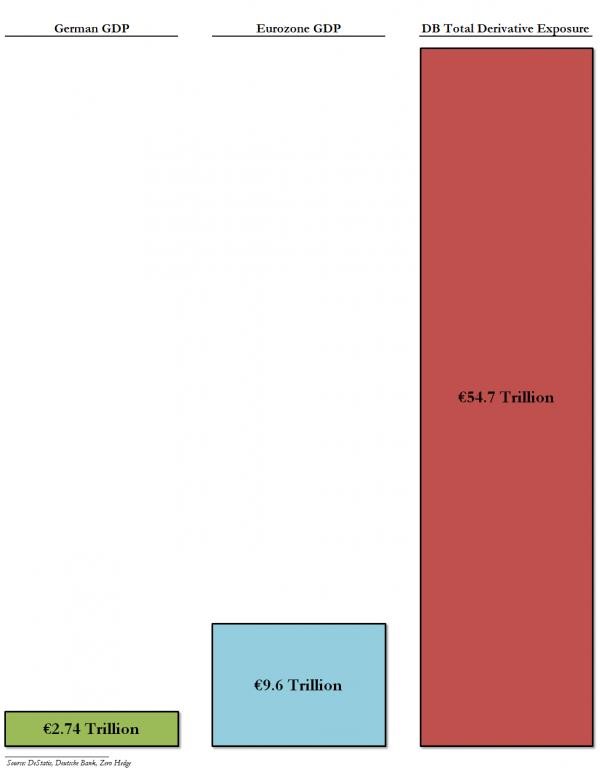

DBKs’ outstanding ‘derivatives’ exposure is 20x the German GDP and 5x the Eurozone GDP.

Amongst all of the chaos, DBKs’ head of currencies trading and emerging-markets debt trading, Ahmet Arinc, has left the company which is the most recent negative news to impact the banks’ financial status. Traders slammed the stock by more than 6% during that trading session, to touch intraday lows of $12.5 after which the stock recovered marginally to close at $12.97.

Germany will not be able to bail out DBK:

The latest bank which might require a bailout is the Italian lender Banca Monte dei Paschi di Siena which is the worlds’ oldest bank. The European Central Bank warned that the Italian bank is holding dangerously high levels of bad debt.

Italy wants a bailout for Monte Paschi, however, the Germans are opposing any such move. Wolfgang Schaeuble, the German Finance Minister, stated in a news conference, in Berlin, that Italy intends to stick to the banking-union rules, as was conveyed to him by his Italian Counterpart, Pier Carlo Padoan.

Italian Prime Minister hits back at Germany:

However, Italy did not wait before hitting back at Germany and it came from none other than the Italian Prime Minister, Matteo Renzi.

Mr. Renzi stated that “the difficulties facing Italian banks over their bad loans are miniscule by comparison with the problems some European banks face over their derivatives.” He reminded the Germans that there were other European banks which had much bigger problems than Monte Paschi, in an indirect hint towards DBK.

“If this non-performing loan problem is worth one, the question of ‘derivatives’ at other banks, at big banks, is worth one hundred. “This is the ratio: one to one hundred,” Renzi stated, reports Reuters.

More troubles ahead for DBK:

The bank is likely to lose its’ place in the STOXX 50 index, according to analysts at Societe Generale. The bank will face renewed selling pressure as the index funds will have to reposition themselves, post the change, which is more than likely to bring about a fresh round of selling. According to a statement by the IMF, DBK is now the most dangerous bank in the world. DBK is currently the riskiest bank which will bring down the entire financial banking system, globally.

Gold is the key asset to own:

The bond king, Jeff Gundlach, stated that “things are shaky and feeling dangerous”. Regarding the European banking crisis, the Double Line bond king noted: “Banks are dying and policymakers don’t know what to do. Watch Deutsche Bank shares go to single digits and people will start to panic… you’ll see someone say, ‘Someone is going to have to do something’.”

Gundlach stated that “gold remains the best investment amid fears of instability in the European Union and prolonged global stagnation, as well as concerns over the effectiveness of central bank policies,” reports Reuters.

Conclusion:

The belief by Wall Street that Germany will not allow DBK to fail is fading. Post the Brexit, tensions are running high among the remaining members, as seen in the spat between Germany and Italy. Due to the earlier hard stance of the Germans, it is likely that any move to bailout DBK will face considerable resistance from all of the member nations. If allowed to fail, DBK will cause a ‘crisis’ many times over that of which Lehman Brothers did. The final meltdown commences!

Americans need to pay attention to this European Financial Crisis because its’ very contagious and going to spread here.

Gold remains the asset to invest in, as I have been advising my subscribers for a long time now. DBK is failing and not even the ECB will be able to stop its’ plunge into oblivion!

Next week I will share with you another asset class rarely mentioned or invested in which could explode in value going forward and actually become a major asset/currency world wide – Stay Tuned!

Chris Vermeulen is full-time trader and research analyst for TheGoldAndOilGuy Newsletter.

Author does not currently have any position in Deutsche Bank at this time.

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.