What US Economic Recovery; 62% of Americans Don't Even Have $1000 in Savings

Economics / US Economy Jul 11, 2016 - 05:17 PM GMTBy: Sol_Palha

"He who is plenteously provided for from within, needs but little from without." ~ Johann Wolfgang Von Goethe

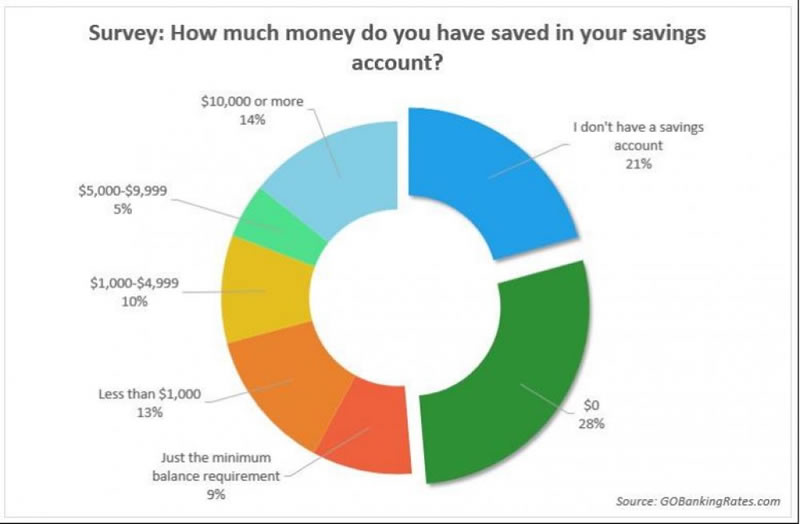

A key sign of financial health is savings; if one does not have a decent amount of money tucked away for a rainy day, it is a sign that all is not well. Americans have a very hard time sticking to a budget and saving, compared to their Asian counterparts. This is reflected in the startling revelation that over 62% of Americans do not even have $1000 in their savings account. Foreigners are shocked when they find out that Americans have so little money saved for a rainy day.

"It's worrisome that such a large percentage of Americans have so little set aside in a savings account," said Cameron Huddleston, a personal finance expert and columnist for GOBankingRates. "It suggests that they likely don't have cash reserves to cover an emergency and will have to rely on credit, friends, and family, or even their retirement accounts to cover unexpected expenses."

If 62% don't have $1000 or more what will they do if someone misfortune should strike? Hope that some Good Samaritan throws money on their laps. Many Americans are having a hard time but if one examines some of the things the typical American family purchases one will note that there are many items that would fall into the category of non-essential's.

Spending money you don't have on junk you don't need to impress people you don't even like is a perfect recipe for disaster. Americans have never learned to live within their means and with the economy in disarray they should be living one to two levels below their means. In general putting money into a savings account amounts to folly, as the current set up (due to ultra-low interest rates) favours speculators, but a small portion of those funds you save should put away as something to fall back. In that sense, not having $1000 to fall back on is a real tragedy.

The situation in China, on the other hand, is quite different; in one of our recent articles of which an excerpt is posted below, we illustrated how many of the Middle-Class Chinese have $50,000 or more in savings.

According to Credit Suisse109 million, Chinese have savings network that ranges from $50,000 to $500,000. The momentum gained traction in 2000; since that time, China's Middle Class has grown at twice the U.S rate. To avoid changes such as unemployment, Credit Suisse, measured wealth rather than income. Hence, these numbers are quite shocking; when you consider that the average worker in the U.S does not even have $5,000 in savings. Makes you wonder if we deserve the superpower designation.

China accounts for a fifth of the World Population but accounts for 10% of the Global Wealth. In the years to come the pace will continue to increase, eventually propelling China to the number one place. China has the World's second most Millionaires and is creating them at a faster rate than the U.S. Currently, China has more than one million millionaires. However, China now has the most billionaires In the World, and this means it's just a matter of time before they have the most millionaires too. ~ Full Story

Conclusion

This economic recovery as we have stated so many times over the past few years is illusory in nature; the main driving force behind this economic recovery is hot money. The Fed has decided to try something new; maintain ultra low-interest rates for an indefinite period and in doing so force corporations and individuals to speculate. Hence the record sums of cash deployed into share buybacks over the past six years. Eventually, the US will be forced to embrace the negative rate bandwagon, and this will foster even more speculation. Translation, the Fed is not going to raise rates; in fact, they are probably getting ready to lower them. Negative rates will create a new trend in speculation, probably the likes of which we have not seen for a very long time. All those individuals who have sat on the sideline cursing this bull market, will eventually be forced to embrace it as speculation will be the only avenue left to preserve one's wealth. Hence, every strong pullback has to be viewed through a bullish lens.

A simple strategy to employ would be to buy when the masses panic and sell when they are euphoric. In simple terms this means, strong corrections should be viewed as buying opportunities, until the trend changes.

"Nothing is enough for the man to whom enough is too little." ~ Epicurus

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.