Gold And Silver – Be Afraid, At The Very Least Be Wary

Commodities / Gold and Silver 2016 Jul 11, 2016 - 05:27 PM GMTBy: Michael_Noonan

BREXIT opened a Pandora's Box for the EU. Will the globalists shut it closed and then reseal it for generations to come? Something may be rotten in the state of Denmark, but the stench emitting from Brussels has been overpowering Europe. People in the Western world are being manipulated each and every day by the elite's mainstream press with everything that can be construed as potentially negative that stems from BREXIT as a scapegoat.

BREXIT opened a Pandora's Box for the EU. Will the globalists shut it closed and then reseal it for generations to come? Something may be rotten in the state of Denmark, but the stench emitting from Brussels has been overpowering Europe. People in the Western world are being manipulated each and every day by the elite's mainstream press with everything that can be construed as potentially negative that stems from BREXIT as a scapegoat.

The world is drowning in debt created by the central bankers and force-fed to states like a goose being fattened for foie gras. Always, always follow the money. Almost everything wrong in the world today can be traced to debt, debt that has been foisted upon states and people by bankers for the sole purpose of enriching only the shadow globalists. At the end of the day, the tab gets passed onto everyone else to pay. That is the sole purpose of the bail-outs and bail-ins. Nothing else, not even you, matters to the elites.

Where did all of the trillions and trillions of newly created "money" go? Back to repay the banks that loaned it out at interest. Greece is a perfect example. Where did most of the Greek bail-out money go? Not to the nation. Not to the state. Not to the people. Almost all of it went to repay the bank loans, and not from Greek banks, but from the elite's IMF.

Britain voted to exit via a popular vote from the people, for those running the government had been vehemently opposed to leaving the European Union. The more pertinent question is, will Britain ever leave? A much lesser important question most have been asking is, what will be the effects of BREXIT? The outcome will be determined by the elites using their ubiquitous Problem-Reaction-Solution formula. If Britain does not leave, take that as your cue that it is game over for people and the NWO has won.

BREXIT was not likely a globalist-created problem although it has become a problem for the globalists. However, they will exacerbate the problem by punishing the British, as in the Sterling Pound being pummeled to 35 year lows. You do not see any media articles extolling the virtues of BREXIT.

Most recently, EU ass-licker extraordinaire, Christine Legarde head of the IMF, said that BREXIT would have "disastrous consequences." For whom, Christine? Only for those dependent on that failing political union called the EU. Only for the bankers that are already in a deep state of unofficial bankruptcy, total insolvency, propped up by phony accounting that does not have to recognize insolvent assets carried on their books.

It is public heresy to go against the interests and dictates of the bankers by first and foremost letting Britain decide on all matters that pertain only to that nation and not being dictated to by an unelected political union with its only mandate being total subjugation by each nation to give up their sovereignty and obey the political union.

As president of the European Parliament, Martin Schultz, stated: "The British have violated the rules. It is not the EU philosophy that the crowd can decide its fate." In essence, people and voters do not matter.

Be afraid, everyone. That is the driving force behind the globalist's agenda. Let no man, no nation decide his or its own fate. In Europe, centuries of sovereign national history is being forcibly replaced by EU membership, dismantling existing borders. The globalists have unleashed a tidal wave of immigrants to permeate Europe with displaced Islamic refugees seeking safe havens in various countries with little to no interest in integrating themselves into a non-Islamic culture. Removing vestiges of borders and national identity and adding disinterested foreigners into the mix is a sure way of destroying national sovereignty and identity. National identity appears most at world soccer events. If only people wold be so fervent in their political identity, as well.

Be wary Americans. Where foreign Islamic refugees are flooding into Europe with an immediate destabilizing and polarizing effect on sovereign citizens, in the US, we have the ongoing militarization of local police forces acting against public safety and interests and even killing citizens with impunity. This is the globalist way of conditioning the population to be compliant out of fear for personal safety as the takeover of this country continues, while most citizens are unaware or unwilling to believe the corporate federal government would betray them. Federal actions are proving those citizens wrong. If only they would pay attention.

Like Europe, the fabric of American society is also disintegrating. The middle class has almost ceased to exist. The American dream, in many forms, is no longer attainable for most. Many seniors cannot afford to retire. Their reliance on savings has disappeared with banker-Federal Reserve-induced zero percent interest rates. Again, follow the money: debt is the most burdensome load for the majority of families.

The EU, as a political union, was designed after the corporate federal takeover of the organic united States [small "u" intended]. The difference is that the US was still in its formative years, so the gradual takeover by the Rothschild moneychangers went unnoticed by almost all citizens. By contrast, European countries have existed for hundreds of years, and the introduction of a federal-like union stands out to the sovereign citizens in the respective European countries. The big tell is how so-called elected heads of state are making themselves duty-bound to Brussels and not their own people. Angela Merkel of Germany is a prefect example of a head of state treason and betrayal to German citizens.

Awareness is the best defense against the imposing globalists and their quest for a One World Government, like the United Nations. The elite's bureaucrats are deeply entrenched in all layers of Western government. It is not so apparent yet, but China is a willing partner to the controlling globalists. It fully intends to cooperate with the IMF and BIS. Watch what that country does, not what it says.

The same may be true of Russia, but that country is a much harder read with Putin's rabid and, at the same time, laudable independence from controlling globalists. When push comes to shove, Russia is also likely to participate in the globalist strategy of world control. Putin just wants to make sure he is an [almost] equal player.

As always, the best defense against the global uncertainty are gold and silver holdings.

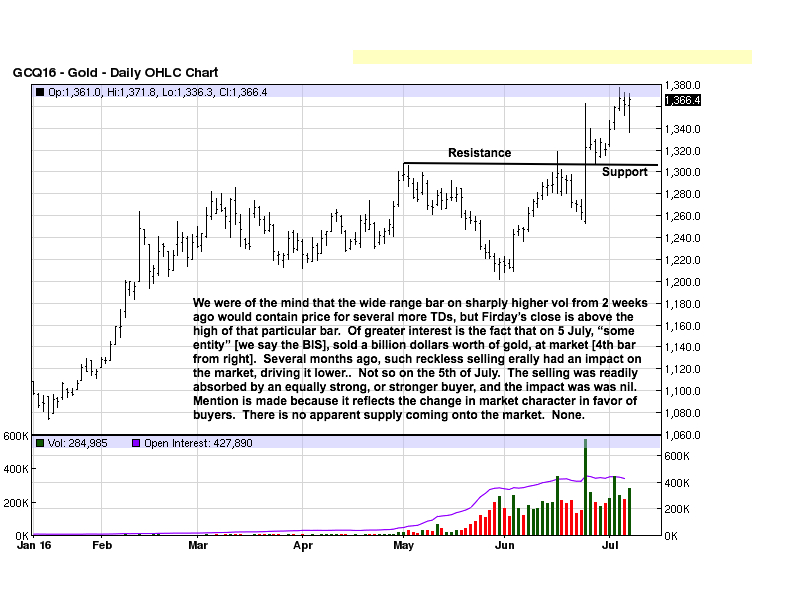

The charts are at an in-between phase. Price has been moving higher, and there is little else about which to comment until some clear reaction, or correction, enters the picture. For now, there is an absence of supply [strong selling volume that take price and keeps it lower during a reaction].

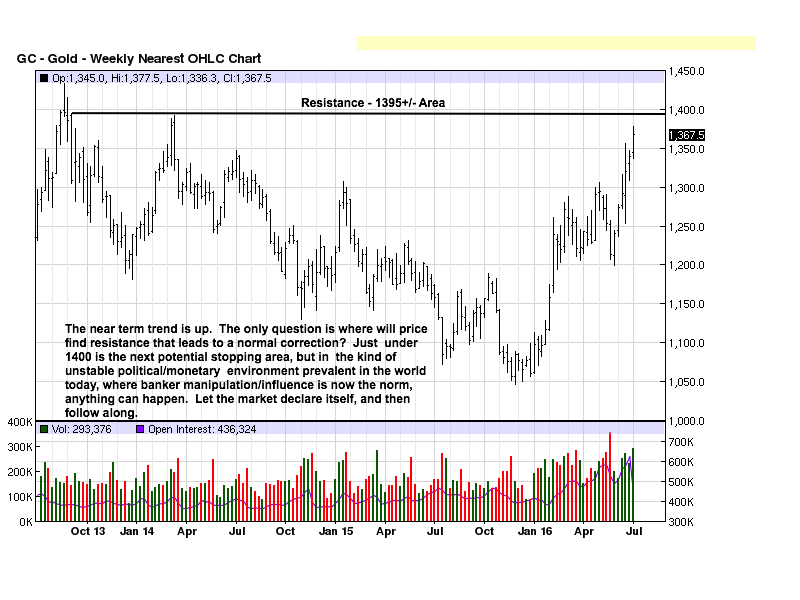

We have been looking at the 1395 area as a potential stopping point for the current rally that has been underway for the past few months. Last week was a smaller range, but the close was near the high so there is no evidence that sellers are overtaking buyers for at least a correction.

There has been no price rejection of the 1380 area. There was an early intra day spike lower on Friday, but the market recovered to negate the early selling effort. For now, gold appears to be poised to continue its current rally. That may change on Monday or later in the week or even a week later. The point is, until a correction begins, let the market prove it by price and volume activity.

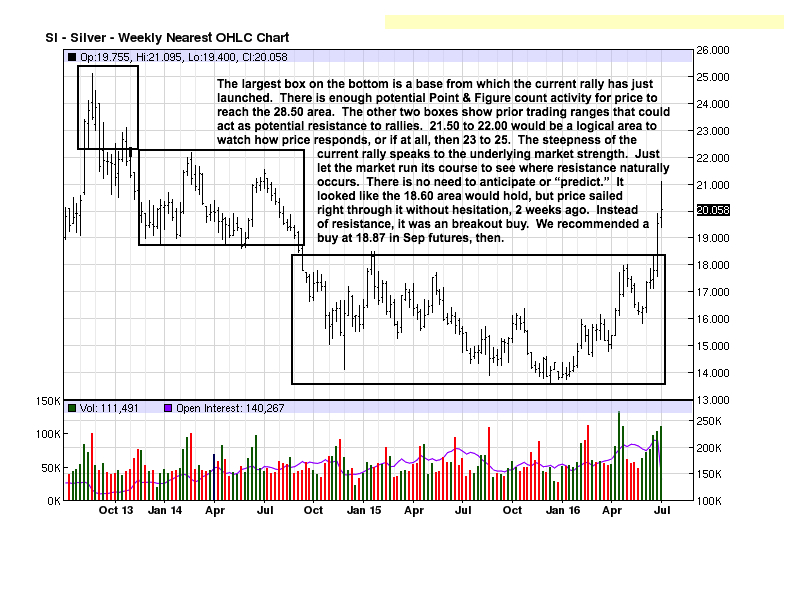

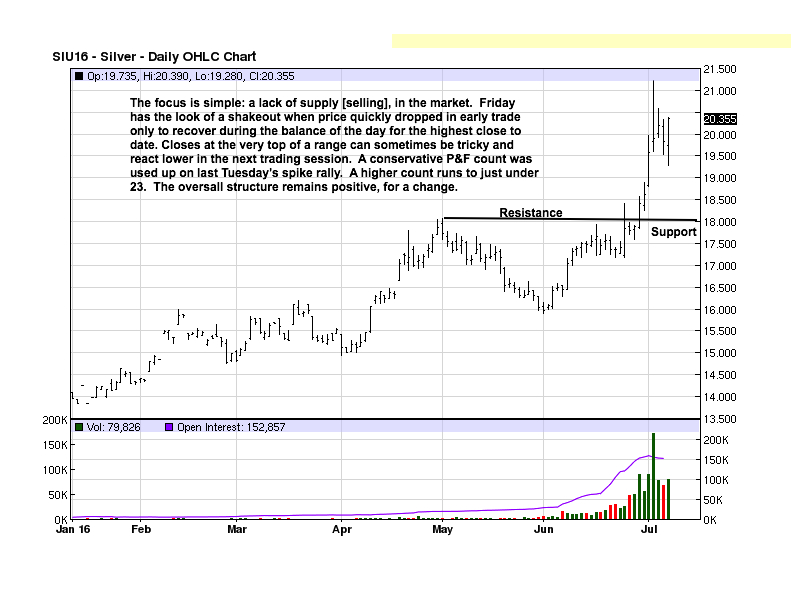

There has been a clear change in market behavior for silver, and it is to the upside as the rally from May to present shows on the chart.

There is really nothing about this chart that addresses a reason not to be long the paper futures. Friday's attempt to take price down failed very quickly evidenced by the just as fast recovery that extended for the balance of the trading session. Last Tuesday's spike high needs to be watched for potential resistance, but even Friday's intra day sell-off was a weak reaction overall, on the daily chart.

Anyone with the financial capacity to buy and personally hold physical gold and silver should continue adding to their holdings. Those who own the physical metal will begin to feel more secure with their commitments as the fiat currencies will continue to require more and more of the fiat to make purchases, and the fiats will also lose their [worthless] value with respect to each ounce of gold and silver.

The price of each metal is not going up. The measure of the number of fiats needed to buy the metals will grow ever more as each country's fiat issuance becomes increasingly debased. That is when the power of holding gold and silver will be felt the most.

Silver continues to gain relative to gold, as we have been saying, and expectations are for the gold:silver ratio to favor silver. Where it was 84:1 a few months back, last week the ratio reached 68:1 Expectations are for 40:1 to as low as 15:1 possible. When, and if that occurs, it will then be time to switch at least a portion of one's silver for gold. Playing the ratio at extremes is a great way to increase one's physical holdings without having to sell.

There are transaction costs, to be sure, but the net gain makes it worthwhile.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.