Could the US Bond Market Bubble Finally Be Ready to Burst?

Interest-Rates / Bond Bubble Jul 12, 2016 - 02:50 PM GMTBy: Harry_Dent

The great commodity bubble has been steadily bursting since mid-2008, but has taken a nosedive since early 2011. It's now down 70% overall, and 80%-plus in industrial commodities like iron ore.

The great commodity bubble has been steadily bursting since mid-2008, but has taken a nosedive since early 2011. It's now down 70% overall, and 80%-plus in industrial commodities like iron ore.

Real estate has seen its first bubble burst and it clearly looks like a second one is on the way.

Stocks have now seen a third bubble and the largest burst is still just ahead… but, the question remains: when does it begin in this endless realm of QE and stimulus?

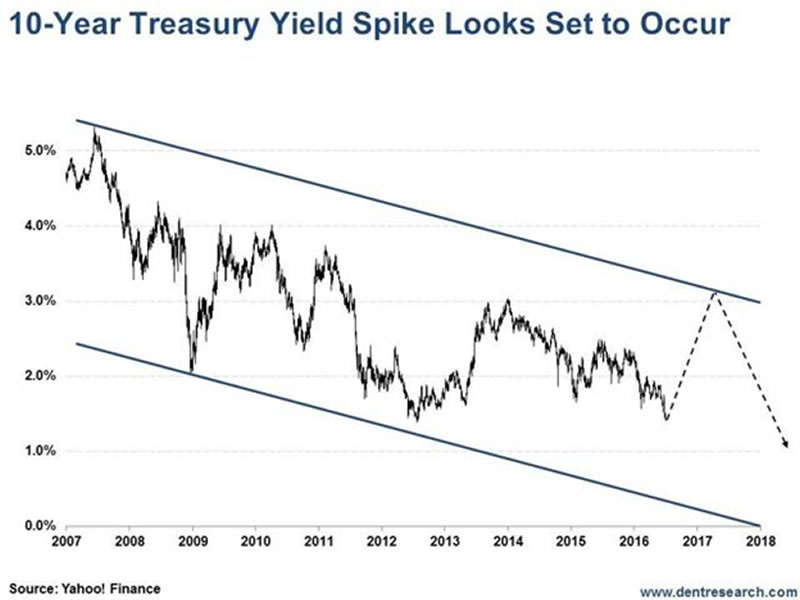

The bond and gold markets may give us some clues here. Look at the 10-year Treasury bond yield below:

The last major spike in yields peaked at 5.3% in mid-2007, just ahead of the great financial crisis.

That crisis brought yields down to 2% in late 2008 - both from recession fears and U.S. bonds becoming the safe-haven play along with the U.S. dollar - not gold!

But QE brought yields back up to just over 4% by early 2010 and they've been falling ever since. Gold is following right along with it, with inflation unexpectedly sinking, rather than rising, after unprecedented QE.

By mid-2012, the first fall in yields was down to 1.37%. We're now at levels even lower than that, with interest on the 10-year Treasury reaching 1.34% Wednesday morning.

This should be a strong endorsement, especially with Lance Gaitan'sTreasury Profits Accelerator predicting a snap-back, near-term move down in bonds (up in yields).

I think a major, or at least substantial, reversal in yields going back up could come soon - just as everyone now expects yields to keep going down towards zero.

And that's the problem.

The "dumb money," or large specs (mostly failing hedge fund managers that have become the trend followers instead of the trend leaders), are at near-record bullish levels long on futures while the commercials (insiders), or smart money, are at record short levels.

They're the ones that are right at major turning points like this. If the shorts are right, then yields will go up substantially… likely for many months.

Last November, in Boom & Bust's "The Fixed Income Trade of the Decade," I was forecasting that 10-year Treasury yields could spike back up to 3%, or higher, making that the time to buy, as deflation will likely bring them back down towards zero for years afterward.

You get higher yields and higher appreciation in the same investment that doubled in value in the 1930s while everything else was collapsing.

Let's hope that bond yields do go back up, as the smart money extreme short positions suggests. This could be a long-term bottom in yields but, more likely, the last low near-term before the ultimate lows hit years from now.

The large specs in gold futures are also at record bullish levels, while the commercials are at record short levels. That suggests we are also close to the peak of the bear market rally we have been predicting, with gold towards $1,400.

We hit $1,373 gold on Wednesday, and it is likely to make it to $1,400. If we don't make it to $1,400 by July 15, I will advise selling anyway. So, it's time to start selling gold and silver if you didn't already do so in April 2011 when we recommended it.

Here are the important insights:

If gold goes down it suggests slowing - not rising - inflation, as gold correlates more with inflation than anything else. Either that and/or we don't see another massive round of higher QE and stimulus, as is currently expected.

If Treasury bond yields rise, it would suggest higher inflation… or more likely in this case if gold is falling, there's an increased risk even for sovereign bonds.

How could that happen, you ask?

Once investors start to realize that Italy is the next Greece, and that it's too big to fail (or bail out), yields in Southern Europe may start spiking.

Germany and Northern Europe could then follow, as they will have to bail Italy out (or not), and that move could prompt investors to question all bonds, even U.S. Treasuries.

Or, put more simply, the long leveraged futures trade in sovereign bonds may finally reverse due to overconfidence and investment!

To summarize: if we see gold down and bond yields up, this will likely be bad for stocks and would suggest the first large crash in stock hits sometime between mid-July and December of this year.

A clear break below the line in the sand at 1,800 on the S&P would confirm this. In the July issue of The Leading Edge, I will look at all major markets around the world and show why there has already been a clear top in 2015, and why a crash looks increasingly imminent, whether U.S. large-cap stocks eke out a slight new high or not… and I think not.

If we do get a spike back to around 3% or a bit higher in 10-year Treasury yields in the next several months, it would bring about The Fixed Income Trade of the Decade in long-term Treasuries, and AAA corporate bonds, that did the best of any other sector in the Great Depression decade of the 1930s…

We will evaluate that if it happens, in case the global debt implosions get so extreme, so fast, that we end up seeing a longer-term bottom in Treasury yields here just below 1.4%.

But more importantly, the present configuration suggests a major crash in stocks very soon rather than later.

That's why it's time to get more conservative in stocks and hold out for the long Treasury and AAA bonds trade likely still ahead.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.