How Long Can Buybacks Continue To Support A Market Which Is Standing On A Fundamentally Flawed Premise?

Stock-Markets / Stock Markets 2016 Jul 16, 2016 - 06:32 AM GMTBy: Gordon_T_Long

FRA Co-Founder Gordon T.Long and Jeffrey Snider, Head of Global Investment Research at Alhambra Investment Partners discuss earnings, the Chinese Yuan, Japanese Yen and the falling credibility of central banks.

FRA Co-Founder Gordon T.Long and Jeffrey Snider, Head of Global Investment Research at Alhambra Investment Partners discuss earnings, the Chinese Yuan, Japanese Yen and the falling credibility of central banks.

As Head of Global Investment Research for Alhambra Investment Partners, Jeff spearheads the investment research efforts while providing close contact to Alhambra’s client base. Jeff joined Atlantic Capital Management, Inc., in Buffalo, NY, as an intern while completing studies at Canisius College. After graduating in 1996 with a Bachelor’s degree in Finance, Jeff took over the operations of that firm while adding to the portfolio management and stock research process.

In 2000, Jeff moved to West Palm Beach to join Tom Nolan with Atlantic Capital Management of Florida, Inc. During the early part of the 2000′s he began to develop the research capability that ACM is known for. As part of the portfolio management team, Jeff was an integral part in growing ACM and building the comprehensive research/management services, and then turning that investment research into outstanding investment performance. As part of that research effort, Jeff authored and published numerous in-depth investment reports that ran contrary to established opinion. In the nearly year and a half run-up to the panic in 2008, Jeff analyzed and reported on the deteriorating state of the economy and markets. In early 2009, while conventional wisdom focused on near-perpetual gloom, his next series of reports provided insight into the formative ending process of the economic contraction and a comprehensive review of factors that were leading to the market’s resurrection. In 2012, after the merger between ACM and Alhambra Investment Partners, Jeff came on board Alhambra as Head of Global Investment Research.

EARNINGS

“It is no doubt that earnings have been under-performing.”

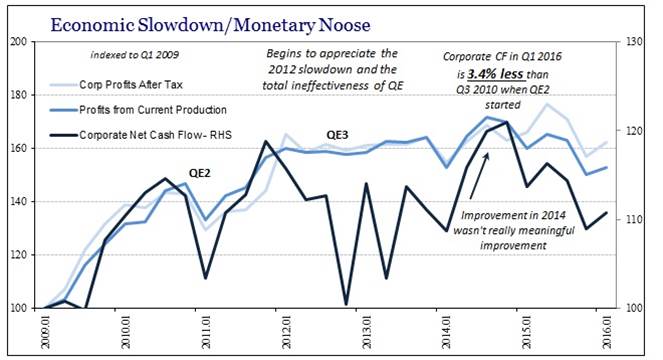

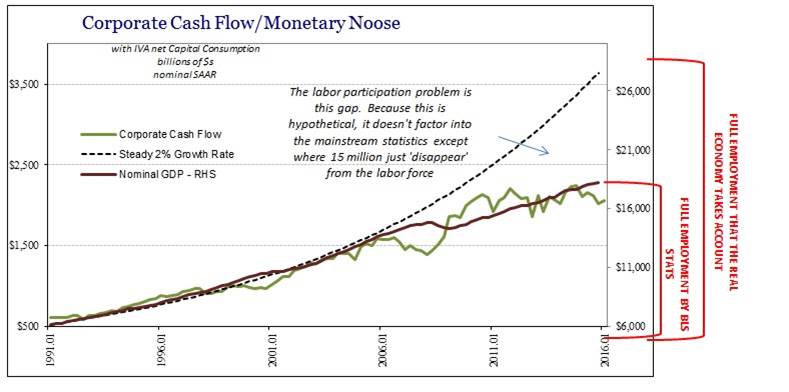

What’s even more concerning is that not even is the top line falling off, but the cash flow is falling dramatically and this impacts credit along with everything else. With no earnings and no cash flow it puts us in a high risk environment. The only thing that has been holding up the market has been excessive corporate buybacks which has come out of cash flow, and to a lesser degree, borrowing. But to borrow is tough when you don’t have the cash flow to justify the credit ratings.

“How long can buybacks continue to support a market which is standing on a fundamentally flawed premise?”

We have had 4 to 5 quarters of falling revenue but the US market seems to ignore it. At some point reality has got to set in. But it is also important to note that trade problems are a systemic factor to the decline in earnings. China’s imports are down 17% year over year, but these imports are coming from basically the emerging markets and commodity markets. They have also borrowed upwards of 9 trillion USD in the last 7 years that has suddenly gotten very expensive for them, I think there is more pain to come.

CHINESE YUAN

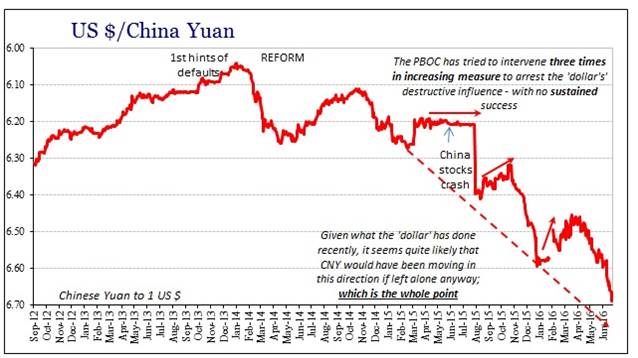

“The health of the Yuan is tied into the global economy and the fact that the global economy is stumbling.”

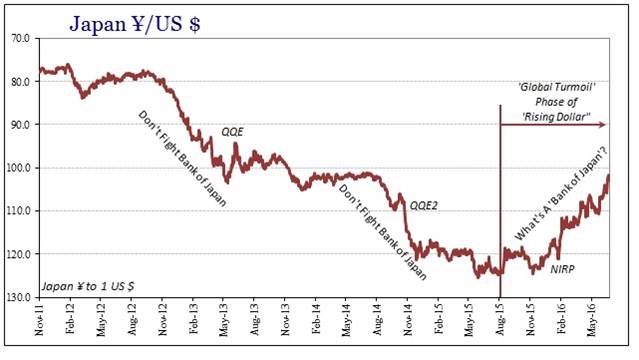

Less growth in China combined with less growth around the world again increases financial risk which fuels more reluctance to funnel dollars into China; it has become a vicious cycle. The Chinese have no choice but to continue going in one direction, they are in a rock in a hard place. As the Chinese Yuan has been falling, the Yen has been rising in strength. This has become a huge issue for Japan to add to their already lost list of issues to deal with. A fracture is likely around the corner, China and Japan cannot go long without devaluing the Yen.

The markets are reassessing what central banks can actually do. And what markets found was that central banks aren’t actually as powerful as everyone believes them to be and Japan is a perfect example of that. No matter what the BOJ does that Yen continues to move on up. It fits into the paradigm of the economy, the financial risk, everyone reevaluating what central banks are capable of etc. The markets are reevaluating central banks because they see that a tight money environment despite efforts from central banks to fuel stimulation.

7

7

“Some major European bank stocks are indicative of an incoming banking crisis. We see already low interest rates around the world getting lower with each passing day; this is indicative of tight money conditions. Low rates are not stimulating.”

TROUBLING MATTERS OF DEBATE

“Most troubling thing to me currently is that there are not many answers available.”

What I see is an unstable global currency regime which we are completely unprepared for. There is no solution that has been presented that would allow for a stable currency to take over Euro dollars which clearly doesn’t work. Generally the central banks can fix liquidity problems, but they cannot fix solvency problems. We see that the credit cycle has turned from non-performing loans so on and so forth.

The idea behind QE for Japan, America and Europe was to kick start a robust recovery. Now that central banks has lost credibility as well as support. Then you have all the unintended consequences that come with almost zero money. We have nearly zero price discoveries and risk is greatly mispriced.

“Policy makers and economists have simply run out of ideas.”

Desperation is a big role of why markets are reevaluating central banks. If we go back 20 years where Alan Greenspan was a genius and he didn’t even do anything, all he did was talk and he made a career out of not talking. No matter what he did he was taken as a genius. Whereas 20 years later, Janet Yellen sounds like a fumbling idiot no matter what she does. All her actions come across as desperate because the credibility has been blown away. The Fed has been forced into action and by being forced into action it has only highlighted what the Fed can’t do.

“Resource allocation is the main benefit of price discovery; it is the life blood of the economy. The more we damage price discovery the more fatal situations will become.”

We need to look at this as an opportunity in the long run. Now that the power of central banks has come to surface and credibility has been shot, it in turn opens the door to credible solutions. The fact of the matter is that the economy is nothing like what it should be and people know that something is wrong and change is needed.

ABSTRACT WRITER: Karan Singh karan1.singh@ryerson.ca

VIDEO EDITOR: Sarah Tung sarah.tung@ryerson.ca

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.