Gold Demand Remains Stable During Sector Weakness

Commodities / Gold and Silver Stocks 2016 Jul 24, 2016 - 12:41 PM GMTBy: Jordan_Roy_Byrne

My favorite indicator for real time Gold demand is the amount of Gold in the GLD and its fluctuations over time. As we wrote in our book , the driving force for Gold is investment demand which is driven by changes in real interest rates. Western-based investment demand from big money (i.e Stan Druckenmiller and George Soros) shows up mostly in the ETFs and specifically, GLD. The amount of Gold in GLD has risen steadily even as Gold consolidated a few months back and has been stable in recent weeks even as Gold and gold stocks correct their Brexit breakouts.

My favorite indicator for real time Gold demand is the amount of Gold in the GLD and its fluctuations over time. As we wrote in our book , the driving force for Gold is investment demand which is driven by changes in real interest rates. Western-based investment demand from big money (i.e Stan Druckenmiller and George Soros) shows up mostly in the ETFs and specifically, GLD. The amount of Gold in GLD has risen steadily even as Gold consolidated a few months back and has been stable in recent weeks even as Gold and gold stocks correct their Brexit breakouts.

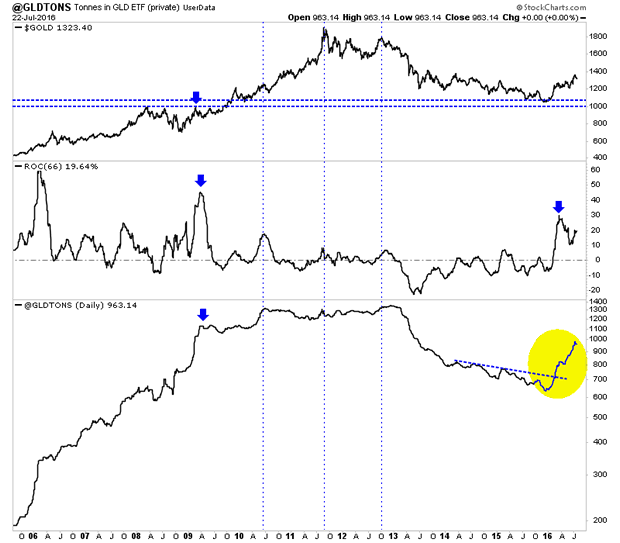

The chart below includes the price of Gold, the amount of Gold in GLD (bottom) and the rolling quarterly change in the amount of Gold in GLD. Even as Gold consolidated for several months in the spring, the amount of Gold in GLD increased. Over the past few weeks Gold has retreated by $65/oz yet the GLD has only lost 2% of its Gold. Moreover, note that the recent demand surge (quarterly change) is the second strongest of the past 10 years.

Note how strong demand for Gold was from 2006 to the middle of 2010. Even though Gold corrected 30% during the financial crisis, GLD only experienced minor outflows of Gold. After Gold bottomed in October 2008, demand exploded.

Interestingly, demand peaked in the middle of 2010 and went sideways for a few years before succumbing to the bear market. That lack of strong demand in 2011 while Gold surged, in hindsight was a warning sign.

In short, this data (amount of Gold in GLD) can be somewhat of a leading indicator for the sector. It has been in the past and it has worked well so far this year. Unless we see huge outflows from the GLD then there isn't much reason to be concerned with the current correction in Gold and gold stocks.

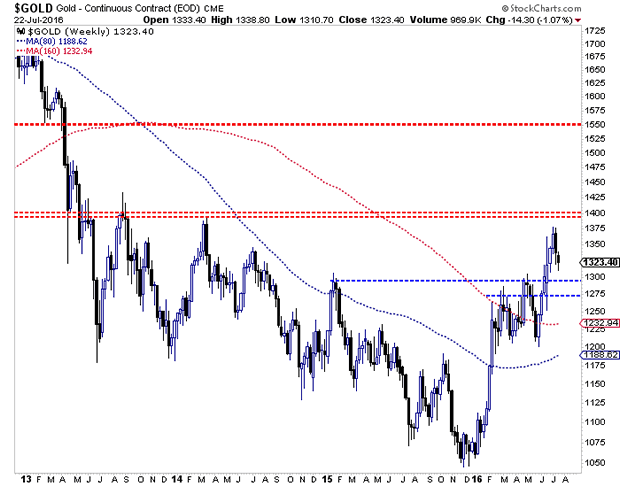

Turning to the technicals, we find that Gold appears headed for a test of support at $1275 to $1300. That would be a retest of the area from which Gold exploded in the wake of Brexit. It also marks previous resistance. Gold's primary trend remains bullish as it holds comfortably above key long-term moving averages shown in the chart (which are equivalent to the 20-month and 40-month moving averages).

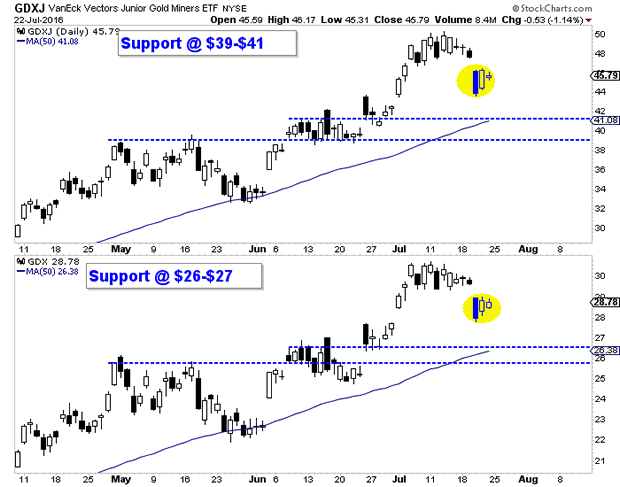

Like Gold, the gold miners and junior gold stocks could be retesting their Brexit breakout. The stocks may be forming a bear flag (yellow) which would lead to another move lower. If that plays out then look for a test of the support points shown, including the 50-day moving averages.

While Gold and gold shares are correcting now, the real time data coming from GLD suggests Gold demand is and should remain firm. Traders and investors are advised to monitor flows in and out of GLD in order to keep tabs on real time investment demand for Gold. This is one of the many things we monitor to stay in tune with market trends. The short-term trend is down and further weakness would bring about a good buying opportunity in select companies.

Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.