Here’s Why You Should Look for Dividend Stocks — and How

Companies / Dividends Aug 19, 2016 - 04:20 PM GMTBy: John_Mauldin

BY TONY SAGAMI : I love dividends, and I’m not alone.

BY TONY SAGAMI : I love dividends, and I’m not alone.

One of the biggest dividend lovers of all is Warren Buffett. He has more than 90% of the Berkshire Hathaway portfolio invested in dividend-paying stocks.

Sure, a 1%, 2%, or 3% dividend may not sound like a fortune, but what looks like small payouts really adds up.

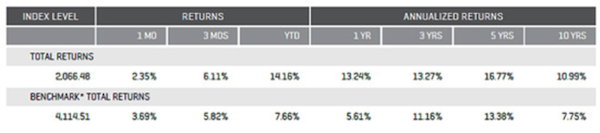

For the first seven months of 2016, the S&P 500 was up 6.3%.With dividends, the total return increased to 7.7%. That’s an extra 22%!

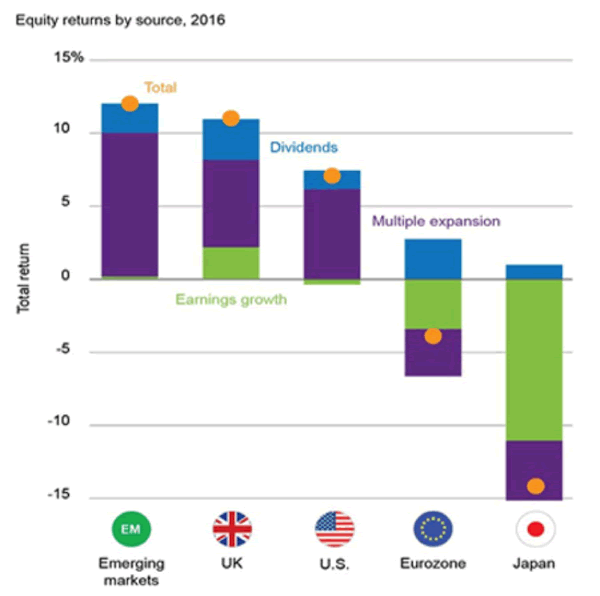

Take a look at the chart below.

The positive impact of dividends can be seen not just in the US, but all over the world. And it’s even more impressive over time.

Since 1930, dividends have made up roughly 40% of the total return of the S&P 500 Index. Plus, dividend-paying stocks have compounded total returns of 9.2% vs. 2.3% a year for non-dividend-paying stocks.

Look for companies that increase dividends

The sweetest spot of the dividend-loving world is companies that can routinely increase their dividend.

Here’s what I mean: If you invested $10,000 in a company that pays a 3% dividend, you’ll receive $300 in dividends a year.

But, what if that company increases its dividend by 5% a year? After 10 years, you’ll have $3,773 in dividends and enjoy a yield of 4.65%.

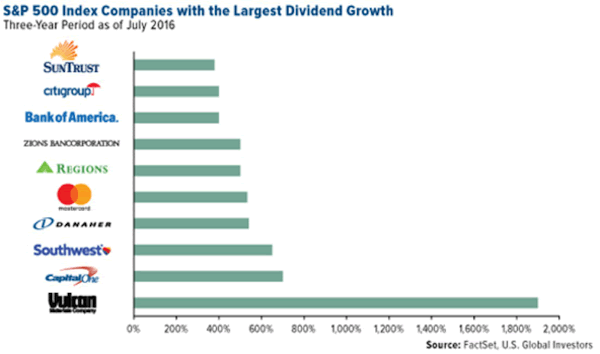

Companies that regularly increase dividends

These 10 S&P 500 stocks have raised their dividends the most over the last three years: SunTrust Banks (STI), Citigroup (C), Bank of America (BAC), Zions Bancorp (ZION), Regions Financial Corp. (RF), MasterCard (MA), Danaher (DHR), Southwest Airlines (LUV), Capital One (COF), and Vulcan Materials (VMC).

Of course, dividends are not a sure thing. They can be reduced or removed at any time a board of directors sees fit. But this select group of companies has increased dividend payments for 25+ consecutive years in a row.

3M (MMM)

Abbott Laboratories (ABT)

AbbVie (ABBV)

Aflac (AFL)

Air Products and Chemicals (APD)

Archer-Daniels-Midland (ADM)

AT&T (T)

Automatic Data Processing (ADP)

Becton, Dickinson & Company (BDX)

Brown-Forman (BFB)

Cardinal Health (CAH)

Chevron (CVX)

Chubb (CB)

Cincinnati Financial (CINF)

Cintas (CTAS)

Clorox (CLX)

Coca-Cola (KO)

Colgate-Palmolive (CL)

Consolidated Edison (ED)

CR Bard (BCR)

Dover (DOV)

Ecolab (ECL)

Emerson Electric (EMR)

Exxon Mobil (XOM)

Franklin Resources (BEN)

Genuine Parts Company (GPC)

HCP, Inc. (HCP)

Hormel Foods (HRL)

Illinois Tool Works (ITW)

Johnson & Johnson (JNJ)

Kimberly-Clark (KMB)

Leggett & Platt (LEG)

Lowe’s (LOW)

McCormick & Company (MKC)

McDonald’s (MCD)

Medtronic (MDT)

Nucor (NUE)

Pentair (PNR)

PepsiCo (PEP)

PPG Industries (PPG)

Procter & Gamble (PG)

Sherwin-Williams (SHW)

Sigma Aldrich (SIAL)

S&P Global (SPGI) (formerly McGraw Hill Financial)

Stanley Black & Decker (SWK)

Sysco Foods (SYY)

T. Rowe Price Group (TROW)

Target (TGT)

V.F. Corporation (VFC)

W.W. Grainger (GWW)

Walgreens Boots Alliance (WBA)

Wal-Mart Stores (WMT)

The media calls these companies “Dividend Aristocrats,” and they are a great starting point for all dividend hunters.

3 ETFs that focus on dividends

If you’re more of an ETF investor, there’s a trio of ETFs that are tailored toward dividends.

SPDR S&P Dividend ETF (SDY) is one of the most popular dividend-focused ETFs. It is made up of companies that have been consistently increasing their dividends every year for at least 25 years, such as the Dividend Aristocrats.

Vanguard Dividend Appreciation ETF (VIG) invests in the NASDAQ US Dividend Achievers Select Index (companies that have increased dividends over the past 10 years).

SPDR S&P Global Dividend ETF (WDIV) takes a global approach to dividends, with companies that have raised dividends for at least 10 consecutive years.

Dividends may seem boring if you’re looking for casino-like thrills. But, the path to long-term wealth is slow and steady.

Subscribe to Tony’s Actionable Investment Advice

Markets rise or fall each day, but when reporting the reasons, the financial media rarely provides investors with a complete picture. Tony Sagami shows you the real story behind the week’s market news in his free weekly newsletter, Connecting the Dots.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.