Stock Market - All Is Calm, All Is Not Right

Stock-Markets / Stock Markets 2016 Aug 27, 2016 - 05:48 AM GMTBy: Doug_Wakefield

With every passing year since 2008, support for the idea of free markets and open competition without constant intervention by central banks has been declining. The idea of trust your central banker to always “assist” the markets has lead the public at large into the false illusion that stocks can always be engineered to return to all time highs in the US, even if just reaching these levels recently.

With every passing year since 2008, support for the idea of free markets and open competition without constant intervention by central banks has been declining. The idea of trust your central banker to always “assist” the markets has lead the public at large into the false illusion that stocks can always be engineered to return to all time highs in the US, even if just reaching these levels recently.

Take for instance today. A few minutes before US markets opened, futures were flat across every major stock index. Then this headline appeared, and US stock indices jumped in the opening minutes of trading.

![]()

Remember, Yellen had not said anything. Everything was merely a reaction by high speed computers to a small number of words in a headline, followed by short term traders looking for scalping opportunities, and the conventional long term investor who almost subconsciously or consciously has come to believe that “they” will “always” keep it up. Constant intervention by the state (i.e. central bank) is good, right?

Why have an exit or sell strategy? Why believe that risk levels have risen substantially with price? There is always more central planning of markets that can be done….right?

Can systemic risk be removed merely by individuals placing their “faith” in more debt, more futures bought by central banks, and more high speed games that have replaced the long held idea that free markets and competition were better than “leave the driving” to central bankers. But does anyone really think this is the right road?

It is no longer 2009, 2011, or 2014. It is now August 2016. Where will we go from the current all time highs in August? The S&P 500’s current all time high is only 2.7% higher than its May 2015 high, and we had to go through 2 declines of more than 12% each to get here.

Why Seek Capitalism Anymore? Financial Socialism Can ‘Always’ Levitate My Stocks!

The majority view is that this statement is too extreme. The minority view, while growing ever larger, is that this is exactly what we have and must continue to monitor.

If you are reading this article, you are thinking. So let’s engage our brains.

Why do we in the West think that state owned businesses in China are a bad model if we don’t see problems coming from the actions of central banks in Japan, Europe, and the US? I forgot, these central banks are only “assisting” the markets on a temporary basis after almost 8 years. How could things possible get better with less debt and a declining role of the state, ie central banks?

As an American there are many reasons I had rather live in the US than China. However, if the European Central Bank prints up money to buy up bonds directly from a European corporation in a private placement, is that really much different than the People’s Bank of China continuing to make loans to massive state owned businesses?

In this short piece, we are going to look at Japan. Europe and the US will be discussed in the September issue of The Investor’s Mind released next week to subscribers.

This is not to discuss economic theory. This is to address the incredible challenge going forward for both bull and bear, and why we must all ask the question, “What dates and events are central banks using to continue to foster the image of ‘things are under our control.’”

This has now become as critical as fundamental and technical analysis.

Bank of Japan: Land of Rising Stock Ownership

Whether you are an investor, advisor, or corporate leader, understanding this massive shift in global finance since 2008 is key to surviving the next major bust, which is running way behind, and could happen any time at these levels.

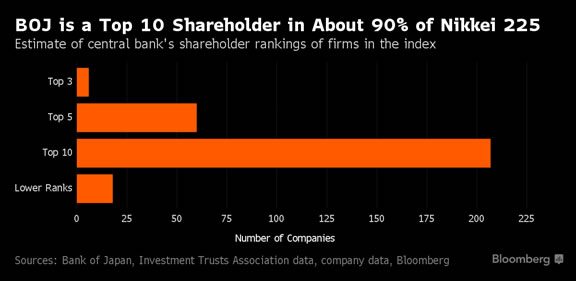

Japan continues to lead the race in centrally planned markets. Back in April, Bloomberg released a piece called The Tokyo Whale in which it was revealed that the Bank of Japan’s “print more debt, buy morestocks” strategy had brought it to a level where it was a top 10 stockholder of more than 200 companies that make up the Nikkei 225.

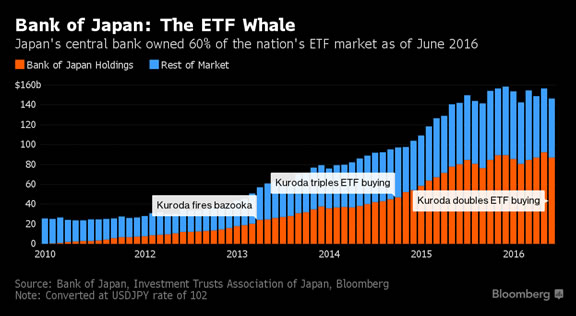

At the time, the article also stated that the Bank of Japan also used this strategy to buy up 55% of the Japanese Exchange Traded Funds. That’s right, the whale investor.

Now leap forward to this month. CLSA’s equity strategist for Japan, Nicolas Smith, wrote that the “BOJ is nationalizing the stock market”. Now let that sink in. Remember when one big insurance company called AIG was in such dire straits that it had to be nationalized?

U.S. To Take Over AIG in $85 Billion Bailout; Central Banks Inject Cash As Credit Dries Up, WSJ, Sept 16, 2008

If we are nationalizing a market in an attempt to make certain the bull fever never dies, what happens when big buyers don’t want to be left holding the bag, and gladly sell down their positions to the BoJ? If AIG plunged in 2008 and was then nationalized, what will happened to the Nikkei when it goes into its next “correction”? Remember, it has been nationalized for years by massive sums of debt created out of thin air.

Akihiro Murakami, chief quantitative strategist for Japan at Nomura in Tokyo, stated this month in another Bloomberg article about the BOJ, that “if the Bank of Japan does not sell, then liquidity will disappear”.

Who in the future will be large enough to replace the Bank of Japan as the buyer of last resort in Japanese stocks? Does the chart below reveal that global investors have shown complete trust in the actions of the BoJ over the last year?

In my opinion, this global drama continues to wait on US equity markets at these all time highs, a watermark seen this month in 5 of the largest stock indices. Current records have only moved 2-3% above their 2015 highs.

The NASDAQ cannot flat line at its March 2000 high indefinitely. Will financial socialism come to the rescue very soon to extend the patient’s bull life, or is it down we go from the August “all time high” headlines?

If we replace free markets with state controlled markets are we not embracing socialism? Is this really a better option than free markets? Are you ready for the next big shift, or waiting for Yellen, Draghi, or Kuroda to signal you or your advisor when it is about to start?

Be a Contrarian, Remember Your History

What mind games must all investors, advisors, and money managers deal with in this global financial/political game we now live in? How does one combine dates and events, financial history, and technical and fundamental analysis in order to gain confidence in this game where we are lead to believe contrarians will never win, and central bankers have overcome gravity? Find out in the September issue of The Investor’s Mind, released next week.

Bulls become bears, and bears become bulls. Trends always end; always begin.

To gain access to the most up to date research, click here to start a six month subscription to The Investor’s Mind, and ongoing trading reports.

On a Personal Note

Check out the posts at my personal blog, Living2024. The latest post is No Worries, “They” Will Keep It Up.

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.