Green Bond Market Will Continue To Grow

Interest-Rates / Renewable Energy Aug 31, 2016 - 02:34 PM GMTBy: Chris_Vermeulen

If a bond has a negative yield, then the bondholders will lose their money on their investment. In the long run, their expectations are lower and consequently they lose the incentive to invest — which may have far-reaching repercussions.

If a bond has a negative yield, then the bondholders will lose their money on their investment. In the long run, their expectations are lower and consequently they lose the incentive to invest — which may have far-reaching repercussions.

Green Bonds Are Changing Investor Expectation’s

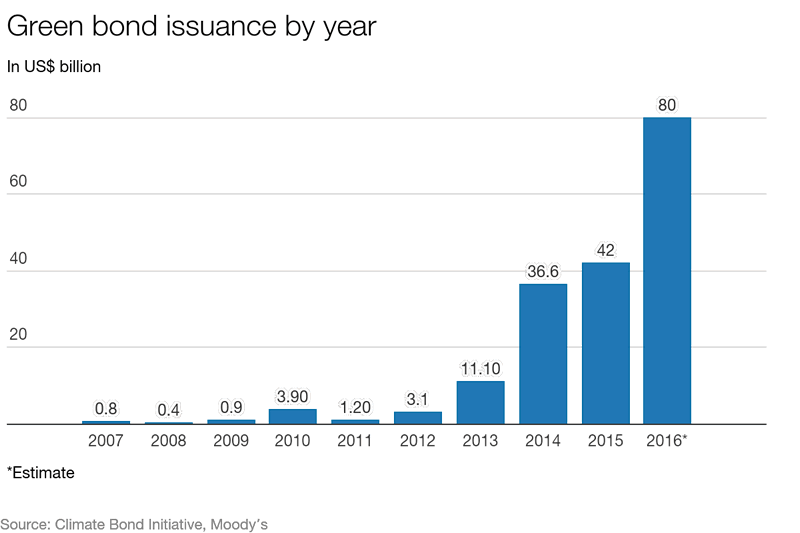

The rapid growth of the green bond market has sparked interest from many audiences.

What are green bonds? Using debt capital markets to fund climate solutions. Green bonds were created to fund projects that have positive environmental and/or climate benefits. The majority of the green bonds issued are green “use of proceeds” or asset-linked bonds.

In this new financial era, how can one ensure that the necessary investments are still coming? In addition, how can investors ensure that they are still receiving financial returns? Green bonds may very well be the solution.

The green bond market provides an innovative way to obtain both a financial return and receive a positive impact. The main characteristic of a green bond is that their proceeds are allocated exclusively to environmentally friendly projects.

According to HSBC, the green bonds market is rapidly increasing; around $80 billion worth of green bonds could be issued by the end of the year. This would represent almost a 100% year-on-year growth.

In this negative-yield bond era, green bonds represent quite a good deal; 82% of them are rated at investment grade and they satisfy the medium long-term preferences of institutional investors, as well as covering a broad range of sectors. Investors are drawn to both the liquid, fixed-income investments that green bonds offer and the positive impact that they can have.

Many institutional investors, such as pension funds, now have mandates for sustainable and responsible investments and are developing strategies that explicitly address climate risks and opportunities in different asset classes. Green bonds can provide the verification and impact measurement that investors need. In the case of World Bank green bonds and IFC green bonds, they also bring AAA ratings.

“Investors increasingly recognize the threats these forces create for long-term financial value and are increasingly considering it in their investment choices,” said Laura Tlaiye, a Sustainability Advisor at the World Bank, one of the first and largest issuers of green bonds with more than US $7 billion issued in 18 currencies.

Green bonds also give smaller investors a way to vote with their money. The State of Massachusetts, for example, received more than 1,000 orders from investors for a green bond that it issued last year – most of them are individual investors interested in supporting their local government’s investment in the environment.

A holistic view of where the economy is headed. Green Bonds enable capital-raising and investment for new and existing projects with environmental benefits. Recent activity indicates that the market for Green Bonds is developing rapidly. The Green Bond Principles (GBP) are voluntary process guidelines that recommend transparency and disclosure and promote integrity in the development of the Green Bond market by clarifying the approach for issuance of a Green Bond. The GBP are intended for broad use by the market: they provide issuers guidance on the key components involved in launching a credible Green Bond; they aid investors by ensuring availability of information necessary to evaluate the environmental impact of their Green Bond investments and they assist underwriters by moving the market towards standard disclosures which will facilitate transactions.

To help investors evaluate green bonds, MSCI/Barclays and others have also launched green bond indexes which score issuers and check their project selection criteria and management of proceeds so as to ensure the promised use and ongoing reporting.

List of Green ETFs for Responsible Investing:

Green bonds have definitely become an exciting market development with demand from investors consistently outstripping supply. If this is of interest to you, take a look at these Green Bond ETFs

If you want to follow my lead as I swing trade and invest long-term using ETFs join me at www.TheGoldAndOilGuy.com

Chris Vermeulen

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.