Gold And Silver – Fiat “Dollar” Says Gold And Silver Will Struggle

Commodities / Gold and Silver 2016 Sep 03, 2016 - 09:30 PM GMTBy: Michael_Noonan

We are taking another look at the globalist-owned Federal Reserve and their totally fiat Federal Reserve Note, more commonly and inaccurately referenced as the “dollar,” which it is not and never was. The fact that people in the United States continue to believe that the “dollar” is real and the Federal Reserve is a part of the US government speaks to how successfully the total Ponzi scheme perpetrated by the elites over the last century plus has fooled almost everyone.

We are taking another look at the globalist-owned Federal Reserve and their totally fiat Federal Reserve Note, more commonly and inaccurately referenced as the “dollar,” which it is not and never was. The fact that people in the United States continue to believe that the “dollar” is real and the Federal Reserve is a part of the US government speaks to how successfully the total Ponzi scheme perpetrated by the elites over the last century plus has fooled almost everyone.

Today, cash is barely 5% of “money” in circulation, and the bankers want to do away with even that paltry source in order to fully gain control over the financial lives of all citizens. The fact that this information still needs to be explained relates to the futility of the public ever wakening to the reality of how all Americans have been, and continue to be fleeced by the elites who control every aspect of how the United States functions, including the bought and paid for politicians, starting with the corporate federal president on down.

Our take on the precious metals charts strongly suggests that gold and silver may work higher, over time, but it will be labored and not without intense effort to overcome the unlimited ability of the Federal Reserve [controlled entirely by the elites] to create an infinite supply of debt that poses as “money.”

Money does not exist in this country. In fact, money does not exist anywhere in the world. What is money? So few people know, and many who profess to know do not. Money is a commodity with a recognized value. Gold and silver remain the last known standard of real money. Remember J P Morgan’s famous words: “Gold is money. Everything else is credit.”

If ever there were anyone in a position to know the difference between what is money and what is not, Morgan certainly knew. Credit is debt. Debt can never be money. Federal Reserve Notes, those that you have in your wallet and circulate in transactions are pure debt issued by the Federal Reserve. As we have stated several times, they are not Federal, there are no reserves, and they are not Notes. A note is a promise to pay something to someone within a specified period of time. There is no such promos on any Federal Reserve Note. These are undeniable facts yet many deny acknowledging this reality.

Federal Reserve Notes, what most people know as the “dollar,” are the biggest Ponzi scam ever. So many people are unable to comprehend this basic truth because they have come to believe in the lie told to them by both the Federal Reserve and the corporate federal government, which is not a government of the people, by the people, or for the people. That Republican form of government ceased to exist over 150 years ago when the South seceded from the Union and then president Lincoln formed a government run by Presidential Orders, and this country has been under martial law ever since, another fact not told to the American public. Whenever marital law exists, the Constitution no longer applies. [There is a reason why the constitution is no longer taught in any law school.]

Those with legitimate money, gold and silver, will stand the best chance of financial survival as the globalist’s continue to destroy the world in order to construct their New World Order dominance over everyone and everything. Will they succeed? So far, they have in an unconstrained manner. How well will those with gold and silver fare once the current fiat “dollar” scheme blows up in their faces and claim they never saw it coming? That remains to be seen. They will have means, but most of those who survive without any financial means will view those who have gold and silver with contempt.

We do not know for how much longer one will be able to acquire gold and silver without being subject to total government scrutiny, but for that reason alone, one should be in a continual purchase mode for as much as one can. It appears that gold and silver prices will continue to be kept low. The anticipated upside explosion did not happen in 2013, 2014, 2015, and most likely not in 2016. As to 2017? It is too soon to tell. Just keep acquiring PMs without letting anyone know you are doing so. Always remember, if you do not personally own and hold it, you do not have it.

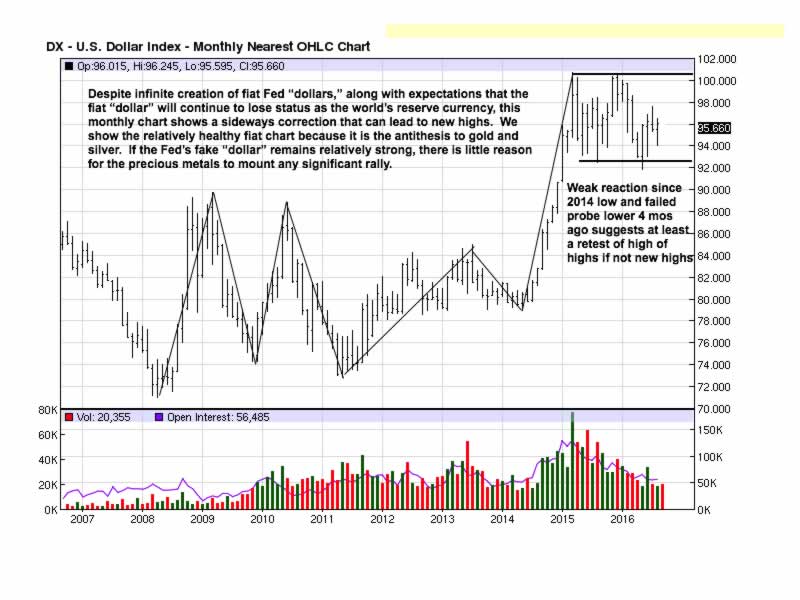

Expectations for the demise of the fiat “dollar” have been misplaced, at least with respect to time, and as everyone knows, timing is everything. Since the breakout rally in 2014 out of a protracted TR, the correction has been mostly sideways. Weak corrections almost always lead to higher prices, and the probability of higher levels is greater than not. That would not be good news for gold and silver.

Any notions that a new currency, including the SDR, will have gold backing is folly. China just issued the first Yuan-denominated SDR, more evidence how the rest of the world is fast-moving away from the dollar as the necessary reserve currency for trade. No more.

China’s currency, [not money, but currency] is all digital, which is imaginary, not real. The interest in having the Yuan included in the SDR basket of currencies, starting in a few months, is China’s acceptance of another paper currency replacement, the SDR, over the US “dollar.” The SDR is controlled by the IMF, the globalist’s organization, and using gold backing by the globalists for anything will never happen.

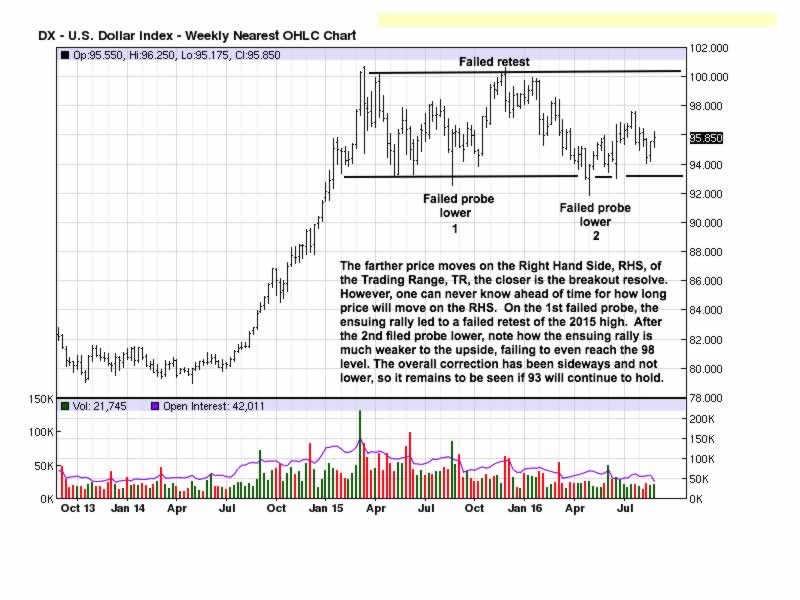

The second rally after the second failed probe lower was not as strong as the rally after the first failed probe lower in 2015. Price is within a TR, so there is little information to gain a solid insight as to which direction price will break.

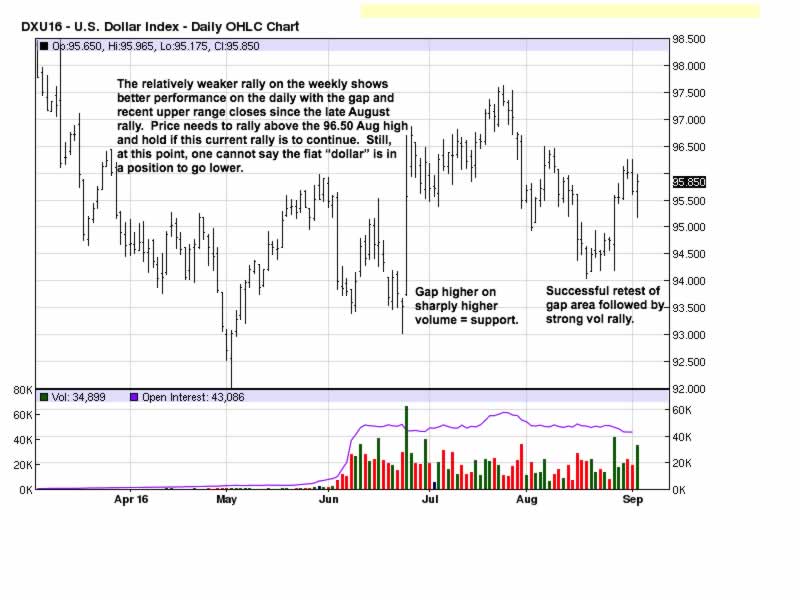

Recent activity from the daily is more constructive than what shows on the weekly chart just discussed. The gap rally in July was a higher low that led to a higher high. Overall, price is in a TR on the daily, but the higher volume bars are to the upside with closes near the highs, and this typifies buyers being in greater control. Odds favor higher prices, and odds favor the central bankers defending the fiat “dollar” from losing its status as a reserve currency, even though that fate is sealed and is just a matter of time. These opposing forces are why PMs prices are not likely to rally with impunity any time soon.

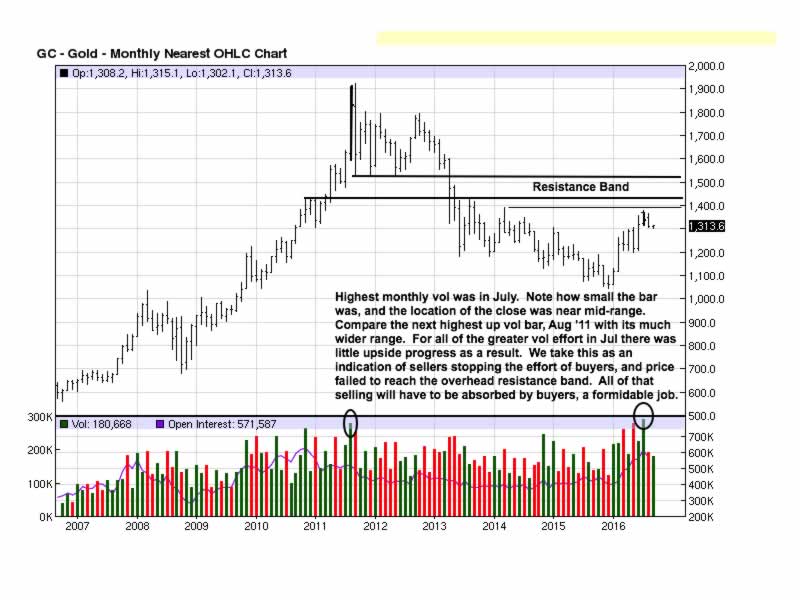

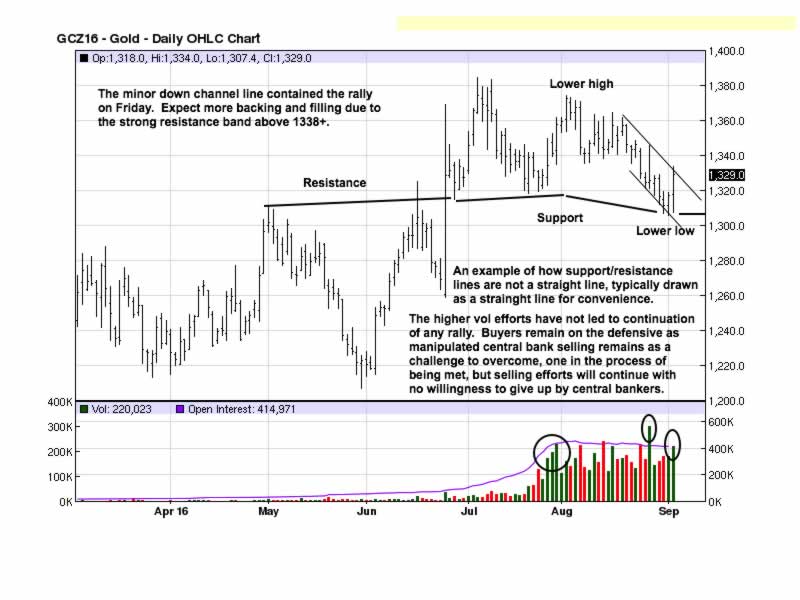

There have been many who report on gold and silver saying charts are incredibly constructive, higher prices are coming soon, etc, etc, etc. We do not see it. The highest volume ever occurred in July, yet the bar range was very small. This tells us that sellers were overwhelming buyer’s effort to move gold higher. Buyers failed. The volume effort was not even enough to retest 1,400.

If the volume and interpretation are on point, then July should act as a cap on gold prices for many months to come until buyers are able to overcome sellers. Even if price were to rally above 1,400, there is still a wide band of resistance to impede rallies. For as much as we favor and expect eventual higher prices for gold, the charts do not indicate it will be any time soon.

All of this can change at any time should some crises occur to propel gold higher, but that would be a future event that has not yet happened, and any analysis can only take into account that which is, with no concern for that which cannot be known in advance, at least in terms of timing.

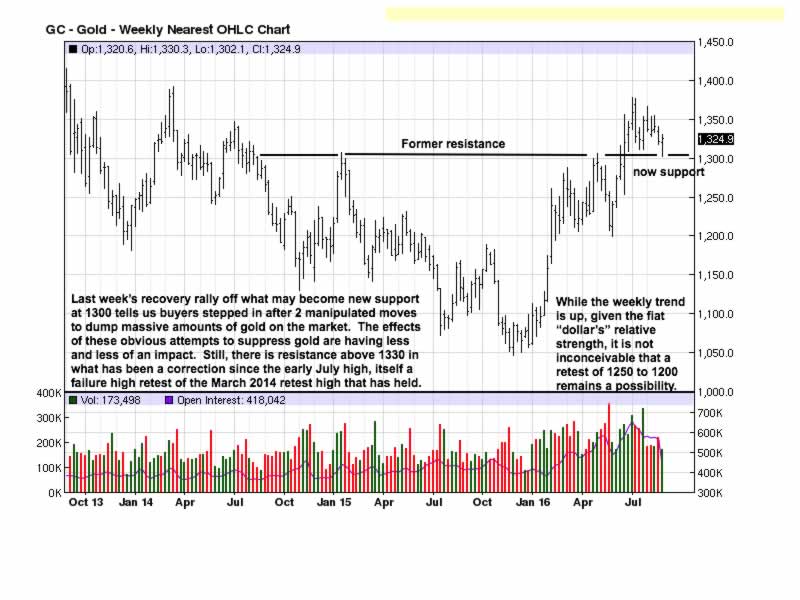

The weekly perspective shows an immediate uptrend since November of 2015, but

over the span of the entire chart, the activity is a broad TR event. 1,300+ is support, as of last week, but it would not take much to breach that level and move lower to retest 1200.

The next few weeks should provide more clarity as to what may unfold near term.

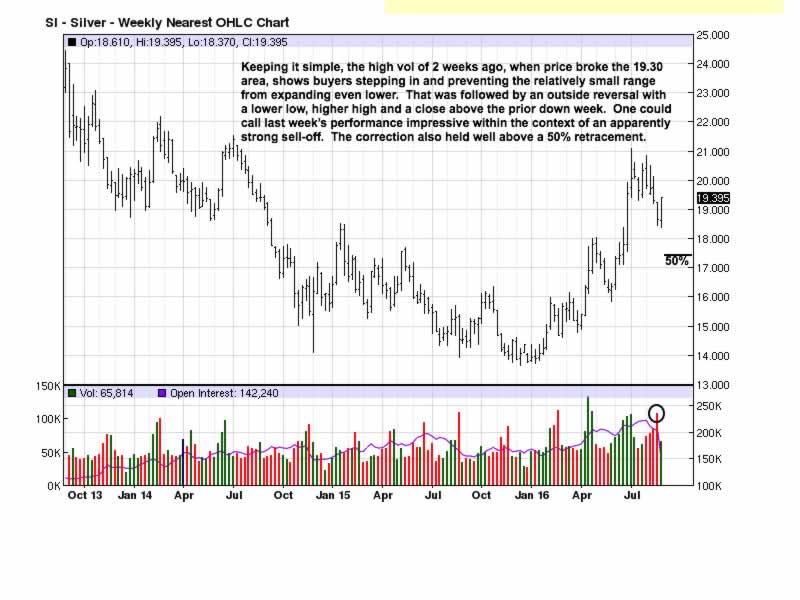

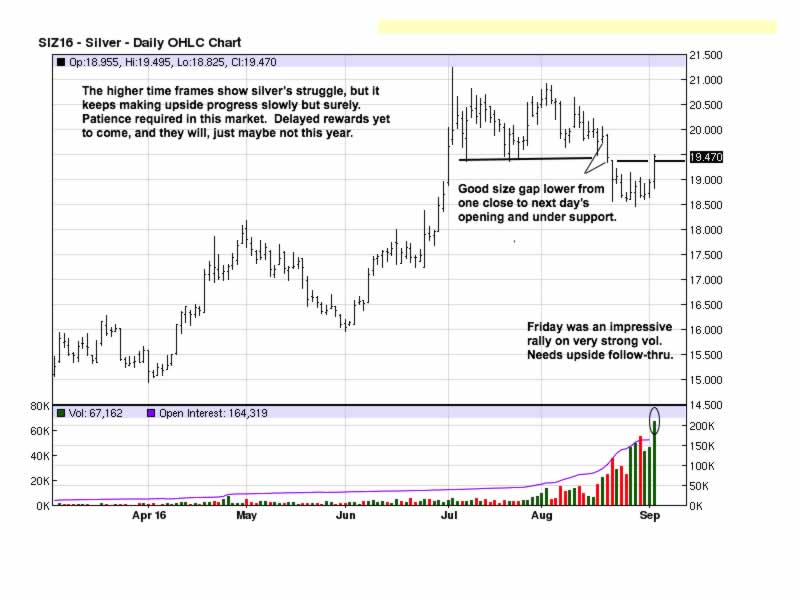

We pointed out the larger volume effort has been on up days, but price is nearer the TR lows since the strong June rally. For all of the effort spent, there has been no upside payoff over the past three months, and our note of caution stems from what the market is indicating, not what people are saying. The market is always the final arbiter.

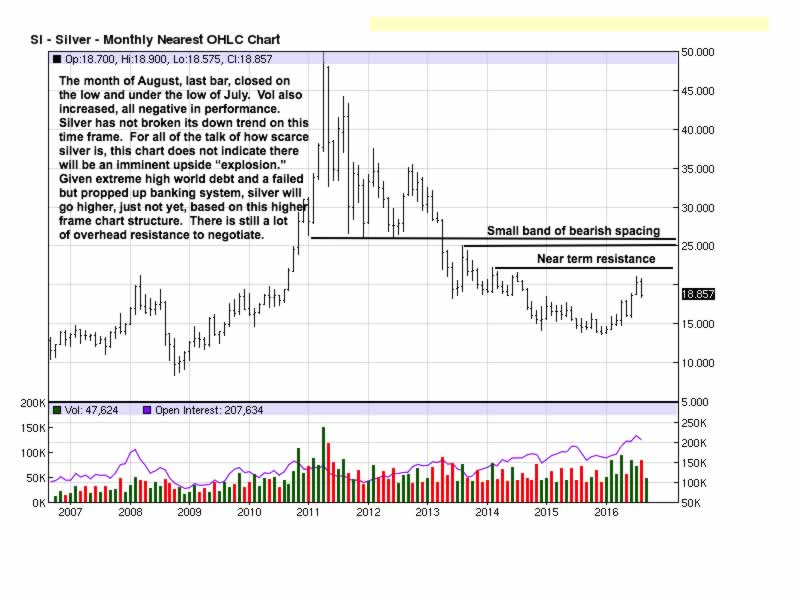

Silver is considered by many to be fundamentally much more bullish than gold, yet the monthly chart shows price is languishing as it seeks to establish a low. The recent low

may well hold, but that does not mean price can move in a much longer TR over the next several months to even another year. Should something happen to catapult price higher sooner, great, but the charts are not showing a dynamic move is coming any time soon.

The near term trend is up since the December 2015 low, and last week’s outside reversal could act as support, but there is still a few months of overhead activity that will act as a buffer for the immediate few weeks ahead.

Price held well above a 50% retracement on the weekly, but is failing to reach a 50% retracement rally on the daily. There is no synergy between the various time frames, and that accounts for the more cautionary read for what price may do in the remaining months for 2016.

All of the above analysis pertains to the paper market, one that is heavily manipulated. The physical prices reflect the paper market, but wholesale recommendation to keep buying physical gold and silver is without any concern for what the paper market is misconveying.

We always recommend buying to have, but the sense of urgency for being fully invested has room to be more select over the next few months. We could be wrong, and one should remain true to their buying physical strategy for reasons other than price. The most prevalent reason would be political, coming from governmental interference of some kind. That is always a wild card.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.