Will BoJ’s New Framework Become a Turning Point for Gold?

Commodities / Gold and Silver 2016 Nov 04, 2016 - 06:38 PM GMTBy: Arkadiusz_Sieron

The Bank of Japan announced in September a cocktail of new monetary policy measures, called “QQE with Yield Curve Control”. Let’s analyze these innovations in detail and discuss their potential implications for the gold market. As we have already noted in the Gold News Monitor, the package consists of two components:

The Bank of Japan announced in September a cocktail of new monetary policy measures, called “QQE with Yield Curve Control”. Let’s analyze these innovations in detail and discuss their potential implications for the gold market. As we have already noted in the Gold News Monitor, the package consists of two components:

- The promise to keep expanding the monetary base until inflation “exceeds the price stability target of 2 percent and stays above the target in a stable manner”;

- The pledge to cap 10-year government bond yields at zero percent.

Let’s start from the commitment to overshoot the inflation target. Generally speaking, this change is very similar to the hike of the inflation target, especially since the BoJ has not defined the “stable manner”. It may assure investors that the BoJ will continue its loose monetary policy even if inflation reaches the 2-percent target. However, nobody knows what “stable manner” means and how long the inflation rate should remain above the target to please the BoJ, so the promise reduces the transparency of the BoJ’s actions. Therefore, as we wrote in the last edition of the Market Overview, the move could increase the risk of higher inflation, which should be positive for the gold market, since the yellow metal usually shines during periods of high and rising inflation, low real interest rates and diminished confidence in the central banks. However, there are two problems. First, weaker yen would translate into a stronger greenback, which should be negative for gold. Second, investors do not believe that the BoJ will be able to overshoot its 2-percent inflation target. It should not surprise us: the monetary policy has not worked in Japan for decades. Why would that suddenly change? Why should the BoJ suddenly produce an inflation rate inflation higher than its target, given the inability to merely meet it for years?

Now, let’s move to the yield curve control. The BoJ adopted yield targeting with the aim of anchoring the 10-year government bond yields at zero percent. On the surface, it seems to be a very nice policy which implies that the BoJ is ready to purchase all bonds investors want to sell. It is always good for investors to have an option to sell their securities at a known price. However, there are three problems with the BoJ’s yield control (except an obvious risk of giving up control over the size of the central bank’s balance sheet and purchasing most or all of the eligible securities when defending a peg).

- First, the Bank has already cornered the market. There are many reports of a lack of sellers in the Japanese sovereign bond market. Given that the BoJ is running out of bonds to buy, the pledge is not as important as it is commonly believed.

- Second, the targeted bond yields are already around zero percent. Therefore, the announcement does not significantly change Japanese monetary policy, so the impact on the gold market can only be limited. Indeed, there is not much change to the BoJ’s stance until there is inflation, because inflation would induce bond holders to sell their securities.

- Third, as Ben Bernanke noticed, the BoJ muddled its message by indicating that it also plans to continue to buy Japanese government bonds worth about 80 trillion yen annually. However, the Bank cannot target the price and quantity of purchased bonds simultaneously. Under yield targeting, the quantity becomes variable. Therefore, the BoJ may buy fewer bonds than it used to, or it is even possible that it may need to sell some bonds when yields decline below the target rate.

All these reasons explain why market reactions to the BoJ’s announcement have been mixed at best. The Japanese central bank changed its policy framework, but not its policy stance. The interest rates were kept unchanged and were not slashed deeper into negative territory (indeed, there was some relief in the markets after the BoJ didn’t reduce interest rates further). The promise to overshoot the inflation target makes little difference when the bank has been unable to achieve its stated 2 percent target, while the set target for the 10-year government bonds is close to the current market rate. And the Bank may even purchase fewer bonds annually to achieve its new yield target. Moreover, the latest BoJ announcement was essentially an admission that quantitative and qualitative easing has failed and it signaled that NIRP and balance sheet expansion had reached their natural limits. The effects of the BoJ’s decision on the currency market are seen in the chart below.

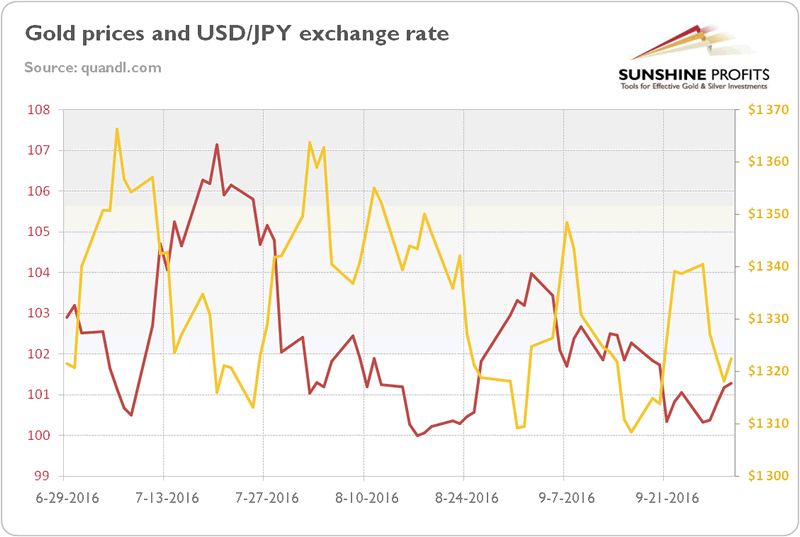

Chart 1: The price of gold (yellow line, right axis, P.M. London Fix) and the USD/JPY exchange rate (red line, left axis) from June 29, 2016 to September 30, 2016.

The Japanese yen initially dropped against the U.S. dollar after the Bank’s announcement of September 21, but the decline was limited and the yen has almost rebounded since then. What is important is the negative correlation between the price of gold and the USD/JPY exchange rate. Indeed, gold prices surged to around $1,340 after the statement, but the yellow metal quickly lost most of these gains. It suggests that the BoJ’s introduction of new monetary policy measures would not be a turning point for the gold market (contrary to the adoption of NIRP, which was an important factor in the precious metals market earlier this year).

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.