Bitcoin Price Above Resistance

Currencies / Bitcoin Dec 21, 2016 - 07:34 AM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

If you’re wondering how Bitcoin-based systems might influence the stock market, Overstock has just given you an example. In an article on CoinDesk, we read:

Online retailer Overstock.com has closed the first-ever Series A preferred funding round with shares sold on a blockchain.

Of the total $10.9m raised from existing shareholders, about $1.9m was raised via shares traded on the tØ blockchian platform developed by Overstock.com subsidiary Medici.

(...)

Shares traded on the blockchain platform settle almost instantly, as opposed to the three days post-trade typically takes on a traditional exchange. The blockchain shares are also intended to help prevent third parties from trading on shares they don’t actually own.

This is an important step forward as far as ledger systems are concerned. The issue shows that there is a possibility of significantly reducing some the time needed to confirm ownership. While it might not seem obvious at first, such improvements might actually lead to leaner exchanges and, perhaps, diminished brokerage fees. Currently, investors are able to buy stocks in the market without too much hassle, however, they are frequently required to pay additional fees related to the processing of the transaction. It is possible that with systems like the one Overstock backs, the ease of use could increase and the costs could go down.

None of this is certain, but exchanges seem interested in the notion. We don’t necessarily think that such a system would mitigate all the problems with traditional exchanges, so putting so much emphasis on short-selling is, perhaps, a stretch. At the same time, it seems that there are purely technological improvements where Bitcoin-based systems might be the way to go forward.

For now, let’s focus on the charts.

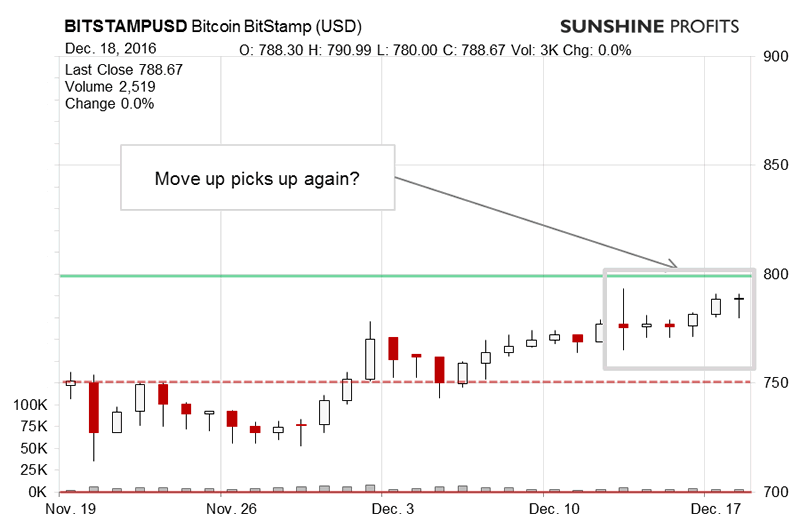

On BitStamp, we saw some appreciation but the action was somewhat muted. What might this mean for the Bitcoin market? Let’s recall our recent alert:

[Earlier alert] The situation now is even a bit closer to $775, which means that the environment is even more tense than it was when our previous alert was sent out. Today has been a day of appreciation (this is written around 11:00 a.m. ET), which doesn’t change much. In particular, we haven’t seen a move above $775. Secondly, the volume seems to be slightly lower than during the previous upswings.

Bitcoin is right at $775. This is the area we’ve been mentioning for some time now. So, we’re right at the most important resistance level in weeks, if not months. The general implications are that Bitcoin might reverse from here to the downside. At the same time, if we see a sustained move above this level, we might actually consider hypothetical long positions.

Bitcoin is above $775 but not very far from this level. We have seen several daily closes above the July top which makes the situation more bullish than it was a couple days ago. Is this enough to consider hypothetical long positions at the moment?

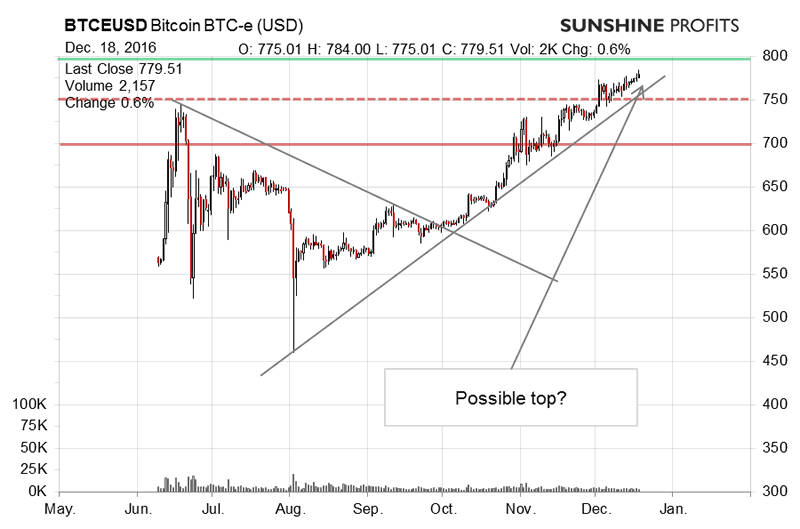

On the long-term BTC-e chart, we are now seeing a move to around $780. This is already above the July top. Recall our recent comments:

Actually, we are now right at $775. The relatively thin volume on which this move is taking place is a bearish indication. This, combined with the overbought levels flashed by the RSI indicator, and the resistance level in play suggest a move to the downside in the near future. On the other hand, the situation is too combustible to hypothetically go short right now. This is because of the fact that a close above $775 confirmed by volume or by further closes above this level could be a start of a new powerful move up.

We are seeing a move above $775 and it’s very close to being confirmed. At the same time, Bitcoin is back in overbought territory based on the RSI Index and the volume is not particularly convincing. This means that the situation is becoming more bullish but betting on higher prices still seems too risky at the moment. If the currency holds up above $775 for some more time (likely days), we might become inclined to look at the long side of the market. This is not the case at the moment.

Summing up, in our opinion not having speculative positions might be favorable at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.