Bitcoin Pulls Back After Massive Price Increase

Currencies / Bitcoin Jan 06, 2017 - 04:11 PM GMTBy: Jeff_Berwick

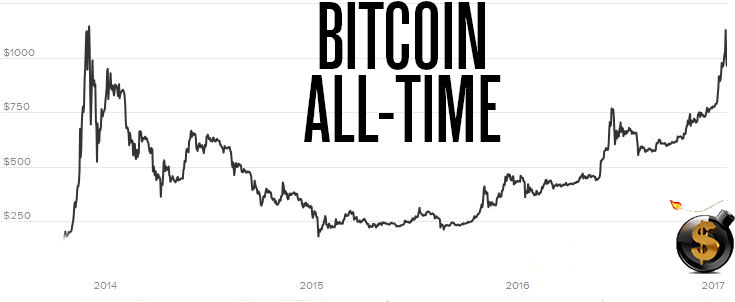

In the last month, bitcoin continued its rise, from $763 to a high of $1,153 yesterday.

In the last month, bitcoin continued its rise, from $763 to a high of $1,153 yesterday.

Then it fell dramatically on Thursday to a low of $953 on Coindesk and has since been hovering in the $1,000 area.

All of this comes just days after the 8th anniversary of the first piece of the blockchain, known as bitcoin’s “Genesis Block” which was mined by the pseudonym known as Satoshi Nakamoto on the 3rd of January, 2009.

According to Coindesk, yesterday the aggregate exchange price average across the major USD denominated exchanges hit a high of $1,153.02, which is just shy of the all time high of $1,242 USD on November 28th 2013 recorded on the Japanese exchange Mt.Gox. Those price levels were sustained for around 12 days, but users never had the ability to withdraw any of those gains.

Bitcoin's price movement is such that it is now within striking distance of Gold’s spot price, currently at $1,179. With the currency at $1,100 per unit yesterday that translated to a market cap of $17.6 Billion or 470 metric tons of gold.

The Danish, Saxo Bank, reassured Bitcoin holders by saying that 2017’s increase will be around 165%. According to Saxo, it will be a year marked by a Donald Trump “spending binge”.

As of December the Saxo Bank price forecast stands at $2100. The bank says it arrived at this price prediction based on Trump’s plan to ramp up spending on infrastructure. This will take place in conjunction with more Federal Reserve rate hikes this year which taken together will cause the already rising dollar to “hit the moon”.

We don’t agree with their analysis on the US dollar, but do think much higher levels for bitcoin could be soon ahead.

Part of what has been driving the current price movement in bitcoin can be attributed to China’s increasingly stringent and restrictive capital controls. For instance, the Chinese are only allowed to withdraw $50,000 USD in foreign currency and there are other measures to stop outbound capital flow via corporate acquisitions and investments.

The Chinese government claims, as governments often do, that this is to protect the integrity of their currency - the yuan - which depreciated almost 6 per cent against the dollar in 2016.

Many Chinese choose to use their $50,000 withdrawal limit as early as possible in the year and that certainly could have provided the major boost to bitcoin we’ve seen lately.

If you want to see how many bitcoins are flooding into China, check out fiatleak.com where they show real time bitcoin transactions. If you watch during the evening on any day of the week you can see nearly every bitcoin being purchased flowing into China.

And, interestingly, the high, just before today’s major pullback, in Chinese Yuan on one Chinese exchange was 8,888. The Chinese love the number eight.

The most striking story though is Mexico where their currency has lost over half its value against the US dollar since 2008. This has caused a massive influx in demand plus soaring premiums for bitcoin on the nation’s two largest exchanges Bitso and Volabit.

The Mexican peso is the 18th most-trade currency for bitcoin today and the price for bitcoin yesterday on the Bitso exchange hit a staggering high of 27,949.00 pesos. That’s the equivalent of $1303.24 USD - more than a 13% premium over the US aggregate exchange average.

For those who felt bad because they had not bought bitcoin during its price rise since 2013, this pullback may offer you the chance to get back in at cheaper prices. For more information on how to get into bitcoin and access to our book, Bitcoin Basics, click here.

And if you really want to be at the epicenter of the cryptocurrency revolution, make sure to attend Anarchapulco, where the entire final day of the conference is called Cryptopulco and has all the biggest names, investors and entrepreneurs in the Crypto space attending.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.