He'll Bring Them Inflation, and They Will Love Him for It

Economics / Inflation Feb 01, 2017 - 06:55 AM GMTBy: Gary_Tanashian

I used to make fun of the FOMC rate hike "decision" language in the mainstream media because under the Obama administration and its economic policies overseen by the Fed's monetary policy, there really was no decision, was there? It was ZIRP-eternity, interrupted by a lone and token rate hike in December 2015 (the Dec. 2016 hike does not count because the transition to a new administration and policy regime was already known; in effect, the Fed has already made its first hike under Trump).

I used to make fun of the FOMC rate hike "decision" language in the mainstream media because under the Obama administration and its economic policies overseen by the Fed's monetary policy, there really was no decision, was there? It was ZIRP-eternity, interrupted by a lone and token rate hike in December 2015 (the Dec. 2016 hike does not count because the transition to a new administration and policy regime was already known; in effect, the Fed has already made its first hike under Trump).

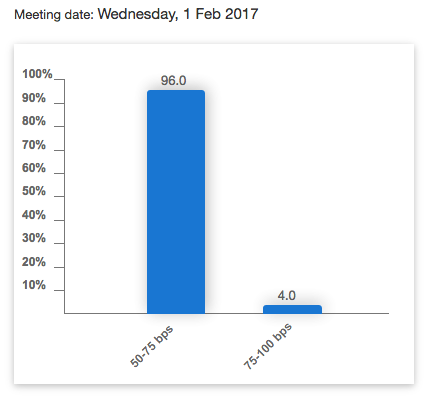

According to the traders who make up the Fed Funds futures, there is no decision tomorrow, either. From CME Group, we have virtually no one predicting two successive rate hikes.

That may or may not be the case. I think everything changed with the election, and the Fed you had before is not the Fed you have today. That Fed was a promoter of inflation and a hands-on supporter of the economy and especially, asset markets. The Fed had kept its implied 'inflate or die' mantra and associated monetary policy in place for 8 long years. But now with the country flipped over like an egg onto its sunny side, a new administration has proven it means what it says (beginning with its blunt, heavy handed and in my opinion, misguided delineation of race and religion on immigration policy).

Focusing on the financial realm, what the Trump administration says is it is going to implement is fiscal (as opposed to monetary) policy in the form of tax breaks to corporations large and small, to tax payers, including and especially the wealthy, infrastructure building, including 'the WALL' (more symbolic than realistic in my opinion) and environmental and business deregulation far and wide. It is a much more business-friendly environment and keeping pure politics out of it, that is a good thing, economically.

In short, what is described above is a scenario where the administration has grabbed the policy burden from the Fed and thus, the Fed is free to do as it pleases now, no longer playing politics. The Fed knows, just as you and I know, that the indirect, and maybe even unintended aim of the Trump administration is to promote inflation. That is because they intend to promote economic growth through policy, just has the Fed has been trying to do for the last 8 years under Obama. By one method or the other, it is in the 'promotion' that inflation lives.

By messing with the dynamics of the inflation signaling system (ref. Operation Twist and its "sanitizing" of inflation signals) the Fed has since 2011 especially, distorted and manipulated signals. So inflation risk #1 is that long repressed (not eliminated) pressures will bubble to the surface. But inflation risk #2 is the active promotion through coming labor cost increases, materials demands and other hard facts of a fiscally stimulated economy.

Let's leave for a future article, talk of the massive debt that will only grow under the Trump plans, leaving the door very wide open to deflationary liquidation at any time along the way of the inflationary path. Though I will ask, in that event, would there be a Federal Reserve standing ready with another monetary bailout as it has done since 2008? The game has changed and the egg is being flipped, after all. But there are so many variables in play that what we might end up with is scrambled eggs instead of a nice, neat 'over easy'.

In straining relations with foreign 'cheap' labor centers in favor of domestic and relatively expensive labor, the implication is rising costs (although I think that where possible, corporations will opt to automate, as opposed to pay $20 to $30 per hour for unskilled labor; we discussed Robotics and Automation here, recently). Corporations, especially those that are public, tend to be ultimately loyal to the bottom line and the bottom line only.

Putting aside the automation aspect (boy, there are a lot of 'put asides' in this article, which to my way of thinking are potholes in waiting along the road to Trump's great new America for the middle class), in freeing corporations and wealthy industrialists and investors of regulatory and tax burdens, the slack should theoretically "trickle down" to the Everyman. In a perfect world, rising costs would be met and offset by rising productivity and declining corporate cost structures. The problem there, of course, is that every time the "trickle down" setup was in place in the past, the only thing that trickled down was brown and lumpen, as in the Army's chain of command. In other, less crude words, the rich get richer and they tend to hold on to a vast majority of that wealth.

Now, I just finished 8 years of complaints about how the rich get richer under the regime of asset-price appreciation through Fed policy as the investor classes gain and the middle class, gets gassed. Surely, the Trump administration is different, but we've seen this blueprint before; first under Reagan, where it worked relatively well (which is very different from saying it worked well for the middle and working classes) and under Bush II, where it did not work well at all (as inflation's effects ate up all the would-be benefits for those going paycheck to paycheck).

This brings me to the title of the article; here on T-minus 1 day to the FOMC "decision", you probably recognize the paraphrased line from Gracchus, in the movie Gladiator. Trump has expressly made the US middle class and its outsourced and offshored jobs a priority. But the shifts toward globalism that were enacted under the Clinton administration have long tentacles and lasting consequences.

Say that worker 'a', an American born and bred and accustomed to certain standards, replaces worker 'b', who immigrated to this country or even more likely, lives abroad in a cheap labor center like China or Mexico. What level of price increase does worker 'a' layer into the cost structure of the product in question? Are we talking an average of $8-10/hr vs. $20-30/hr? Will the average American do the work in question for $20/hr? Even if so, that is a 100% increase in labor cost.

But again, we can look at the coming tax and regulation relief for businesses as a leveler of that cost dynamic. Corporations would theoretically be able to absorb employment cost increases because of the cost reductions elsewhere. But will they? When our corporate chiefs do the inevitable (under the Corporate Chief in Chief, Trump) and you start hearing stories of executive piggish excess again – and you will – who will be there to stop or moderate them?

The bottom line here is that while I don't pretend to know what the exact course will be, whether straight line inflation, inflationus interruptus (i.e. a deflationary liquidation event) or stagflation, the little guy will continue to bear the burden because as they say in the Army, the shit flows downhill; and it's just a matter of what pipe it will flow through (don't worry, no pics for this analogy).

Meanwhile, the FOMC is on tap and I for one am not on a foregone conclusion that they will play nice, either in words or potentially, in action.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2017 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.