Ignore Trump Sabre-Rattling and Buy Gold

Commodities / Gold and Silver 2017 Feb 03, 2017 - 03:06 PM GMTBy: GoldCore

Gold hits 12-week high

Gold hits 12-week high- USD Gold price up 4.85% in last month

- Sabre-rattling from Trump administration set-to benefit gold

- Iran upset and Middle East tensions could drive oil and gold prices up.

- Financial Times foresees “not only currency wars but a fully fledged trade confrontation that could be disastrous for the world economy.”

- Royal Mint producing 50 % more gold bullion coins and bars compared to 2016

- Utah moves to hold public funds in gold

- WGC report demand for gold hit four-year high in 2016

- Investment demand climbed by 70% last year fuelled by geopolitical uncertainties

The Trump administration continues to sabre-rattle at global powers and threatens to disrupt the status-quo of international relations. Comments in just 24-hours by Donald Trump and his team have included attacking an Ivy League university, a nuclear power and two of the United States’ key trading partners.

We continue to look on as the unconventional tweets and announcement appear, but in the meantime watch the gold price hit 12-week highs and inflows of roughly 1.2 million ounces surge into gold ETFs, as uncertainty continues to drive investors towards safe havens.

FOMC stand-by to watch the Donald

Many market observers may have found a funny sort of comfort in seeing the statement of the FOMC meeting, this week. A funny thing to say, but given each day appears to bring a new surprise there is something reassuring that meetings and announcements from the likes of the Federal Reserve, continue as scheduled.

Unsurprisingly, and despite Janet Yellen’s warnings of a ‘nasty surprise on inflation if it was too slow with rate hikes’, the Federal Reserve held back from a further rate rise this week. The committee painted a fairly positive outlook of the economy, it was perceived to be dovish. The statement helped to ultimately push gold prices higher as the dollar fell in disappointment to no rate hike. For some this was an example of ‘The Fed that cried Wolf.’

The Fed is still expected to hike rates up at points throughout the year, but uncertainty about when and how much remains. The FOMC are waiting for further disclosure President Trump’s economic policy.

Gold was the only commodity that climbed higher (+0.9%) following the Fed announcement.

Iran on notice: be on notice to buy gold

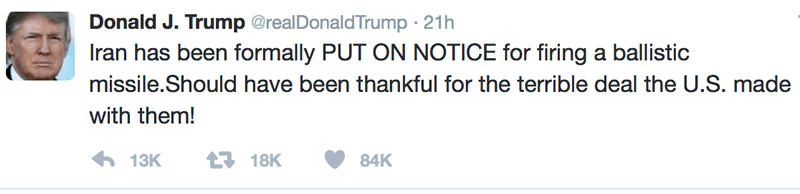

Earlier this week Iran tested a ballistic missile and attacked a Saudi navy vessel. The Trump did not disappoint in letting the world that they were unhappy, through both Twitter and Mike Flynn.

Mike Flynn, Trump’s national security advisor stated, ““Recent Iranian actions involving a provocative ballistic missile launch and an attack against a Saudi naval vessel conducted by Iran-supported Houthi militants underscore what should have been clear to the international community all along about Iran’s destabilizing behaviour across the entire Middle East”

Flynn concluded, “As of today, we are officially putting Iran on notice.” This was followed by a Tweet confirming this position, by Trump.

Fordham University maritime law professor and former US Navy Commander Lawrence Brennan spoke to Business Insider on Monday.

“This attack is likely to impact US naval operations and rules of engagement (ROE) in nearby waters,” said Brennan, who pointed out that Iranian ships frequently harass and sail very closely to US Navy ships.

Brennan suggested that in light of the recent suicide boat attacks, the US Navy should now consider shooting Iranian or hostile vessels that get too close.

Given that Trump has so far proven his intention to follow through on campaign promises, we expect him to do the same with Iran. Whilst campaigning in Florida, in September, he told a rally of thousands that when it comes to Iran, “when they circle our beautiful destroyers with their little boats, and they make gestures at our people that they shouldn’t be allowed to make, they will be shot out of the water.”

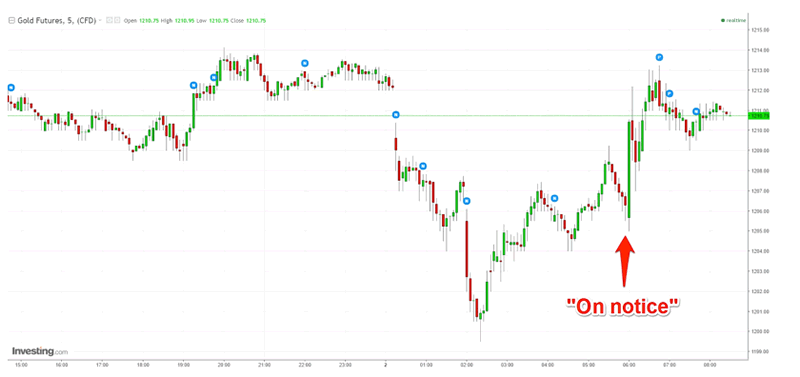

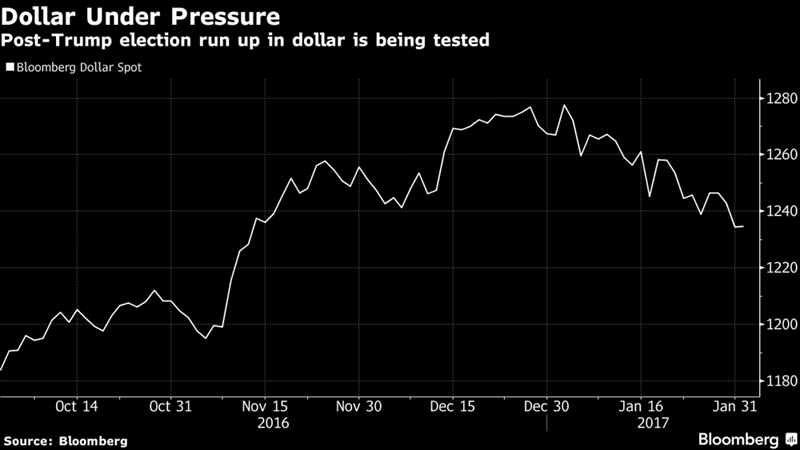

The remarks from Trump and Flynn took immediate effect on the US dollar (already weakened by the FOMC’s statement) and sent gold higher (as shown in this Business Insider chart).

Iran weighed in on the matter with defence minster Hossein Dehghan telling Iranian state media that contrary to the claims of the US, “The test was not a violation of a nuclear deal with world powers or any UN resolution,”

Later Ali Akbar Velayati, senior adviser to Iran’s supreme leader Ali Khamenei, told the Fars news agency, “”This is not the first time that an inexperienced person has threatened Iran … the American government will understand that threatening Iran is useless.”

Iran to dump the dollar but stocking up on gold

Of course, this wasn’t the first time President Trump has rattled the Iranians since he took office. When he declared a travel ban on seven countries, including Iran, the country’s central bank decided to respond.

Iranian Central Bank Governor, Valiollah Seif, told sate Press TV that the bank “is seeking to replace the dollar with a new common foreign currency or use a basket of currencies in all official financial and foreign exchange reports.” This will come into force on 21st March 2017. Seif has apparently recommended currencies “ with a high degree of stability.”

The country reportedly receives around USD$41billion in oil revenues, a risk on both sides of the equation.

It is also worth noting that Iran bucked the trend for gold demand in the last quarter of 2016. The WGC reports that a growth of 15% in Q4 helped push annual demand up to 41.0t. This push for gold was supported by the improving domestic economy and is set to continue to climb as the central bank releases new coins later this year.

Good for oil, good for gold

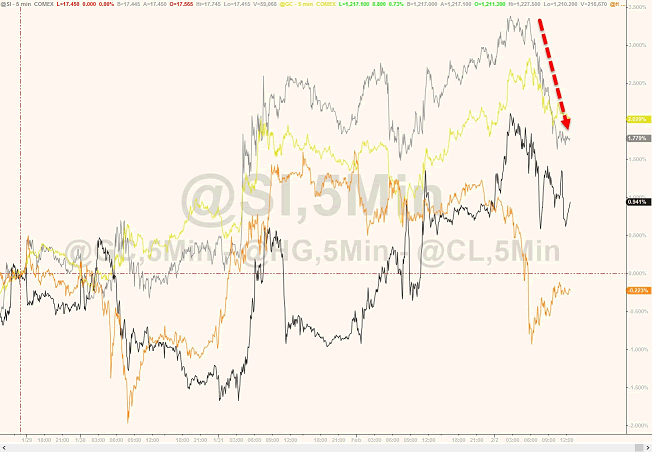

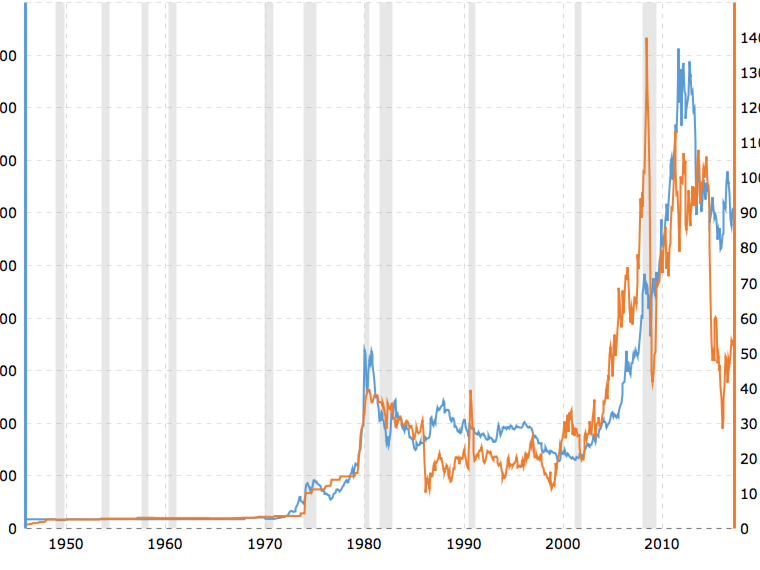

Low oil prices across the Middle East affected gold demand, according to the World Gold Council’s 2016 Q4 report, however with Trump’s ongoing fighting-talk (and executive orders to the Middle East) we expect the correlation between oil and gold prices to work in our favour.

Whilst the jury is still out on the correlation between gold and oil returns, there is some clearer correlation between their prices. It is estimated that over 60% of the time, there is a strong correlation between the two. The above chart compares the month-end LBMA fix gold price with the monthly closing price for West Texas Intermediate (WTI) crude oil since 1946.

With all the fighting talk with Iran, oil has had a bit of a pop up (also helped by Exxon’s (XOM) Rex Tillerson being sworn in as Secretary of State). As tensions increase in the Middle East and Trump carries on protecting America’s trade, we expect to see higher oil and therefore gold prices.

As oil prices rise, this pushes up inflation. Gold is an inflation hedge and therefore an increase in demand for the yellow metal, as a safe haven, will increase. It is also worth remembering the damage high oil prices can do on economic growth – by slowing it. Slow economic growth is likely to impact equity markets and boost demand for alternative investments such as gold and silver.

Currency wars set to come out into the open

It is not just the price of oil which signals a positive picture for gold in both the long and short-term. Currency wars, as most recently discussed by us a week ago are now an open threat to the stability of the global financial and trade system.

Trump suggesting that the US dollar was too strong and enticing China into a currency war now seems like a distant memory. It was in fact the start of a trend of the new administration to take on currencies.

Peter Navarro, head of the National Trade Council, had accused Germany of exploiting a ‘grossly undervalued Euro’. This came just days after Shinzo Abe had accused Trump of attacking both China and Japan and for “play[ing] the devaluation market” and was forced deny reports of yen manipulation.

Following Navarro’s Euro comments Ulrich Leuchtmann, an analyst with Germany’s Commerzbank, warned clients to “buckle up for a currency war that might become nasty…With his statement [Mr Navarro] has in fact fired the next salvo in the currency war the US administration is currently conducting against the rest of the world,”

These latest moves by both the President and Navarro signal further steps away from the usual protocol of government leaders who do not openly comment on the currencies of other countries. A job which is usually handled by the Treasury Secretary.

It will be interesting to see what Trump and Navarro think they can do about the strong dollar and other currencies. It is not so easy to devalue, as it once might have been. Moves to weaken the dollar are likely to occur through protectionist measures which will ultimately see price inflation exported around the world as the dollar is used in the majority of trade. This will not be taken well across the globe. The Financial Times echoes such concerns:

“But the chaotic start to the administration and what many see as its protectionist agenda have amplified fears of not only currency wars but a fully fledged trade confrontation that could be disastrous for the world economy.”

Hype overshadows the real news

Despite the announcement from the Yellen and her team, the ongoing sabre-rattling from the Trump administration distracts from economic reports that once influenced markets. For example, today the January employment report will be released, economists are expecting gains of 170,000 which could raise expectations of a rate-hike in March. However, markets appear distracted by activities in the Trump administration and a certain twitter account.

Should the jobs report be positive news then we may see a small-pullback in the gold price, however it is unlikely that investors wish to be short-gold given the world-wide geopolitical environment of uncertainty.

But it is not just Trump that is prompting upset and discomfort, as highlighted by the recent WGC report, gold demand was high in 2016 (and continues to be in 2017) because of ongoing uncertainty with Brexit, elections in France, Germany and Holland.

This has been reflected in an insightful report into government owned Royal Mint shows the explosion in demand for gold across both the UK and Europe. Reuters reports that demand has climbed by 50% since the same point last year and sales rose by one-third in January.

Demand in the UK is reportedly up 25%, whilst sales to German more than doubled in volume terms, in the last year. Workers at the Mint point to uncertainties surrounding Brexit, the EU and the United States as reasons for the dramatic pick-up in demand.

Far away from the White House and the communications machine that is Twitter, in Utah Rep. Ken Ivory introduced a bill that will add several provisions to state law that will allow (and arguably encourage) the use of gold and silver as legal tender.

House Bill 224 will give the state the option to hold public funds in gold and silver, as opposed to Federal Reserve notes. Utah has long been at the forefront in the move to sound money, in 2011 it was the first state in 80 years that allowed the precious metals to be used as legal tender. This latest bill is seen as the next step in allowing gold and silver to be used in everyday transactions.

2017 set to shine like 2016

Whilst Q4 saw outflows, 2016 was the second best year for ETFs on record according to the WGC’s latest report. Global demand for gold-backed ETFs was 531.9t – the highest since 2009.

The World Gold Council points to three main factors driving the surge in gold demand in 2016: negative interest rates, the FOMC’s decisions and uncertainty stemming from the geopolitical situation.’

Demand for ETFs continues to be strong, just one month into the year. A report released on January 20th, Inauguration Day, by Bank of America Merrill Lynch said that precious metals saw the first ETF inflows of $1.3 billion, the largest weekly gain in five months.

According to Bloomberg, almost $1.6 billion poured into the 10 precious-metals ETFs that have attracted the most money in January. In Europe, in the week of Trump’s inaugurations, Germany’s Xetra-Gold ETF added $544 million in gold-backed ETF inflows. That amount is ten times that in the world’s biggest gold-backed ETF, SPDR Gold Shares (GLD).

Uncertainty remains, as does the need to buy gold

As we discussed yesterday, there is much uncertainty in the markets at present. The inauguration of Donald Trump just two weeks ago has, if anything, increased this feeling rather than reassure markets. However this sabre-rattling is distracting and markets do not know where to turn.

Supply and demand ultimately affect prices, but it is expectations and sentiment that make markets move. Despite Trump doing exactly what he promised, he continues to shock in the way he is delivering on those promises and this is confusing the sentiment in the market. Putting aside the events in the first week of his Presidency, this week in just 24 hours President Trump managed to threaten an Ivy League institution with a stop their federal funding, put a nuclear power ‘on notice’ and insult Australia over immigrants.

What is not confusing, as we see in the levels of gold demand, is market expectations. The market is expecting a period of uncertainty, it is expecting a period of raised tensions between the United States and the growing list of countries it has publicly taken issue with and it is expecting people to turn to safe havens such as gold and silver.

Yesterday we wrote about how big declarations and fear-mongering can distract us from what is really going on and, therefore, distract us from making the right decisions. It is clear that there is growing number of investors, around the world, who are not being distracted by the noise and the hype and are choosing to invest in safe havens such as gold and silver.

It would be wise to expect heightened uncertainty in the forthcoming months, if not longer. There is little point in looking to market sentiment at a time when a 140-character tweet can flip it upside down. Instead, investors should look to hold some of their wealth in gold and silver, assets that have long-held their value at times of unpredictability and turmoil whether through war, economic crises or political upheaval – all of which appear to be on the cards.

KNOWLEDGE IS POWER

10 Important Points To Consider Before You Buy Gold

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Gold Prices (LBMA AM)

02 Feb: USD 1,224.05, GBP 966.14 & EUR 1,131.88 per ounce

01 Feb: USD 1,210.00, GBP 960.01 & EUR 1,122.03 per ounce

31 Jan: USD 1,198.80, GBP 964.91 & EUR 1,119.20 per ounce

30 Jan: USD 1,189.85, GBP 949.38 & EUR 1,112.63 per ounce

27 Jan: USD 1,184.20, GBP 943.81 & EUR 1,108.77 per ounce

26 Jan: USD 1,191.55, GBP 945.14 & EUR 1,111.95 per ounce

25 Jan: USD 1,203.50, GBP 956.90 & EUR 1,119.62 per ounce

24 Jan: USD 1,213.30, GBP 972.22 & EUR 1,130.07 per ounce

Silver Prices (LBMA)

02 Feb: USD 17.71, GBP 13.95 & EUR 16.38 per ounce

01 Feb: USD 17.60, GBP 13.91 & EUR 16.29 per ounce

31 Jan: USD 17.29, GBP 13.86 & EUR 16.07 per ounce

30 Jan: USD 17.10, GBP 13.65 & EUR 16.03 per ounce

27 Jan: USD 16.70, GBP 13.32 & EUR 15.61 per ounce

26 Jan: USD 16.86, GBP 13.39 & EUR 15.71 per ounce

25 Jan: USD 16.93, GBP 13.46 & EUR 15.74 per ounce

24 Jan: USD 17.10, GBP 13.73 & EUR 15.92 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.