How Investors Can Profit From Trumps Military Ambitions

Commodities / Metals & Mining Feb 06, 2017 - 02:18 AM GMTBy: OilPrice_Com

Tesla just activated its battery gigafactory, and China is moving to hoard the world’s cobalt supplies at the same time that Trump promises a military build-up that can only happen with the precious metal. This all means supply panic for everything from the electric car break-out to the military industrial complex.

Tesla just activated its battery gigafactory, and China is moving to hoard the world’s cobalt supplies at the same time that Trump promises a military build-up that can only happen with the precious metal. This all means supply panic for everything from the electric car break-out to the military industrial complex.

Right in the middle of this we have small-cap North American explorers—our new potential barons-in-the-making—in whose hands our energy revolution now lies.

China is going to spend a massive US$360 billion through 2020 on renewable power sources as it seeks to dominate what is one of the fastest-growing industries in the world—and it will need a huge amount of cobalt to pull this off. If China starts hoarding global cobalt supplies, we’ll be looking at another phase of cobalt supply panic.

Cobalt is also a highly strategic material—it defines our defensive capabilities, and Donald Trump is now playing with yet another executive order to boost the military, and military spending.

For cobalt, we’ll be looking at the only major venue left under control for new supply—Canada, the #3 cobalt producer in the world.

It’s a brilliant set-up for small-cap companies like LiCo Energy Metals (TSX:LIC.V; OTCQB:WCTXF), which is staking out lucrative claims uniquely for both cobalt and lithium.

LiCo is one of the fastest-moving new small-cap explorers on this tight supply scene. It’s pinging investors radars not only with its hungry lithium acquisitions in Nevada and Chile, but also with a unique primary cobalt in Ontario, which means it’s a pure cobalt play, and not simply a by-product of nickel and copper.

The company has stepped into an exploration world that offers three highly attractive scenarios for investors: 1) grabbing market share on two high-demand metals; 2) low-cost resource definition; and 3) near-term production.

Sitting on the highest grade of lithium in the world, in Chile, and carving out new primary cobalt supply in Canada to meet soaring demand, this small-cap company is set to play a key role in the emerging energy revolution.

3 reasons to keep a close eye on LiCo (TSX:LIC.V; OTCQB:WCTXF):

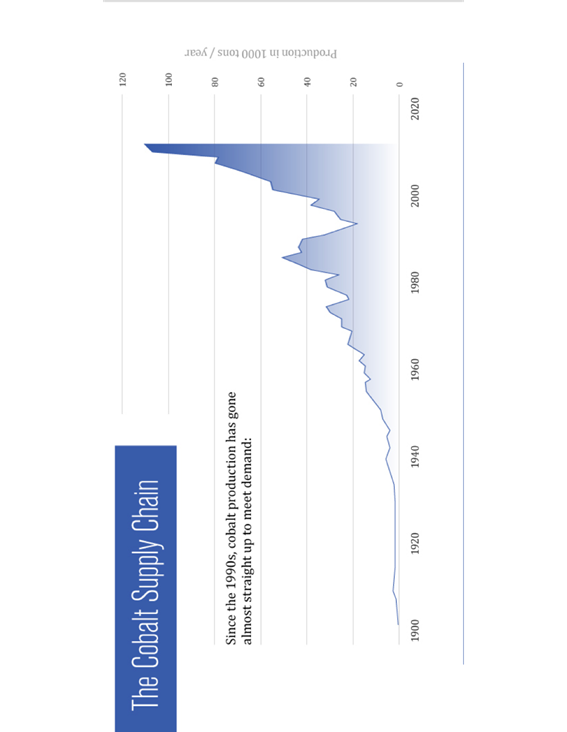

#1 Cobalt is Scarce and Supply is Elusive

The battery industry currently uses 42 percent of global cobalt production. The remaining 58 percent is used in diverse industrial and military applications—and the two sides are going to find themselves competing for dwindling supply.

Companies like Tesla (NASDAQ:TSLA) and Panasonic (NYSE:PC) need reliable sources of the metal, and the supply chain is anything but.

Around 97% of the world’s cobalt supply comes from what is largely an afterthought—as a by-product of nickel or copper mining—it becomes clear that answering an imminent spike in demand will be challenging at best.

And as the price of nickel and copper continue to plunge, it makes mining them uneconomical, further tightening the cobalt supply picture.

Further supply chain panic comes from the fact that some 60% of the world’s cobalt supply comes from the massively unstable Democratic Republic of Congo (DRC). The entrenched corruption that stems from the unregulated industry and illegal artisanal miners who used tens of thousands of children to mine cobalt, make the DRC a high-risk venue. The auto industry doesn’t like to source its cobalt from here because any connections to this supply chain are bad for reputation in terms of corporate social responsibility. China, however, has no such qualms.

Source: Visual Capitalist

So where is Tesla going to get its North American supply? Canada and the U.S. currently produce a meager 4% of the world’s supply of cobalt combined. This isn’t even enough to feed 500,000 of Tesla’s new Model 3 EVs, which would consume about 6% of the world’s cobalt production, according to some estimations.

It is definitively going to be up to emerging small-cap companies like LiCo to fill this void with new supply.

The major miners aren’t even mining cobalt; they’re mining nickel and copper, both of which have seen prices plunge to record lows. With the big players, there will only be cobalt if there is enough demand for nickel and copper.

Tomorrow’s sources come from the junior companies, and far from the chaos and risk of the DRC. Along with the U.S. state of Idaho, the Northwest Territories, and British Columbia, Ontario, Canada is shaping up to be one of the best new venues for our cobalt-driven future. This is one of the only places in the world where there have ever been primary cobalt mines, meaning that they’re not just by-products of nickel and copper.

This is exactly where LiCo (TSX:LIC.V; OTCQB:WCTXF), has set itself up to take advantage of the cobalt boom.

LiCo’s Teledyne Cobalt Project is a high-grade, advanced-stage cobalt project in the heart of a historical mining district in Ontario, Canada. Covering 11 claims across over 1,368 acres, this project already boasts CAD$25 million in inflation-adjusted infrastructure.

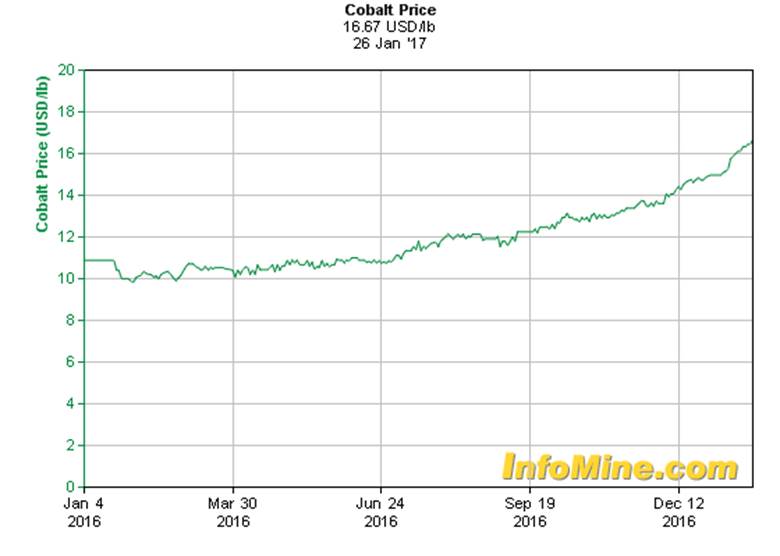

Cobalt prices continue their climb, week-on-week, month-on-month and year-on-year. In the last 6 months Cobalt is up 70%.

In 2015, cobalt prices were falling quarter-on-quarter, and on into Q1 2016, but Q2 and Q3 of 2016 saw a recovery, with prices now trending between US$13 and US$14/lb. Roskill anticipates demand for cobalt to grow at roughly 5% per year with demand for cobalt in Li-ion battery applications expected to increase at nearly 7% per year, to 2025.

We’re staring directly at a major cobalt deficit, with CRU estimating a 12,000-tonne deficit—at least—by 2020.

LiCo has hit the ground running with its CAD$700,000 exploration program on its cobalt property, and we expect big things very soon.

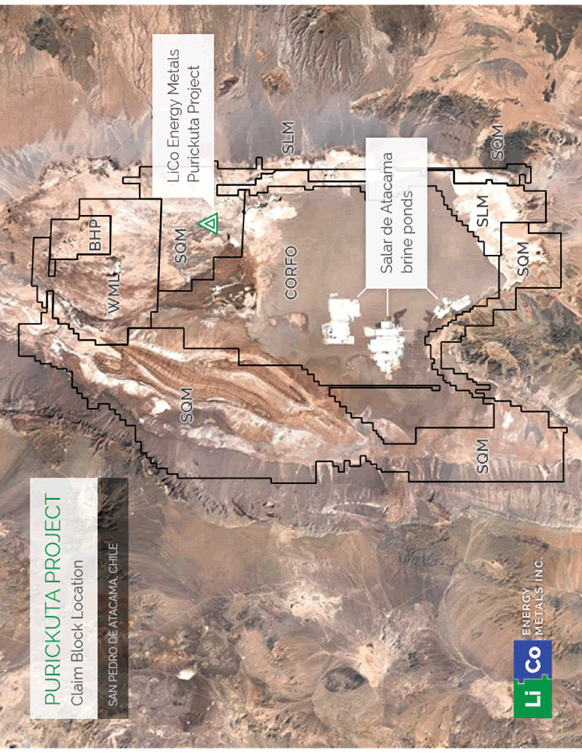

#2 Lithium Bound: The Rush to Atacama, Home to 37% of Cobalt Production

The real future supply coup is this: LiCo has just acquired interest in a major exploration project Chile’s prized lithium development, Salar de Atacama, home to around 37% of the world’s entire lithium production. LiCo—which will take on up to a 60% interest in the Purickuta Project—is now exposed to one of the best new lithium supplies in the world. The project covers 160 hectares and is one of a few exploitation concessions granted within the highly sought-after Salar de Atacama.

It is surrounded by major lithium mining and is right in the middle of an existing exploitation concession owned by mining major Sociedad Quimica y Minera (NYSE: SQM) and only 3 kilometers north of another exploitation concession of CORFO (the Chilean Economic Development Agency). But this is lithium central, so that’s just the tip of the iceberg. Some 22 kilometers south-east of this project, SQM and Albemarle have large-scale production facilities, two of which produce, combined, over 62,000 tonnes of Lithium Carbonate Equivalent annually. They account for 100% of Chile’s existing lithium output.

For a small-cap explorer, one might think it doesn’t get any better that this—but it does. Salar de Atacama’s lithium is easier and cheaper to produce than anywhere else in the world because its high-grade lithium and potassium has a high rate of evaporation and extremely low annual rainfall.

Just like cobalt, the future also spells deficit for lithium supply, and spot prices would agree. Lithium spot prices more than tripled in a matter of months at the beginning of 2016, up to April, when they retreated only slightly.

This is a bull run that is going to be a long one—there is no sign of a halt to the lithium breakout as it drives a clear and visible energy revolution. In 2015, lithium consumption nearly tripled. Since 2010, the market has grown by 10,000 tons per year, led by the lithium-ion battery market. Lithium prices have been surging since the second half of 2015, and short-term contract prices have been on the rise since the first half of 2016. For 2017—if current contract negotiations are anything to go by—analysts expect to average over US$10,000 for lithium hydroxide and over US$15,000 for lithium carbonate.

#3 Targeting the Two Hottest Commodities in the World

As future supplies of lithium and cobalt promises to fall well below soaring demand, the name of the game is stake out new potential lithium acreage and get an early foothold on cornering the market share for what is no less than an energy revolution.

The surge this year in lithium spot prices in China coupled with the ravaging hunger for lithium-ion batteries and power storage solutions has triggered fears that we are on the edge of a major supply problem—but it’s a euphoric problem for lithium exploration companies and it has opened up the playing field to new entrants.

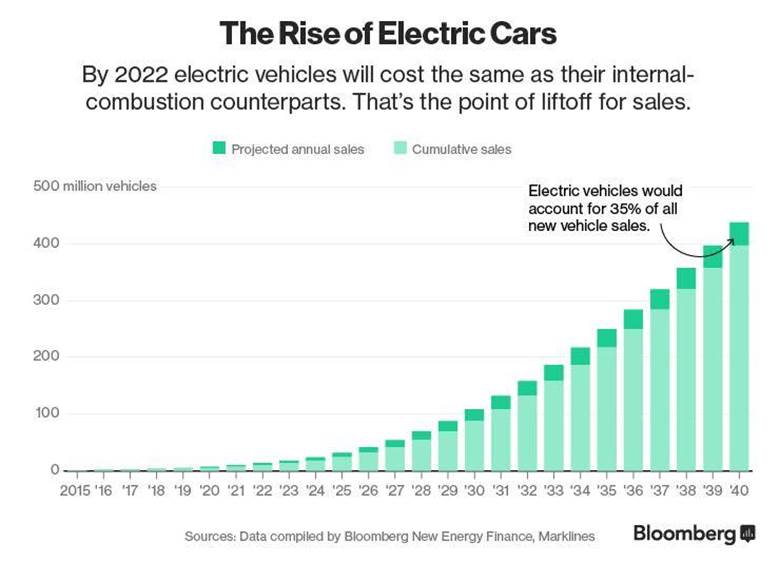

It’s even more euphoric when you come across a company that is cornering new market share for both of these commodities because the line-up of supermajor companies that are going to be scrabbling for supply is impressive—even if we just consider those investing in electric vehicles. By 2020, it is estimated that one-fifth of cobalt demand will come from EVs.

According to Deutsche Bank, demand for lithium will rise from 209,000 tonnes in 2016 to 534,000 tonnes in 2025.

Tesla Motors is leading the market for now because competition is all about lithium-ion batteries, and it just flipped the switch on its gigafactory in Nevada. German and Chinese competitors are racing to the finish line as well, making this a very heated battle for market share. It will only be Tesla’s lack of battery supply that could give its competitors—like BMW (NASDAQ:BAMXF), Volkswagen (NASDAQ:VLKAF), and Daimler’s (NASDAQ: DDAIF) Mercedes-Benz—a chance to cut in.

By 2018, Tesla predicts it will churn out 35 gigawatts of batteries per year. It’s a massive amount that surpasses more than what the rest of the world combined produces. In other words, one of Elon Musk’s many claims to fame will be doubling global battery production capacity as early as 2018.

And while the mass production of Tesla’s Model 3 electric sedan is one of the more exciting and visible drivers of demand—with 370,000 vehicles already ordered—there are other major drivers, such as massive energy storage systems, that will push demand to exponentially higher.

Volkswagen (OTCPK:VLKAY) is sure that a whopping 25% of its car sales by 2025 will be EVs, and the World Energy Council expects 1 in 6 cars sold in 2020 will be EVs. By 2022, according to Bloomberg, EVs will be cheaper than traditional vehicles.

And with a mind-boggling 12 battery gigafactories on the books globally, we’re looking at a supply and demand equation that is overwhelming in favor of the new lithium miner. LG Chem (OTC:LGCEY, Foxconn, BYD (OCTPK:BYDDY) and Boston Power are all building new battery factories, too—among others. Imagine the manufacturing capacity here that requires monumental amounts of lithium and cobalt that we simply won’t have.

With both cobalt and lithium exploration projects—it’s hard to find a junior set-up that is more strategically positioned than LiCo Energy Metals to take advantage of the fundamental reality of this energy revolution.

By. James Burgess of Oilprice.com

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Oilprice.com only and are subject to change without notice. Oilprice.com assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.