The Leading Power In East Asia Will Be Japan—Not China

Politics / GeoPolitics Feb 09, 2017 - 04:36 PM GMTBy: John_Mauldin

BY GEORGE FRIEDMAN AND JACOB L. SHAPIRO : By 2040, Japan will rise as East Asia’s leading power. This is one of our most controversial forecasts at Geopolitical Futures.

BY GEORGE FRIEDMAN AND JACOB L. SHAPIRO : By 2040, Japan will rise as East Asia’s leading power. This is one of our most controversial forecasts at Geopolitical Futures.

Our readers know that GPF is bearish on China. And while some may disagree on that point, they usually see that the reasoning is sound. China will face serious problems in coming years… problems that will strain the Communist Party’s rule. (I write about this topic extensively in This Week in Geopolitics—subscribe here for free.)

Japan, though, seems a bridge too far. Its population is less than a tenth of China’s size (and it’s not just aging… it’s shrinking). Japan also has a debt-to-GDP ratio over 229%.

So, how is it that Japan will emerge in the next 25 years as East Asia’s most powerful country?

A good place to start is a broad comparison of the structure of China and Japan’s economies (the second and third largest economies in the world, respectively).

This analysis will reveal strengths and weaknesses for both and will bring our forecast into sharper relief.

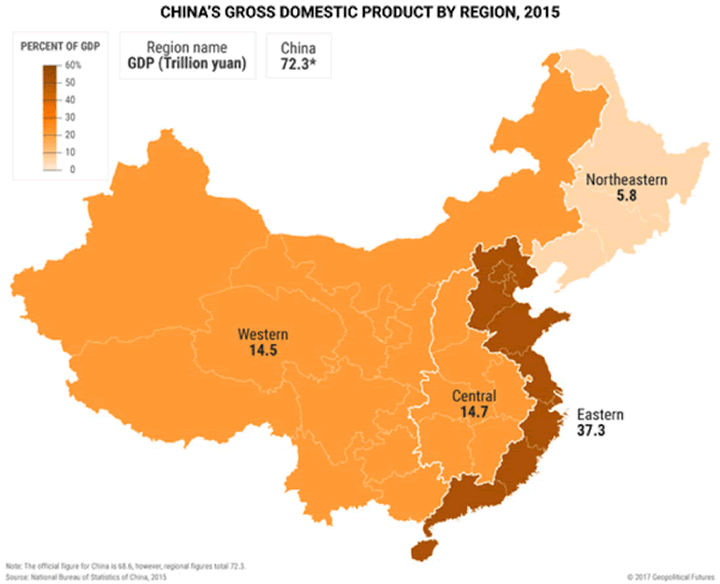

A look at China’s economy by region

The map below divides China into four geographic regions by contribution to national GDP. The data come from China’s National Bureau of Statistics. China sometimes uses these divisions to understand how the economy is performing at a regional level. (It must be noted that these figures are likely manipulated for political purposes.)

The data contain notable discrepancies, in spite of which it still reveal much about China’s economic weaknesses.

The coastal Eastern Region accounts for more than half of all economic activity in China. The Central and Western regions each produce about 20% of China’s economic wealth. But let’s take a closer look.

The Western Region makes up more than half of China’s total land area. When compared to other regions, it produces less than half of what the Eastern Region does. And it produces the same amount as the Central Region, which is less than half its size.

The Northeastern Region appears to be an outlier. It accounts for just 8% of China’s GDP. Most of this region’s economic activity is heavy industry and has been under severe pressure as China attempts to increase internal demand and decrease dependence on exports.

What does this mean in practical terms?

Poverty is China’s greatest weakness

China’s biggest economic weakness… and its most potent enemy… is poverty. Regional economic disparities exist in many countries in the world. But in China, they have always been particularly acute.

China’s sheer size magnifies this problem.

In 1981, roughly 1 billion Chinese people lived on less than $3.10 a day (at 2011 purchasing power parity). The World Bank’s latest data (from 2010) show that the number dropped to 360 million that year.

That is a great accomplishment. The problem is that it is not enough.

China has been growing at a remarkable rate for the past 30 years, but that growth is slowing down. 360 million people still live in abject poverty.

The map shows us that most of China’s economic success is enjoyed by the coast… not the rest of the country.

China’s double-edged sword

China is the most populous country in the world and the fourth largest in terms of area. This is a source of great power, but it is also a double-edged sword.

There are great advantages. China can deploy huge armies. It is buffered from enemies by vast territory or harsh geography on all sides. It can also mobilize human capital like no other country.

On the other hand, it means that China often spends more on internal security than it does on the much-vaunted People’s Liberation Army. It also rules over many regions that are not ethnically Han Chinese… regions that want greater autonomy (if not independence). And China must maintain a robust capability to guard its borders.

China is a formidable land-based power, but it has never been a global maritime power. It has always been susceptible to internal revolution, and at times, external conquest.

Now, let’s look at Japan.

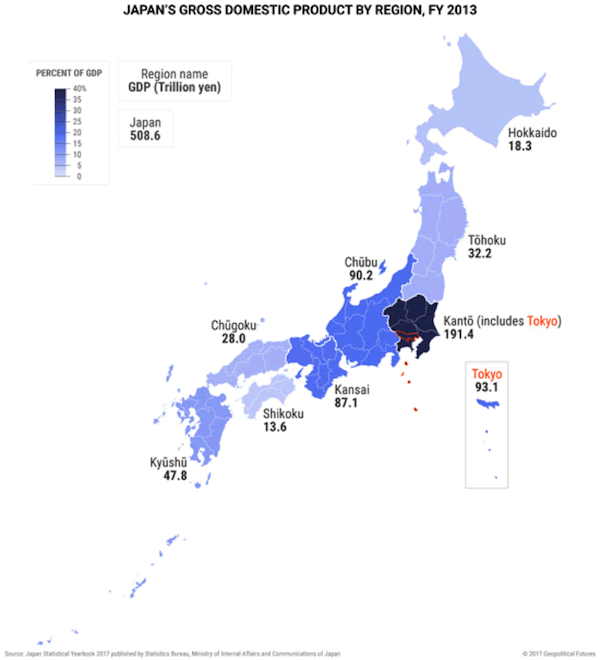

Wealth concentration in Japan

At first glance, this map of Japan (below) seems to imply a similar level of wealth concentration in certain regions. Like China, Japan is informally divided into regions and sometimes reports data at the regional level.

Japan is made up of four main islands: Kyūshū, Shikoku, Honshu, and Hokkaido.

Kyūshū, Shikoku, and Hokkaido constitute regions of their own. Honshu (the largest and most populous of the Japanese islands) is subdivided into five additional regions.

These five Honshu regions account for 87% of the Japanese economy. (About 43% of that economic activity comes from the Kantō Region’s seven prefectures.)

This map also separates Tokyo prefecture from the others to provide a sense of how much it contributes to Japan’s total GDP. Tokyo prefecture (by itself) accounts for just over 18%.

Factoring in the Tokyo greater metropolitan area increases this figure. According to the latest available data from the Organisation for Economic Co-operation and Development (from 2012), Tokyo had the largest GDP of any city in the world at $1.48 trillion. (Seoul was second with a GDP of less than half of that.)

That means that greater Tokyo accounts for almost a third of Japan’s total GDP.

Japan’s advantage

Unlike China, Japan’s wealth is spread much more evenly among its population. On the simplest level, this is easier to accomplish with a population of 127.3 million than with a population of 1.3 billion.

But this is not strictly about size. What holds China back is the diversity that results from its size.

Japan does not have to deal with the type of coastal versus interior diversity that China does.

In the China example, almost every coastal province could be compared with an interior province and a similar gulf would exist. In Japan, only Tokyo is significantly above the mean per capita income of 3.1 million yen for the entire country, and that is due, in part, to the higher cost of living in the city.

There is wealth disparity in Japan to be sure, but the disparity is not on the same scale as that which exists at the provincial level in China.

Japan’s greatest challenge

Japan’s great weakness is its dependence on imports for food and raw materials. The country’s total food self-sufficiency ratio based on calorie supply was just 39% in 2015. Based on production value, it was just 66%.

Japan relies almost entirely on imports for staples like wheat, barley, corn, and soy.

Energy is another example of this dependence on imports. One of the main reasons Japan entered World War II was to protect its access to oil.

Today, Japan is still reliant on foreign sources of energy. Even before the Fukushima nuclear reactor accident in 2011, Japan relied on foreign sources for close to 80% of its energy supply.

Since 2012, that number has risen to almost 91% (according to the US Energy Information Administration).

Some will argue that Japan’s bigger problem is demographics. It is true that Japan has a rapidly aging population. But so does China. Most European countries also face this issue.

But Japan has options

Japan is one of the top investors in the world in artificial intelligence research, automation, and robotics technology in order to maintain productivity.

And while Japanese society is homogenous and relatively unfriendly to outsiders, desperate circumstances could call for desperate measures and necessitate changing policies on immigration.

The broader Asia-Pacific region also offers opportunities for Japan to find workers to address this problem.

A final comparison

Japan is the 62nd largest country in terms of area. It is the 11th largest in terms of population. But neither of these facts disqualifies Japan from rising as a regional power.

Unlike China, Japan has no land-based enemies—it is an island nation. Unlike China, the Japanese government has no concern about its ability to impose its writ throughout the entire country.

Nor does it have to deal with a huge gulf in wealth disparity between regions. Japan has also managed a transition from a high-growth economy to a low-growth economy without revolution.

Japan’s weaknesses have manifested in the development of a strong navy able to guard maritime supply lines. It has also cultivated a tight alliance with a country that will guard those supply lines, the United States.

To be clear, China is still a very powerful country relative to most in the world. As such, much of our writing remains focused on understanding how economic problems in China are manifesting in political challenges.

For now, Japan is less dynamic and important… though it will become more so… and our writing on Japan will increase as it becomes the leading power in the Asain Pacific.

Subscribe to This Week in Geopolitics and Navigate the Geopolitical Roadmap with George Friedman

Keep your eye on China and other emerging world powers from one of the most sought-after experts in geopolitics. Sign up for George Friedman’s free This Week in Geopolitics newsletter for a bird’s eye view of the forces shaping global economies.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.