The Eurozone isn't Working ... Warns Greenspan, Buy Gold

Commodities / Gold and Silver 2017 Feb 20, 2017 - 12:28 PM GMTBy: GoldCore

“The eurozone isn’t working …” warns Greenspan

“The eurozone isn’t working …” warns Greenspan

“I view gold as the primary global currency” said Greenspan

“Significant increases in inflation will ultimately increase the price of gold”

“Investment in gold now is insurance…”

Alan Greenspan, the former head of the Federal Reserve has warned that the euro may collapse, saying that he has “grave concerns” about its future.

The imbalances in the economic strength of euro area countries make the continued function of the single currency area a primary concern, said former US Federal Reserve chairman Alan Greenspan in an interview (February issue of “Gold Investor”) with the World Gold Council.

He suggests the inequality is largely down to a north/south geographical divide which means the division between the northern and southern EU countries is too big. The bloc’s more prosperous nations such as Germany consistently fund the deficits of those in the south, and that simply can’t go on, said Greenspan.

“The European Central Bank (ECB) has greater problems than the Federal Reserve. The asset side of the ECB’s balance sheet is larger than ever before, having grown steadily since Mario Draghi said he would do whatever it took to preserve the euro,” he said.

“And I have grave concerns about the future of the euro itself… The eurozone is not working”, added Greenspan.

Greenspan, chairman of the Federal Reserve from 1987 and 2006 has consistently been critical of the eurozone and the European Monetary Union (EMU). He has long maintained that the eurozone was doomed to fail because the impact of the divergent cultures and economies in the bloc has been grossly underestimated.

Greece is currently in the midst of yet another financial crisis with withdrawals from bank accounts and new bank runs indicating the public is preparing for a crash. Meanwhile Europe’s oldest bank, Banca Monte dei Paschi di Siena, in Italy is on the verge of bankruptcy and needs another bail out to survive.

Even Germany’s largest lender Deutsche Bank is facing a crisis of gargantuan proportions as it struggles with its shadow banking assets book which is plagued with non performing loans (NPLs).

Ireland, Spain and Portugal face their own economic challenges and many are doubtful whether there can be any meaningful recovery given the scale of the national debt and total debt burden in the periphery euro nations.

Mr Greenspan said Brexit will almost certainly trigger a collapse of the ECB despite the UK not having adopted the euro:

“Brexit is not the end of the set of problems, which I always thought were going to start with the euro because the euro is a very serious problem.”

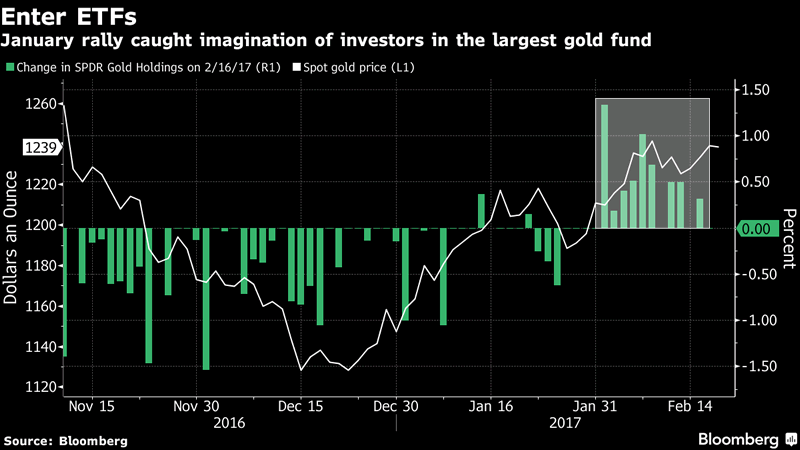

Mr Greenspan says that investors are diversifying into precious metals and increasingly seeking to buy gold, because there is a deepening lack of trust in the euro and in the banking system.

The former Fed chair, correctly pointed out that investment in gold now is insurance; and it’s not for short-term gain, but for long-term protection:

“Significant increases in inflation will ultimately increase the price of gold. Investment in gold now is insurance…” advised Greenspan.

Given the increasing uncertainty regarding the economic outlook, many investors internationally are now considering how to buy gold for the first time. A prudent diversification into non bank, non digital, physical gold will protect and grow their wealth in the coming years.

“Gold Investor” with the World Gold Council can be accessed here

Gold Prices (LBMA AM)

20 Feb: USD 1,235.35, GBP 991.49 & EUR 1,163.21 per ounce

17 Feb: USD 1,241.40, GBP 1000.57 & EUR 1,165.55 per ounce

16 Feb: USD 1,236.75, GBP 988.41 & EUR 1,163.29 per ounce

15 Feb: USD 1,225.15, GBP 985.27 & EUR 1,161.81 per ounce

14 Feb: USD 1,229.65, GBP 986.67 & EUR 1,157.84 per ounce

13 Feb: USD 1,229.40, GBP 982.04 & EUR 1,155.64 per ounce

10 Feb: USD 1,225.75, GBP 980.23 & EUR 1,151.35 per ounce

09 Feb: USD 1,241.75, GBP 988.18 & EUR 1,161.04 per ounce

08 Feb: USD 1,235.60, GBP 989.47 & EUR 1,160.10 per ounce

Silver Prices (LBMA)

29 Feb: USD 17.98, GBP 14.42 & EUR 16.92 per ounce

17 Feb: USD 18.00, GBP 14.50 & EUR 16.90 per ounce

16 Feb: USD 18.10, GBP 14.49 & EUR 17.02 per ounce

15 Feb: USD 17.88, GBP 14.38 & EUR 16.93 per ounce

14 Feb: USD 17.91, GBP 14.37 & EUR 16.85 per ounce

13 Feb: USD 17.97, GBP 14.34 & EUR 16.89 per ounce

10 Feb: USD 17.62, GBP 14.15 & EUR 16.55 per ounce

09 Feb: USD 17.71, GBP 14.10 & EUR 16.58 per ounce

08 Feb: USD 17.74, GBP 14.20 & EUR 16.66 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.