Bitcoin Is Now As Good As Gold, Actually It’s Better

Currencies / Bitcoin Mar 04, 2017 - 04:33 PM GMTBy: Jeff_Berwick

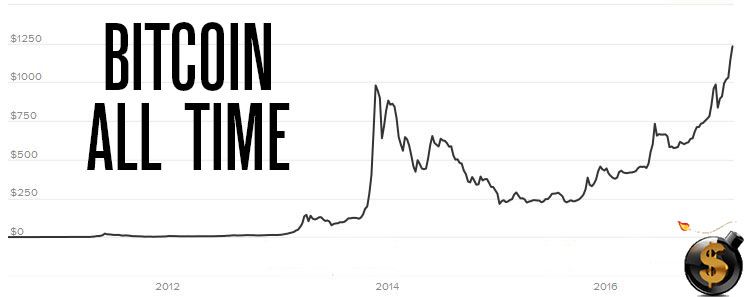

It wasn’t too long after I discovered bitcoin in 2011, trading at $3, that I became one of its biggest promoters.

I have even said on several different occasions, that if bitcoin reaches its ultimate potential it will be worth more than $1 million in today’s US dollar terms. Of course, if it did, we wouldn’t be talking about the price of bitcoin in dollars because dollars likely wouldn’t exist anymore.

We’ve still got a long way to go until we reach that kind of valuation for bitcoin, but yesterday we did hit a major milestone.

At approximately 10:20 a.m. Eastern time on Thursday, the price of Bitcoin climbed to $1,241.30 which was an all-time high for the digital currency. At the same time, the spot price of gold sat at about $1,241.25 per ounce.

So it is now accurate to say that bitcoin is as good as gold or better from a fiat price standpoint. And it just hit another all-time high of over $1,290 and continues to rise!

There is a good deal of speculation that it won’t be approved and that may bring the price of bitcoin down. But the Chinese especially are buying so much bitcoin that over time the upward surge in prices may not be deterred by any one thing.

Another contributing factor to bitcoin’s recent surge has been the Chinese’s need to protect assets.

With the number of strict capital controls that exist in the country, the Chinese people have been piling into bitcoin as a safe haven asset despite the PBOC’s attempts to freeze withdrawals from major exchanges.

Overall, bitcoin has risen over 185% in the last year. Gold has been nearly flat in the meantime, making bitcoin far and away the best performing currency and one of the best performing overall assets in the world.

Bitcoin isn’t the only cryptocurrency that has been skyrocketing though. We featured another, less than a month ago, in the TDV newsletter (subscribe here) when it was at $17.15 and said that it could take over a large portion of bitcoin’s market share.

Since, it has traded over $60 for more than a 200% gain in just a few weeks.

And, while there are sure to be pullbacks along the way, we are still very early in the cryptocurrency revolution.

If you don’t really understand the inner workings of bitcoin, we highly recommend reading our ebook Bitcoin Basics which will be made available to you as a subscriber.

And, a large reason why bitcoin and many other cryptocurrencies have been skyrocketing in the last few days has been because most of the major cryptocurrency people in the world all just met at the TDV Investment Summit, Anarchapulco and Cryptopulco last week in Acapulco, Mexico.

You can get access to a lot of what was said by viewing the videos of many of the speeches here.

A lot is going on. And your stock broker or investment advisor probably doesn’t even know what bitcoin is yet… much less has been telling you to buy it since 2011.

Stick with us here as we lead the cryptocurrency evolution and cover the ongoing collapse of the evil fiat currency, central banking system.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.